Alabama Business Personal Property Return Faq Form

What is the Alabama Business Personal Property Tax Return?

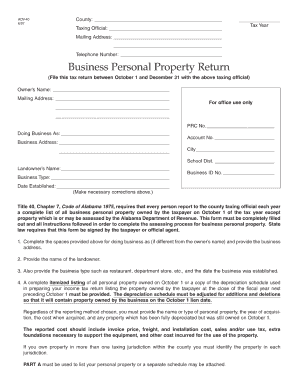

The Alabama Business Personal Property Tax Return is a crucial document for businesses operating in Alabama. It is used to report personal property owned by a business, which may include equipment, machinery, and furniture. This form helps the state assess the value of the property for taxation purposes. Completing this return accurately is essential to ensure compliance with state tax laws and to avoid potential penalties.

Steps to Complete the Alabama Business Personal Property Tax Return

Completing the Alabama Business Personal Property Tax Return involves several key steps:

- Gather necessary information about your business and its personal property.

- Obtain the tax return form from the appropriate state agency or online.

- Fill out the form, providing accurate details about the property, including its value and location.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, ensuring you follow the required submission method.

Required Documents for the Alabama Business Personal Property Tax Return

When filing the Alabama Business Personal Property Tax Return, certain documents may be required to support your claims. These documents typically include:

- Proof of ownership for the personal property.

- Purchase invoices or receipts for equipment and machinery.

- Previous tax returns, if applicable.

- Any relevant financial statements that reflect the value of the property.

Filing Deadlines for the Alabama Business Personal Property Tax Return

It is important to be aware of the filing deadlines for the Alabama Business Personal Property Tax Return. Typically, the return must be filed by April first of each year. Missing this deadline can result in penalties and interest on unpaid taxes. Businesses should mark their calendars and ensure timely submission to avoid complications.

Form Submission Methods for the Alabama Business Personal Property Tax Return

The Alabama Business Personal Property Tax Return can be submitted through various methods. Businesses may choose to:

- File online through the state’s tax portal, if available.

- Mail the completed form to the appropriate local tax office.

- Deliver the form in person to the local tax office.

Each method has its own advantages, and businesses should select the one that best suits their needs.

Penalties for Non-Compliance with the Alabama Business Personal Property Tax Return

Failure to file the Alabama Business Personal Property Tax Return or inaccuracies in the submission can lead to significant penalties. These may include:

- Monetary fines based on the assessed value of the property.

- Interest on unpaid taxes.

- Potential legal action for continued non-compliance.

It is crucial for businesses to adhere to the filing requirements to avoid these consequences.

Quick guide on how to complete alabama business personal property return faq form

Facilitate Alabama Business Personal Property Return Faq Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a remarkable eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with every tool needed to create, edit, and eSign your documents rapidly without delays. Manage Alabama Business Personal Property Return Faq Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Alabama Business Personal Property Return Faq Form with ease

- Locate Alabama Business Personal Property Return Faq Form and then select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Alabama Business Personal Property Return Faq Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama business personal property return faq form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Alabama business personal property tax return instructions?

The Alabama business personal property tax return instructions detail the process of filing for tax on business-owned equipment and property. It is crucial for businesses to understand how to properly complete these forms to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with Alabama business personal property tax return instructions?

airSlate SignNow simplifies the process of managing and submitting the required documents for Alabama business personal property tax return instructions. With easy eSignature capabilities, your business can ensure that all necessary forms are completed and filed on time.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers a range of features including document templates, real-time collaboration, and automated workflows. These features are particularly beneficial for following Alabama business personal property tax return instructions efficiently and accurately.

-

Are there any costs associated with using airSlate SignNow for tax returns?

Yes, airSlate SignNow has a flexible pricing model that caters to various business needs. Investing in this cost-effective solution can save time and reduce errors while following Alabama business personal property tax return instructions.

-

Can I integrate airSlate SignNow with other software to handle tax filings?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and document management systems. This allows you to easily access and manage your Alabama business personal property tax return instructions within your existing workflows.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents by implementing robust encryption and compliance standards. This ensures that your Alabama business personal property tax return instructions and sensitive information are protected during the signing process.

-

What benefits will I see by using airSlate SignNow for tax-related documents?

Using airSlate SignNow streamlines the document signing process, reduces turnaround time, and enhances accuracy. By following Alabama business personal property tax return instructions with our platform, your business can focus more on operations and less on paperwork.

Get more for Alabama Business Personal Property Return Faq Form

Find out other Alabama Business Personal Property Return Faq Form

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile