540a Form

What is the 540a

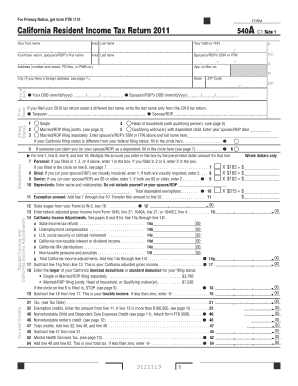

The 540a form is a California state income tax return specifically designed for residents who have a straightforward tax situation. It is a simplified version of the standard 540 form, allowing eligible taxpayers to report their income and claim deductions efficiently. This form is particularly beneficial for individuals with uncomplicated tax circumstances, such as those without dependents or significant itemized deductions. By using the 540a form, taxpayers can streamline their filing process while ensuring compliance with state tax regulations.

How to obtain the 540a

To obtain the 540a form, taxpayers can visit the California Franchise Tax Board's official website, where the form is available for download. Additionally, paper copies can be requested through the mail or picked up at local tax offices. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process. Taxpayers can also consult with tax professionals who may provide the form as part of their services.

Steps to complete the 540a

Completing the 540a form involves several key steps to ensure accurate reporting of income and deductions. First, gather all necessary documents, including W-2 forms, 1099s, and any relevant receipts for deductions. Next, fill in personal information, such as name, address, and Social Security number. Then, report your total income and calculate any applicable deductions. After completing the form, review all entries for accuracy and ensure that all required signatures are present. Finally, submit the form either electronically or by mail, depending on your preference.

Legal use of the 540a

The 540a form is legally binding when completed accurately and submitted according to California tax laws. To ensure its legal standing, taxpayers must comply with all relevant regulations, including those governing eSignatures if filing electronically. The form must be signed by the taxpayer, and any information provided must be truthful and complete to avoid penalties. Understanding the legal implications of submitting the 540a form helps taxpayers maintain compliance and avoid potential issues with the Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the 540a form typically align with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing additional time to file without incurring penalties. Staying informed about these important dates is crucial for timely and compliant tax filing.

Required Documents

When preparing to complete the 540a form, certain documents are essential to ensure accurate reporting. Required documents typically include:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any deductible expenses

- Social Security numbers for all dependents, if applicable

- Any relevant tax credits documentation

Having these documents ready will facilitate a smoother and more efficient filing process.

Digital vs. Paper Version

Choosing between the digital and paper version of the 540a form can impact the filing experience. The digital version allows for electronic submission, which is often faster and may provide immediate confirmation of receipt. Additionally, eFiling can reduce the risk of errors through built-in checks. On the other hand, some taxpayers may prefer the paper version for its tangible nature. Regardless of the choice, both versions are equally valid as long as they are completed and submitted correctly.

Quick guide on how to complete 540a

Complete 540a seamlessly on any device

Web-based document management has become favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to find the needed form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle 540a on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign 540a with ease

- Find 540a and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically provided for this purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign 540a and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 540a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 540a forms printable?

540a forms printable are simplified tax return forms used by individuals to report their income and tax credits. These forms are designed for ease of use and can help streamline the filing process. Using airSlate SignNow, you can easily download, fill, and eSign your 540a forms printable securely.

-

How can I access 540a forms printable on airSlate SignNow?

To access 540a forms printable on airSlate SignNow, simply log into your account and navigate to the forms section. From there, you can download the printable versions of the 540a forms you need. This gives you the flexibility to fill them out electronically or print them for manual completion.

-

Are there any costs associated with obtaining 540a forms printable?

airSlate SignNow offers a range of pricing plans that include access to 540a forms printable. Whether you're a small business or an individual, our affordable solutions provide great value while enabling you to manage your documents seamlessly. Check our pricing page for specific details on costs.

-

What features does airSlate SignNow offer for handling 540a forms printable?

airSlate SignNow provides various features such as eSignature capabilities, document management, and secure storage for your 540a forms printable. Additionally, our platform supports real-time collaboration and offers templates to ensure you fill out the forms correctly and efficiently.

-

Can I integrate airSlate SignNow with other applications when using 540a forms printable?

Yes, airSlate SignNow offers seamless integrations with numerous applications like Google Drive, Dropbox, and various CRM systems. This allows you to manage your 540a forms printable alongside your other tools, enhancing your workflow and productivity. Integration options can be viewed on our integration page.

-

What are the benefits of using airSlate SignNow for 540a forms printable?

Using airSlate SignNow for your 540a forms printable provides signNow benefits, including time savings, enhanced security, and ease of use. Our platform allows you to send, receive, and manage signed documents without the hassle of paper, making your filing process more efficient. Plus, it's fully compliant with relevant legal standards.

-

Is it easy to fill out 540a forms printable using airSlate SignNow?

Absolutely! airSlate SignNow features an intuitive interface that simplifies the process of filling out 540a forms printable. You can easily type in your information, add signatures, and make edits as necessary, ensuring your documents are accurate and professionally presented. Our platform is designed for user-friendliness.

Get more for 540a

- Sworn statement form

- Account corporation form

- Florida notice transfer form

- Florida abandonment form

- Affidavit of abandonment and intent to recommence construction form mechanic liens corporation or llc florida

- Notice form construction 497302784

- Notice form construction 497302785

- Notice commencement 497302786 form

Find out other 540a

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe