N 15 Rev NonResident and Part Year Resident Income Tax Return Forms Fillable 2022

Understanding the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

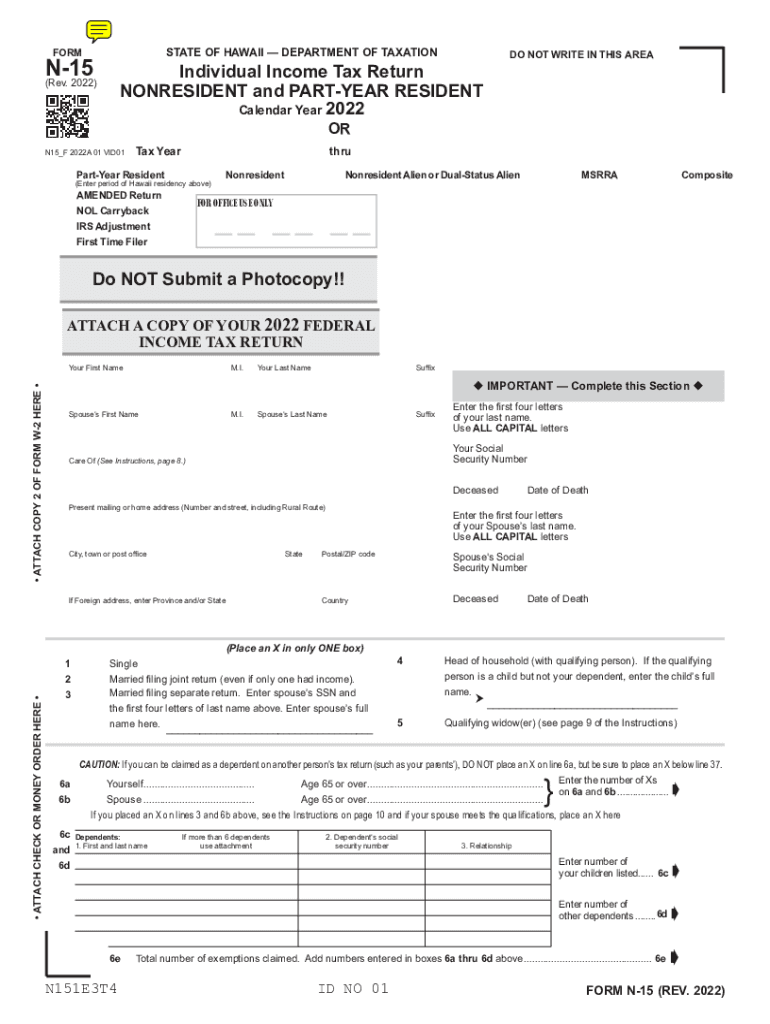

The N-15 Rev is a crucial tax form for nonresidents and part-year residents of Hawaii. This form is specifically designed for individuals who earned income in Hawaii but do not meet the residency requirements for full-year residents. It allows these taxpayers to report their income earned within the state and calculate their tax liability accordingly. Understanding the purpose and structure of the N-15 Rev is essential for accurate tax filing and compliance with Hawaii state tax laws.

Steps to Complete the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

Completing the N-15 Rev form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income earned in Hawaii during the tax year.

- Calculate your total income and apply any applicable deductions.

- Determine your tax liability based on the income reported.

- Review the completed form for accuracy before submission.

By following these steps, you can ensure that your N-15 Rev form is completed correctly, reducing the risk of errors that could lead to penalties.

Legal Use of the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

The N-15 Rev form is legally recognized for tax reporting purposes in Hawaii. To be considered valid, the form must be filled out accurately and submitted by the appropriate deadlines. Compliance with state tax regulations is crucial, as failure to file or inaccuracies can result in penalties or interest on unpaid taxes. Additionally, using electronic filing methods can enhance the security and efficiency of your submission, ensuring that your form is processed in a timely manner.

Required Documents for the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

When preparing to complete the N-15 Rev form, it is important to gather all required documents. These typically include:

- W-2 forms from employers reporting income earned in Hawaii.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any other income sources, such as rental income or investment earnings.

- Documentation of deductions or credits that may apply to your tax situation.

Having these documents ready will streamline the process of completing your N-15 Rev form and help ensure that all income is accurately reported.

Filing Deadlines for the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

Timely filing of the N-15 Rev form is essential to avoid penalties. Generally, the deadline for submitting the N-15 Rev is the same as the federal tax deadline, which is typically April fifteenth. However, if you are unable to file by this date, you may request an extension. Be aware that an extension to file does not extend the time to pay any taxes owed, so it is advisable to estimate and pay any tax liability by the original deadline to avoid interest and penalties.

Examples of Using the N-15 Rev NonResident and Part Year Resident Income Tax Return Form

The N-15 Rev form is applicable in various scenarios. For instance, a nonresident who worked in Hawaii for part of the tax year must report only the income earned during their time in the state. Similarly, a part-year resident who moved to Hawaii mid-year must report income earned while a resident of another state, as well as income earned in Hawaii. By understanding these examples, taxpayers can better navigate their specific tax situations and ensure compliance with Hawaii tax laws.

Quick guide on how to complete n 15 rev 2022 nonresident and part year resident income tax return forms 2022 fillable

Prepare N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable with ease

- Find N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow streamlines your document management needs in just a few clicks from any device you prefer. Modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n 15 rev 2022 nonresident and part year resident income tax return forms 2022 fillable

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev 2022 nonresident and part year resident income tax return forms 2022 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'hawaii n form' and how does it work?

The 'hawaii n form' is designed to simplify the process of collecting and signing documents within the state of Hawaii. Using airSlate SignNow, users can easily upload their documents, specify where signatures are needed, and send them out for electronic signing. This streamlined process helps save time and enhances efficiency in document management.

-

How much does using the 'hawaii n form' cost with airSlate SignNow?

Pricing for using the 'hawaii n form' through airSlate SignNow is competitive and varies based on the plan and features chosen. Customers can select from several tiered packages to fit their business needs, which include eSignature capabilities and additional tools for document management. Visit our pricing page for detailed information on costs and features.

-

What features are included in the 'hawaii n form'?

The 'hawaii n form' includes features such as customizable templates, real-time tracking of document status, and integrations with popular applications. These functionalities enable businesses to manage their documents effectively while maintaining compliance with legal standards. Additionally, airSlate SignNow provides tools for secure document sharing and storage.

-

What are the benefits of using 'hawaii n form' for my business?

Using the 'hawaii n form' streamlines your document signing process, resulting in faster turnaround times and enhanced productivity. It also reduces the reliance on paper, contributing to environmental sustainability. With airSlate SignNow, businesses can ensure compliance and save costs through efficient digital workflows.

-

Can 'hawaii n form' integrate with other applications?

Yes, the 'hawaii n form' can seamlessly integrate with various applications, enhancing its functionality. airSlate SignNow supports integrations with CRM systems, cloud storage services, and productivity tools, allowing for a cohesive workflow. This interoperability ensures users can manage their documents efficiently across different platforms.

-

Is the 'hawaii n form' secure for sending sensitive documents?

Absolutely, the 'hawaii n form' adheres to industry standards for security and data protection. airSlate SignNow uses encryption and complies with regulations such as GDPR and HIPAA to safeguard sensitive information. Users can trust that their documents are safe from unauthorized access while being sent for signing.

-

How do I get started with the 'hawaii n form' on airSlate SignNow?

Getting started with the 'hawaii n form' is easy! Simply sign up for an account on airSlate SignNow, and you can customize your forms to meet your specific needs. Our user-friendly interface guides you through the document uploading, signing, and management process, making sure you can start efficiently.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Hoa proxy form florida

- Akc hunt test texas form

- Renew belize passport in usa form

- Core phonics survey form

- Position analysis questionnaire example form

- Ogra pakistan complaint form

- Parent complaint form

- State of wisconsin circuit court milwaukee county for official use affidavit of nonmilitary service plaintiff petitioner form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free