Schedule K 1 Form N 35 Rev Shareholder's Share of Income, Credits, Deductions, Etc 2022

What is the Schedule K-1 Form N-35?

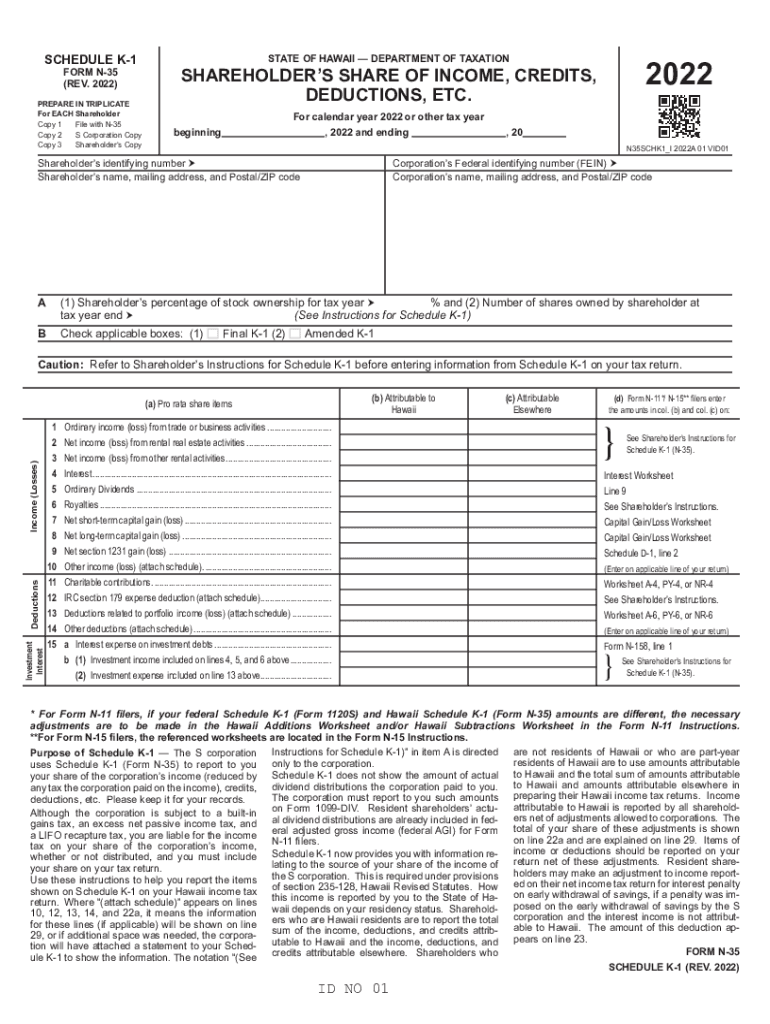

The Schedule K-1 Form N-35 is a tax document used in Hawaii to report a shareholder's share of income, credits, deductions, and other tax-related items from S corporations. This form is essential for shareholders to accurately report their income on their individual tax returns. It helps ensure that all income and deductions are accounted for, providing a clear picture of the shareholder's financial situation for the tax year.

Steps to Complete the Schedule K-1 Form N-35

Completing the Schedule K-1 Form N-35 involves several key steps:

- Gather necessary financial documents, including income statements and records of deductions.

- Fill out the identification section with the shareholder's name, address, and taxpayer identification number.

- Report the shareholder's share of income, deductions, and credits in the appropriate sections of the form.

- Ensure all calculations are accurate and that the form is signed where required.

Double-checking the form for accuracy is crucial to avoid potential issues with the IRS or state tax authorities.

Legal Use of the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 is legally binding when filled out correctly and submitted in accordance with IRS regulations. It is essential for shareholders to understand that the information reported on this form must be accurate and truthful, as discrepancies can lead to penalties or audits. The form serves as a key document for reporting income and ensuring compliance with tax obligations.

Filing Deadlines / Important Dates

Shareholders must be aware of the filing deadlines associated with the Schedule K-1 Form N-35. Typically, the form must be provided to shareholders by the end of March, aligning with the tax filing season. Shareholders should file their personal tax returns by the established deadline, usually April 15, to avoid late fees and interest on unpaid taxes.

Who Issues the Form?

The Schedule K-1 Form N-35 is issued by S corporations operating in Hawaii. These corporations are responsible for preparing and distributing the form to their shareholders. It is important for shareholders to receive this form in a timely manner to ensure they can accurately report their income and deductions on their tax returns.

Examples of Using the Schedule K-1 Form N-35

Shareholders may encounter various scenarios when using the Schedule K-1 Form N-35. For instance, an individual who owns shares in an S corporation will use the form to report their share of the corporation's income on their personal tax return. Additionally, shareholders may utilize the form to claim any applicable credits or deductions that the corporation has passed through to them, which can help reduce their overall tax liability.

Quick guide on how to complete schedule k 1 form n 35 rev 2022 shareholders share of income credits deductions etc

Effortlessly Prepare Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Manage Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc with Ease

- Obtain Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sharing the form, whether by email, SMS, or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2022 shareholders share of income credits deductions etc

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2022 shareholders share of income credits deductions etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hawaii Schedule N 35?

Hawaii Schedule N 35 is a form used by businesses and individuals in Hawaii to report specific tax information. It is designed to help taxpayers comply with state tax regulations and ensure accurate reporting. Understanding Hawaii Schedule N 35 is crucial for anyone dealing with tax obligations in the state.

-

How can airSlate SignNow help with filling out Hawaii Schedule N 35?

airSlate SignNow provides an easy-to-use platform for completing and eSigning forms like Hawaii Schedule N 35. Users can securely fill out the form digitally, ensuring all necessary information is correctly entered without the fuss of paper documentation. The solution streamlines the process, saving time and reducing errors when submitting your tax forms.

-

What pricing plans does airSlate SignNow offer for businesses needing Hawaii Schedule N 35 support?

airSlate SignNow offers a range of pricing plans tailored for different business needs, especially for those requiring assistance with forms like Hawaii Schedule N 35. Pricing is competitive, ensuring that every business can find a suitable plan that fits their budget. You can compare features and choose a plan that aligns with your eSigning and document management requirements.

-

Is airSlate SignNow easy to integrate with other tools for Hawaii Schedule N 35 submissions?

Yes, airSlate SignNow seamlessly integrates with various applications, making it convenient to manage and submit documents like Hawaii Schedule N 35. Whether you use CRM systems, accounting software, or cloud storage solutions, integrations enhance workflow efficiency. This means you can easily access and send your Hawaii Schedule N 35 forms without switching between multiple platforms.

-

What are the main benefits of using airSlate SignNow for Hawaii Schedule N 35?

Using airSlate SignNow for Hawaii Schedule N 35 provides numerous benefits, including faster processing times and reduced paperwork. The platform enhances collaboration, enabling multiple stakeholders to review and sign documents securely. Additionally, it features advanced security measures to keep your sensitive tax information protected.

-

Can I track the status of my Hawaii Schedule N 35 submissions with airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your Hawaii Schedule N 35 submissions. You’ll receive real-time updates when documents are viewed, signed, or completed, providing transparency throughout the process. This is especially helpful for managing deadlines and ensuring all parties are engaged.

-

Do I need technical skills to use airSlate SignNow for Hawaii Schedule N 35?

No, you don't need technical skills to use airSlate SignNow for Hawaii Schedule N 35. The platform is designed to be user-friendly, with an intuitive interface that guides you through each step. Whether you’re a seasoned user or new to digital solutions, you’ll find it easy to complete and manage your Hawaii Schedule N 35 forms.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer