Ct 9u Kansas Use Tax Return Define Form

What is the Ct 9u Kansas Use Tax Return Define

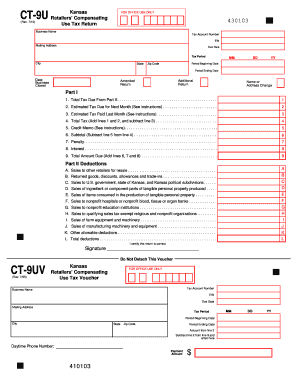

The Ct 9u Kansas Use Tax Return is a tax form used by businesses and individuals in Kansas to report and pay use tax on taxable purchases made outside the state. This form is essential for compliance with Kansas tax laws, particularly for items that were not subject to sales tax at the time of purchase. The use tax ensures that local businesses are not disadvantaged by out-of-state purchases. The Ct 9u form captures information about the buyer, the items purchased, and the corresponding tax owed.

How to Use the Ct 9u Kansas Use Tax Return Define

To effectively use the Ct 9u Kansas Use Tax Return, taxpayers should first gather all relevant purchase information, including receipts and invoices. The form requires details such as the date of purchase, description of the items, and the amount paid. After filling out the form with accurate information, taxpayers can calculate the total use tax owed based on the applicable rates. It is important to ensure that all information is complete and accurate to avoid penalties or delays in processing.

Steps to Complete the Ct 9u Kansas Use Tax Return Define

Completing the Ct 9u Kansas Use Tax Return involves several key steps:

- Gather all purchase documentation, including receipts and invoices.

- Fill in personal or business information at the top of the form.

- List each taxable item purchased, including descriptions and amounts.

- Calculate the total use tax owed based on the current Kansas use tax rate.

- Sign and date the form to certify its accuracy.

- Submit the completed form by the designated deadline.

Legal Use of the Ct 9u Kansas Use Tax Return Define

The legal use of the Ct 9u Kansas Use Tax Return is governed by state tax regulations. This form must be filed accurately to ensure compliance with Kansas tax laws. Failure to file or incorrect reporting can lead to penalties, interest on unpaid taxes, and potential audits. It is crucial for taxpayers to understand their obligations and ensure that they are using the form correctly to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 9u Kansas Use Tax Return typically align with the state’s tax calendar. Generally, the form must be submitted annually, with specific due dates that may vary based on the taxpayer's reporting period. It is important to stay informed about these deadlines to avoid late fees and penalties. Taxpayers should check the Kansas Department of Revenue website or consult a tax professional for the most current information on filing dates.

Required Documents

When completing the Ct 9u Kansas Use Tax Return, taxpayers should have the following documents on hand:

- Receipts or invoices for all taxable purchases.

- Previous tax returns, if applicable.

- Any correspondence from the Kansas Department of Revenue regarding tax obligations.

- Documentation of any exempt purchases, if claiming exemptions.

Form Submission Methods

The Ct 9u Kansas Use Tax Return can be submitted through various methods, including:

- Online submission through the Kansas Department of Revenue's e-filing system.

- Mailing a printed copy of the form to the appropriate state address.

- In-person submission at designated state tax offices.

Quick guide on how to complete ct 9u kansas use tax return define

Complete Ct 9u Kansas Use Tax Return Define effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Ct 9u Kansas Use Tax Return Define on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Ct 9u Kansas Use Tax Return Define with ease

- Find Ct 9u Kansas Use Tax Return Define and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using features specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate the printing of new copies. airSlate SignNow efficiently meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct 9u Kansas Use Tax Return Define and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 9u kansas use tax return define

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 9u kansas use tax return define?

The ct 9u kansas use tax return define is a specific form used by Kansas residents and businesses to report and pay use tax on taxable items purchased outside the state. This return helps ensure compliance with state tax laws and facilitates proper record-keeping for tax authorities. Understanding this form is essential for accurate tax reporting.

-

How can airSlate SignNow assist with the ct 9u kansas use tax return define?

AirSlate SignNow offers a user-friendly platform to easily sign and submit your ct 9u kansas use tax return define electronically. By streamlining document processing, businesses can save time and reduce the likelihood of errors in tax return submissions. The eSignature feature ensures that your return is legally binding and securely stored.

-

What features does airSlate SignNow provide for managing tax returns?

AirSlate SignNow includes features such as template creation, document editing, and customizable workflows that are particularly useful for managing your ct 9u kansas use tax return define. With its intuitive interface, users can easily navigate through the return process, ensuring all necessary information is accurately captured and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses needing to file the ct 9u kansas use tax return define?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses, making it a cost-effective solution for filing the ct 9u kansas use tax return define. By eliminating paper-based processes and reducing filing errors, companies can save money in administrative costs and potential penalties associated with inaccurate tax submissions.

-

Can I integrate airSlate SignNow with my accounting software for the ct 9u kansas use tax return define?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, allowing for an efficient workflow when handling the ct 9u kansas use tax return define. This integration helps maintain accurate financial records and simplifies the tax filing process by automatically populating necessary data from your accounting system.

-

What benefits do I get by using airSlate SignNow for tax document management?

Using airSlate SignNow streamlines your tax document management, particularly for forms like the ct 9u kansas use tax return define. Benefits include reduced paperwork, faster turnaround times, and enhanced accuracy, ultimately minimizing the stress associated with tax season. Additionally, the platform provides a secure environment for sensitive financial documents.

-

How does the eSigning process work with airSlate SignNow for the ct 9u kansas use tax return define?

The eSigning process with airSlate SignNow is simple and efficient. Once you have completed your ct 9u kansas use tax return define, you can send it electronically to relevant signers, who can sign from any device. This process eliminates the need for physical signatures and speeds up document processing, ensuring timely submissions.

Get more for Ct 9u Kansas Use Tax Return Define

- Open pdf file 7229 kb for ry2021 hospital quality contact form

- Special notices for acute hospitalsmassgov form

- Please select dcf office ctgov form

- 23 13 246 administrative rules of the state of montana form

- Podiatry license form

- Nebraska podiatry license form

- Clinical mental health counseling wayne state college form

- Fillable online hospital pharmacy quality fax email form

Find out other Ct 9u Kansas Use Tax Return Define

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile