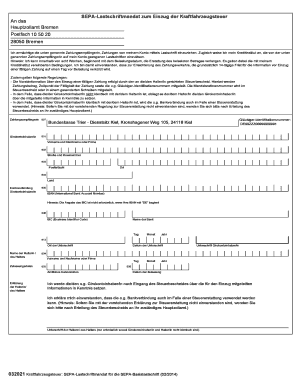

Kraftfahrzeugsteuer Form

What is the Kraftfahrzeugsteuer

The Kraftfahrzeugsteuer, or vehicle tax, is a mandatory tax imposed on vehicle owners in Germany. This tax is calculated based on various factors, including the vehicle's emissions, engine size, and type of fuel used. The purpose of the Kraftfahrzeugsteuer is to generate revenue for road maintenance and environmental initiatives. Understanding this tax is crucial for vehicle owners to ensure compliance and avoid penalties.

Steps to complete the Kraftfahrzeugsteuer

Completing the Kraftfahrzeugsteuer involves several key steps:

- Gather necessary documents, including vehicle registration and proof of identity.

- Calculate the tax amount based on the vehicle's specifications.

- Fill out the SEPA lastschriftmandat zum einzug der kraftfahrzeugsteuer form, which authorizes automatic withdrawals for the tax payment.

- Submit the completed form to the relevant tax authority, either online or by mail.

- Keep a copy of the submission for your records.

Legal use of the Kraftfahrzeugsteuer

The legal framework governing the Kraftfahrzeugsteuer is established by German tax law. Vehicle owners must ensure they are registered and that their tax payments are up to date to avoid legal repercussions. Failure to comply with tax regulations can result in fines or other penalties. It is essential to understand the legal obligations associated with vehicle ownership and tax payments.

Required Documents

When completing the Kraftfahrzeugsteuer, specific documents are necessary to ensure a smooth process:

- Vehicle registration certificate (Zulassungsbescheinigung).

- Proof of identity, such as a driver's license or passport.

- Details regarding the vehicle's emissions and engine size.

- Completed SEPA lastschriftmandat form for automatic payment.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Kraftfahrzeugsteuer form:

- Online: Many tax authorities offer online submission through their official websites, allowing for quick processing.

- Mail: You can print the completed form and send it via postal service to the appropriate tax office.

- In-Person: Some individuals may prefer to submit their forms directly at their local tax office, where they can receive immediate assistance.

Penalties for Non-Compliance

Failure to pay the Kraftfahrzeugsteuer on time can result in significant penalties. These may include:

- Late fees added to the outstanding tax amount.

- Legal action taken by tax authorities to recover unpaid taxes.

- Potential restrictions on vehicle registration or renewal.

Quick guide on how to complete kraftfahrzeugsteuer

Effortlessly Prepare Kraftfahrzeugsteuer on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly replacement for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Kraftfahrzeugsteuer on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Kraftfahrzeugsteuer with Ease

- Locate Kraftfahrzeugsteuer and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Kraftfahrzeugsteuer to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kraftfahrzeugsteuer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SEPA Lastschrift and how does it work for Kraftfahrzeugsteuer?

SEPA Lastschrift is a direct debit scheme in the eurozone that allows businesses to collect payments from customers' bank accounts. For Kraftfahrzeugsteuer, this means you can authorize payments automatically, ensuring timely settlements without manual intervention. This method simplifies the payment process and enhances cash flow management.

-

How can airSlate SignNow assist with setting up SEPA Lastschrift for Kraftfahrzeugsteuer?

AirSlate SignNow streamlines the setup of SEPA Lastschrift für Kraftfahrzeugsteuer by providing an easy-to-use platform for document management and eSigning. You can create and send the necessary authorization forms quickly, ensuring that your customers can grant permission for automatic payments without hassle.

-

What are the benefits of using airSlate SignNow for SEPA Lastschrift zum Einzug der Kraftfahrzeugsteuer?

Using airSlate SignNow for SEPA Lastschrift zum Einzug der Kraftfahrzeugsteuer enhances efficiency, reduces paperwork, and accelerates the payment process. By automating payments, it minimizes late fees and promotes better financial planning for both businesses and customers.

-

Is there a cost associated with using airSlate SignNow for SEPA Lastschrift?

AirSlate SignNow offers a competitive pricing model tailored to your business needs when utilizing SEPA Lastschrift. Our plans ensure you have access to all necessary features while keeping costs manageable, allowing you to focus on what matters most – your business.

-

Can I integrate airSlate SignNow with my existing financial software for SEPA Lastschrift?

Yes, airSlate SignNow supports integrations with various financial software systems, making it easier to manage SEPA Lastschrift zum Einzug der Kraftfahrzeugsteuer. This compatibility ensures a seamless flow of information, reducing manual data entry and potential errors.

-

How secure is using airSlate SignNow for processing SEPA Lastschrift?

Security is a priority for airSlate SignNow when processing SEPA Lastschrift. We implement robust encryption protocols and compliance measures to protect sensitive financial data, ensuring that your transactions for Kraftfahrzeugsteuer are safe and secure.

-

What features of airSlate SignNow enhance the SEPA Lastschrift experience?

AirSlate SignNow includes features like automated reminders, customizable templates, and a user-friendly interface that signNowly improve the SEPA Lastschrift experience. These tools enable businesses to manage their Kraftfahrzeugsteuer collections efficiently and effectively.

Get more for Kraftfahrzeugsteuer

- Motion hearing form

- First request for production of documents and things to defendant mississippi form

- First set interrogatories 497314269 form

- Objection production form

- First set interrogatories 497314271 form

- Respond admissions form

- Objections interrogatories form

- Defendants supplement to interrogatories and request for production of documents mississippi form

Find out other Kraftfahrzeugsteuer

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy