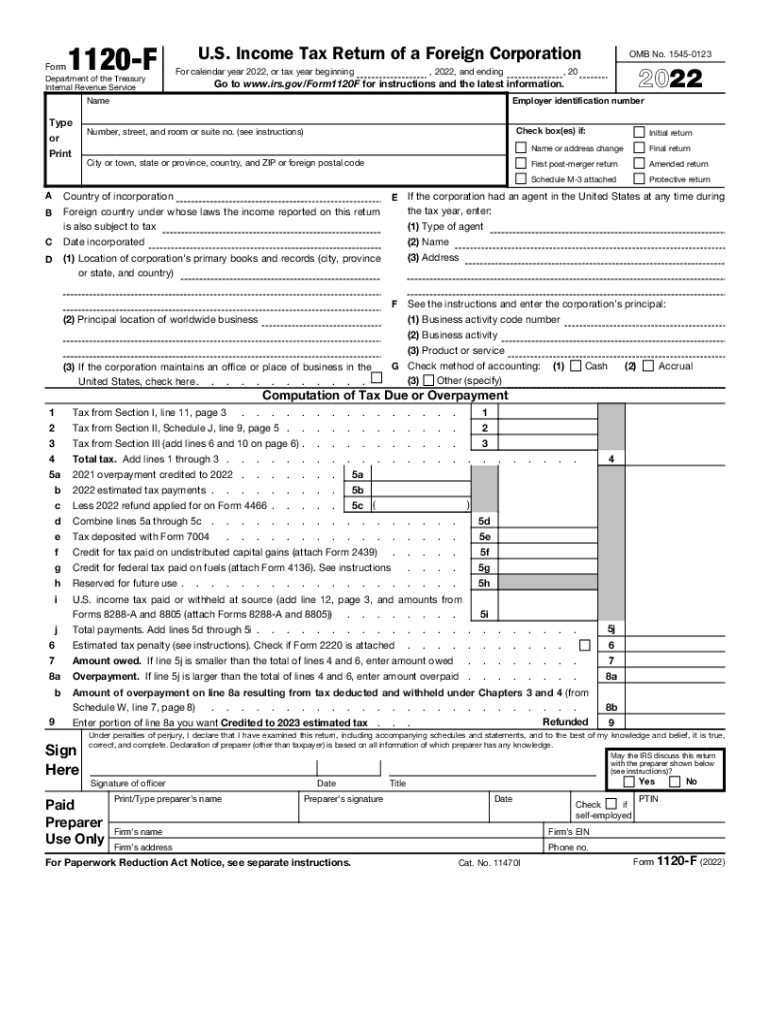

Form 1120 F U S Income Tax Return of a Foreign Corporation 2022

What is the fillable 2017 Form 1120?

The fillable 2017 Form 1120 is the U.S. Income Tax Return for Corporations. It is used by domestic corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal tax liability. This form is essential for corporations as it provides the IRS with a comprehensive overview of their financial activities for the fiscal year. Completing this form accurately is crucial for compliance with federal tax regulations.

Steps to complete the fillable 2017 Form 1120

Completing the fillable 2017 Form 1120 involves several key steps:

- Gather necessary documents: Collect all financial records, including income statements, balance sheets, and previous tax returns.

- Fill in basic information: Enter the corporation's name, address, Employer Identification Number (EIN), and the date of incorporation.

- Report income: Complete the income section by detailing all sources of revenue, including sales and investment income.

- Calculate deductions: List all allowable deductions, such as salaries, rent, and interest expenses, to determine taxable income.

- Determine tax liability: Use the calculated taxable income to find the corporation's tax liability based on current tax rates.

- Sign and date the form: Ensure that an authorized officer of the corporation signs and dates the form before submission.

IRS Guidelines for the fillable 2017 Form 1120

The IRS provides specific guidelines for completing the fillable 2017 Form 1120. These guidelines include instructions on how to report various types of income, allowable deductions, and tax credits. It is important to refer to the IRS instructions for the 2017 Form 1120 to ensure compliance with tax laws. The guidelines also outline the necessary schedules and forms that may need to be attached based on the corporation's activities.

Filing Deadlines for the fillable 2017 Form 1120

The deadline for filing the fillable 2017 Form 1120 is typically the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 15, 2018. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Legal use of the fillable 2017 Form 1120

The fillable 2017 Form 1120 is legally binding when completed and submitted in accordance with IRS regulations. It serves as an official document that reports a corporation's financial activities and tax obligations. To ensure legal compliance, corporations must accurately report all income and deductions, maintain proper documentation, and file the form by the established deadlines. Failure to comply with these requirements may result in penalties or audits by the IRS.

Key elements of the fillable 2017 Form 1120

Several key elements are essential to understand when completing the fillable 2017 Form 1120:

- Income Section: This section requires detailed reporting of all income sources.

- Deductions: Corporations can claim various deductions to reduce taxable income.

- Tax Computation: This section calculates the corporation's tax liability based on taxable income.

- Signatures: An authorized officer must sign the form to validate the submission.

Quick guide on how to complete 2022 form 1120 f us income tax return of a foreign corporation

Complete Form 1120 F U S Income Tax Return Of A Foreign Corporation effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed papers since you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 1120 F U S Income Tax Return Of A Foreign Corporation on any device with the airSlate SignNow apps for Android or iOS and streamline any document-centered process today.

The easiest way to modify and electronically sign Form 1120 F U S Income Tax Return Of A Foreign Corporation without hassle

- Find Form 1120 F U S Income Tax Return Of A Foreign Corporation and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to apply your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1120 F U S Income Tax Return Of A Foreign Corporation to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1120 f us income tax return of a foreign corporation

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 1120 f us income tax return of a foreign corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 2017 form 1120?

A fillable 2017 form 1120 is a digital version of the U.S. Corporation Income Tax Return that allows users to enter data directly into the fields. This format simplifies tax preparation and ensures accurate filing. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax process.

-

How can airSlate SignNow help with the fillable 2017 form 1120?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning your fillable 2017 form 1120. Our solution simplifies document management, allowing you to complete and send forms securely. Additionally, the platform ensures compliance while you focus on important business operations.

-

Is there a cost associated with using airSlate SignNow for the fillable 2017 form 1120?

Yes, airSlate SignNow offers flexible pricing plans that scale with your needs. Depending on the features you require, the cost can vary, but you will find it to be cost-effective compared to traditional methods. Investing in our service can save you time and reduce the risk of errors in your fillable 2017 form 1120.

-

Can I integrate airSlate SignNow with other applications for my fillable 2017 form 1120?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow. You can easily connect our platform with tools like Google Drive and Slack to enhance your experience when working with the fillable 2017 form 1120 and other documents.

-

What benefits do I get from using airSlate SignNow for the fillable 2017 form 1120?

Using airSlate SignNow enhances your efficiency with its intuitive interface and secure eSigning capabilities. You can save time on document handling and improve the accuracy of your fillable 2017 form 1120. Additionally, our platform ensures that your sensitive data is protected throughout the signing process.

-

How secure is my data when using airSlate SignNow for the fillable 2017 form 1120?

Security is a top priority at airSlate SignNow. We use bank-grade encryption to ensure that your data, including the fillable 2017 form 1120, is protected from unauthorized access. Our platform is built with strict security protocols to give you peace of mind while you manage sensitive documents.

-

How do I create my fillable 2017 form 1120 on airSlate SignNow?

Creating your fillable 2017 form 1120 on airSlate SignNow is simple. Just upload the form, and our platform will allow you to fill it out electronically. Once completed, you can eSign and share it directly from the application, making the tax process more efficient.

Get more for Form 1120 F U S Income Tax Return Of A Foreign Corporation

Find out other Form 1120 F U S Income Tax Return Of A Foreign Corporation

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF