Client Tax Information Sheet Eva Smith & Associates

What is the Client Tax Information Sheet Eva Smith & Associates

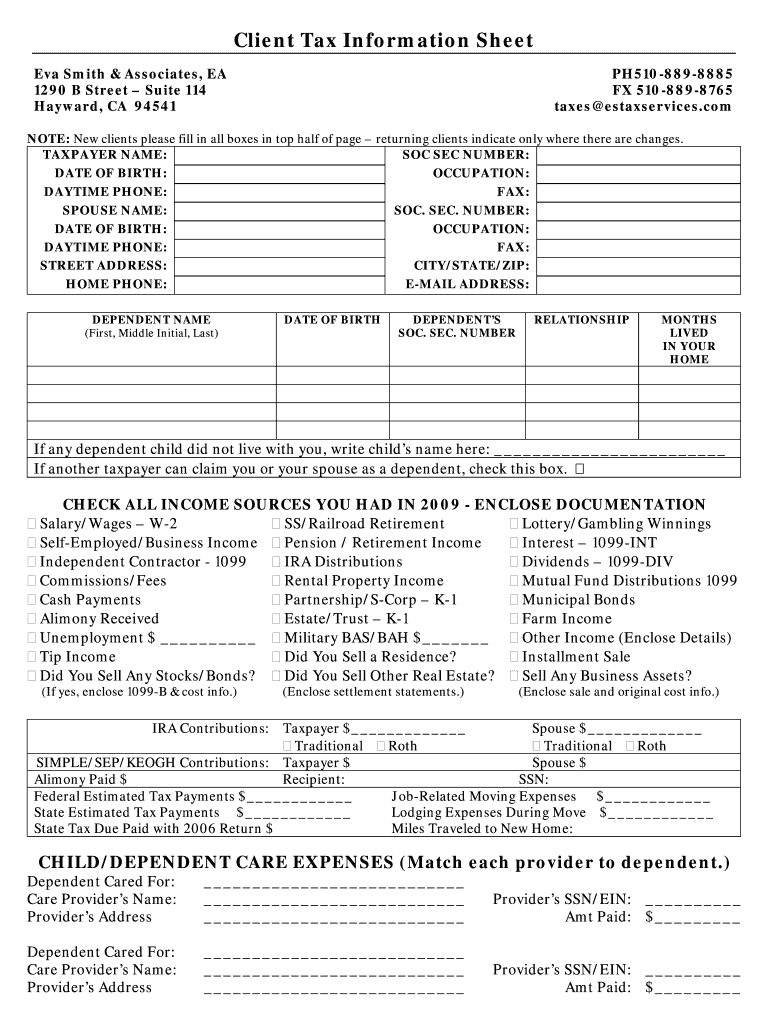

The Client Tax Information Sheet Eva Smith & Associates is a crucial document designed to collect essential tax-related information from clients. This form typically includes personal details, income sources, deductions, and other relevant financial data necessary for accurate tax preparation. By gathering this information, Eva Smith & Associates ensures compliance with tax regulations and helps clients maximize their tax benefits. Understanding the purpose and components of this sheet is vital for both clients and tax professionals.

Steps to complete the Client Tax Information Sheet Eva Smith & Associates

Completing the Client Tax Information Sheet Eva Smith & Associates involves several important steps to ensure accuracy and compliance. First, gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. Next, fill out personal information, including your name, address, and Social Security number. Then, report your income sources and any applicable deductions. Finally, review the completed form for accuracy before submission. Each step is essential to ensure that your tax information is complete and correct.

Legal use of the Client Tax Information Sheet Eva Smith & Associates

The legal use of the Client Tax Information Sheet Eva Smith & Associates is governed by U.S. tax laws and regulations. This document must be completed accurately to ensure compliance with the Internal Revenue Service (IRS) requirements. Electronic signatures on this form are valid under the ESIGN Act, provided that certain conditions are met. Using a reliable eSignature platform, like signNow, ensures that the document is legally binding and secure, protecting both the client and the firm from potential legal issues.

Key elements of the Client Tax Information Sheet Eva Smith & Associates

Key elements of the Client Tax Information Sheet Eva Smith & Associates include personal identification information, income details, and deduction eligibility. Specific sections may require clients to disclose their filing status, dependents, and any tax credits they may qualify for. Additionally, the form may ask for previous tax returns to provide context for the current year's filing. These elements are essential for accurate tax preparation and compliance with IRS guidelines.

IRS Guidelines

IRS guidelines dictate the requirements for tax documentation, including the information that must be reported on the Client Tax Information Sheet Eva Smith & Associates. Clients should be aware of the latest IRS updates regarding income reporting, deduction eligibility, and filing deadlines. Adhering to these guidelines ensures that clients avoid penalties and take advantage of any available tax benefits. Regularly consulting IRS resources can help clients stay informed about their tax responsibilities.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical for the timely submission of the Client Tax Information Sheet Eva Smith & Associates. Generally, the deadline for individual tax returns is April 15, unless it falls on a weekend or holiday. Clients should also be aware of any extensions available and the implications of late submissions. Keeping track of these dates helps ensure compliance and avoids potential penalties from the IRS.

Required Documents

To complete the Client Tax Information Sheet Eva Smith & Associates, clients must gather several required documents. These typically include W-2 forms from employers, 1099 forms for freelance or contract work, and receipts for deductible expenses. Additional documents may include bank statements, investment income reports, and prior year tax returns. Having these documents ready simplifies the completion process and ensures that all necessary information is accurately reported.

Quick guide on how to complete client tax information sheet eva smith amp associates

Effortlessly Prepare Client Tax Information Sheet Eva Smith & Associates on Any Device

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents promptly without any delays. Manage Client Tax Information Sheet Eva Smith & Associates on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Client Tax Information Sheet Eva Smith & Associates effortlessly

- Obtain Client Tax Information Sheet Eva Smith & Associates and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Client Tax Information Sheet Eva Smith & Associates to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the client tax information sheet eva smith amp associates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Client Tax Information Sheet Eva Smith & Associates?

The Client Tax Information Sheet Eva Smith & Associates is a comprehensive document designed to gather essential tax-related information from clients. This sheet simplifies the tax preparation process, ensuring that all necessary details are accounted for during filing. By using this template, businesses can streamline their data collection and improve efficiency.

-

How does airSlate SignNow help with the Client Tax Information Sheet Eva Smith & Associates?

airSlate SignNow provides an intuitive platform to send, receive, and eSign the Client Tax Information Sheet Eva Smith & Associates. This solution enables businesses to easily share documents with clients and ensures that all signatures are captured securely and electronically. With SignNow, you can simplify the process and keep your records organized.

-

Is there a pricing plan for using the Client Tax Information Sheet Eva Smith & Associates with airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs when using the Client Tax Information Sheet Eva Smith & Associates. You can choose from monthly or annual subscriptions, allowing you to find a plan that suits your budget. Each plan provides access to essential features and support to help you manage your documents effectively.

-

What features are included with the Client Tax Information Sheet Eva Smith & Associates on airSlate SignNow?

When you use the Client Tax Information Sheet Eva Smith & Associates on airSlate SignNow, you benefit from features such as customizable templates, real-time editing, and secure electronic signatures. Additionally, the platform offers document tracking and reminders to ensure timely completion of forms. These features help streamline your workflow and enhance user experience.

-

Can the Client Tax Information Sheet Eva Smith & Associates be integrated with other software?

Absolutely! airSlate SignNow allows seamless integration with various software applications, enhancing the functionality of the Client Tax Information Sheet Eva Smith & Associates. You can connect it with CRM tools, accounting software, and other business applications to create a comprehensive workflow. This integration saves time and minimizes errors during data entry.

-

What are the benefits of using the Client Tax Information Sheet Eva Smith & Associates?

Using the Client Tax Information Sheet Eva Smith & Associates ensures accuracy and efficiency in gathering client information for tax purposes. It helps reduce paperwork and manual data entry errors, which can lead to complicated tax issues. Moreover, clients appreciate the professional approach and ease of completing their tax-related documentation.

-

Is the Client Tax Information Sheet Eva Smith & Associates secure?

Yes, security is a top priority with airSlate SignNow. The Client Tax Information Sheet Eva Smith & Associates is handled with robust security protocols, ensuring that your client's sensitive information remains confidential. Electronic signatures and document storage are encrypted, providing peace of mind for both businesses and clients.

Get more for Client Tax Information Sheet Eva Smith & Associates

- Liability paragliding form

- Waiver and release from liability for adult for sorority function form

- Waiver and release from liability for minor child for sorority function form

- Waiver and release from liability for adult for fraternity event form

- Release liability event form

- Waiver release liability form 497427219

- Babysitting form 497427220

- Waiver liability house form

Find out other Client Tax Information Sheet Eva Smith & Associates

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation