About Form 4684, Casualties and Thefts IRS 2022

Understanding Form 4684: Casualties and Thefts

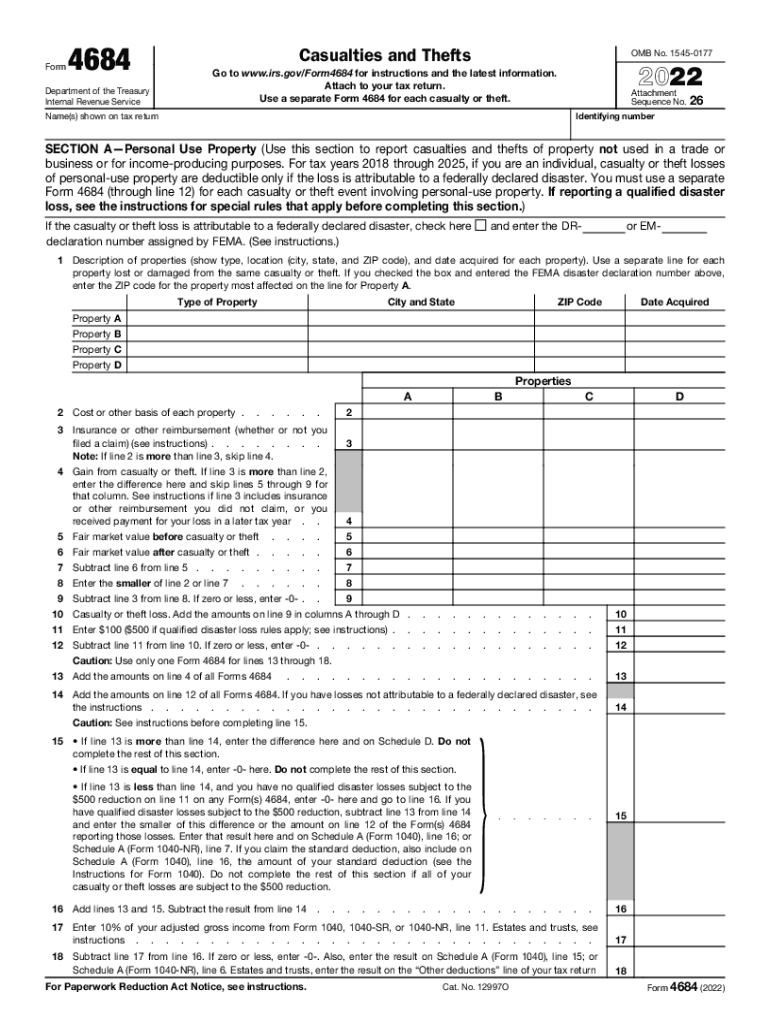

Form 4684 is a crucial document used by taxpayers in the United States to report casualties and thefts. This form allows individuals to claim deductions for losses incurred due to unexpected events such as natural disasters, accidents, or theft. The IRS requires this form to ensure that taxpayers accurately report their losses and determine the appropriate deductions they are entitled to. Understanding the purpose and requirements of Form 4684 is essential for effective tax reporting and compliance.

Steps to Complete Form 4684

Completing Form 4684 involves several key steps to ensure accurate reporting of losses. Begin by gathering all necessary documentation related to the casualty or theft. This may include police reports, insurance claims, and photographs of the damage. Next, fill out the form by providing detailed information about the event, including the type of loss, date of occurrence, and the amount of loss. It is important to follow the instructions carefully to avoid errors that could delay processing or lead to penalties. After completing the form, review all entries for accuracy before submission.

Legal Use of Form 4684

Form 4684 must be used in accordance with IRS regulations to ensure that claims for deductions are valid. Taxpayers must adhere to specific guidelines regarding the types of losses that can be claimed, as well as the documentation required to substantiate these claims. The form is legally binding, and any inaccuracies or fraudulent claims can result in penalties, including fines or audits. Understanding the legal implications of using Form 4684 is vital for maintaining compliance with tax laws.

Examples of Using Form 4684

Form 4684 can be utilized in various scenarios where taxpayers experience losses. For instance, if a homeowner suffers damage to their property due to a hurricane, they can use this form to report the loss and claim deductions. Similarly, if an individual’s vehicle is stolen, they may also file Form 4684 to report the theft and seek relief. Providing clear examples of how to use this form can help taxpayers better understand its application in real-life situations.

Filing Deadlines for Form 4684

Timely filing of Form 4684 is essential to ensure that taxpayers can claim their deductions without penalties. The form must be submitted along with the taxpayer's annual income tax return. Typically, the deadline for filing individual tax returns is April fifteenth of each year, unless an extension is granted. It is important to be aware of any changes to deadlines that may occur due to specific circumstances, such as natural disasters or other emergencies.

Required Documents for Form 4684

To successfully complete Form 4684, taxpayers must gather various documents that support their claims. Essential documents include proof of ownership, such as titles or receipts, and evidence of the loss, like photographs or repair estimates. Additionally, any insurance documentation that outlines coverage and claims made should be included. Having all necessary documents on hand simplifies the completion process and enhances the credibility of the claim.

Digital vs. Paper Version of Form 4684

Form 4684 is available in both digital and paper formats, providing flexibility for taxpayers. The digital version can be filled out and submitted online, which may streamline the process and reduce the likelihood of errors. Conversely, some individuals may prefer the traditional paper format for record-keeping purposes. Regardless of the format chosen, it is important to ensure that the completed form is submitted by the appropriate deadline to avoid complications with the IRS.

Quick guide on how to complete about form 4684 casualties and thefts irs

Effortlessly Prepare About Form 4684, Casualties And Thefts IRS on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage About Form 4684, Casualties And Thefts IRS on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The easiest method to modify and electronically sign About Form 4684, Casualties And Thefts IRS without hassle

- Obtain About Form 4684, Casualties And Thefts IRS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, either via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign About Form 4684, Casualties And Thefts IRS to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4684 casualties and thefts irs

Create this form in 5 minutes!

How to create an eSignature for the about form 4684 casualties and thefts irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4684 and why do I need it?

Form 4684 is used to report gains and losses from the sale or exchange of property. It's essential for accurately filing your taxes and ensuring compliance with IRS regulations. By understanding how to properly fill out form 4684, you can avoid potential penalties and streamline your tax preparation process.

-

How can airSlate SignNow help with form 4684?

airSlate SignNow offers an efficient way to sign and manage documents electronically, including form 4684. With features that allow you to upload, edit, and share documents securely, you can ensure your form 4684 is completed accurately and filed on time. This reduces the hassle of paperwork and helps you stay organized.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers several pricing plans to suit different business needs, starting with a free trial and progressing to more comprehensive subscription options. Each plan provides access to essential features that can simplify the completion and signing of documents like form 4684. You can choose a plan that fits your budget while ensuring your documentation needs are met.

-

Is it easy to eSign form 4684 with airSlate SignNow?

Yes, eSigning form 4684 with airSlate SignNow is very simple. The platform allows users to electronically sign documents with just a few clicks, eliminating the need for printing and scanning. This not only saves time but also ensures that your form 4684 is securely signed and stored digitally.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to enhance your workflow. Whether you use CRM systems, document management tools, or financial software, you can easily share and manage form 4684 alongside your other business documents for streamlined operations.

-

What are the benefits of using airSlate SignNow for form 4684?

Using airSlate SignNow for form 4684 simplifies the process of gathering signatures and managing document workflows. The platform enhances productivity by reducing the time spent on paperwork and increasing efficiency. Additionally, it provides a secure environment for handling sensitive information associated with form 4684.

-

Are there templates available for form 4684?

Yes, airSlate SignNow provides templates for various documents, including tax forms like form 4684. These templates are designed to facilitate quick and accurate completion. This feature can help you avoid common mistakes and ensure that you fill out form 4684 correctly according to IRS guidelines.

Get more for About Form 4684, Casualties And Thefts IRS

Find out other About Form 4684, Casualties And Thefts IRS

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online