Kotak Mutual Fund Unclaimed Dividend Form

What is the Kotak Mutual Fund Unclaimed Dividend Form

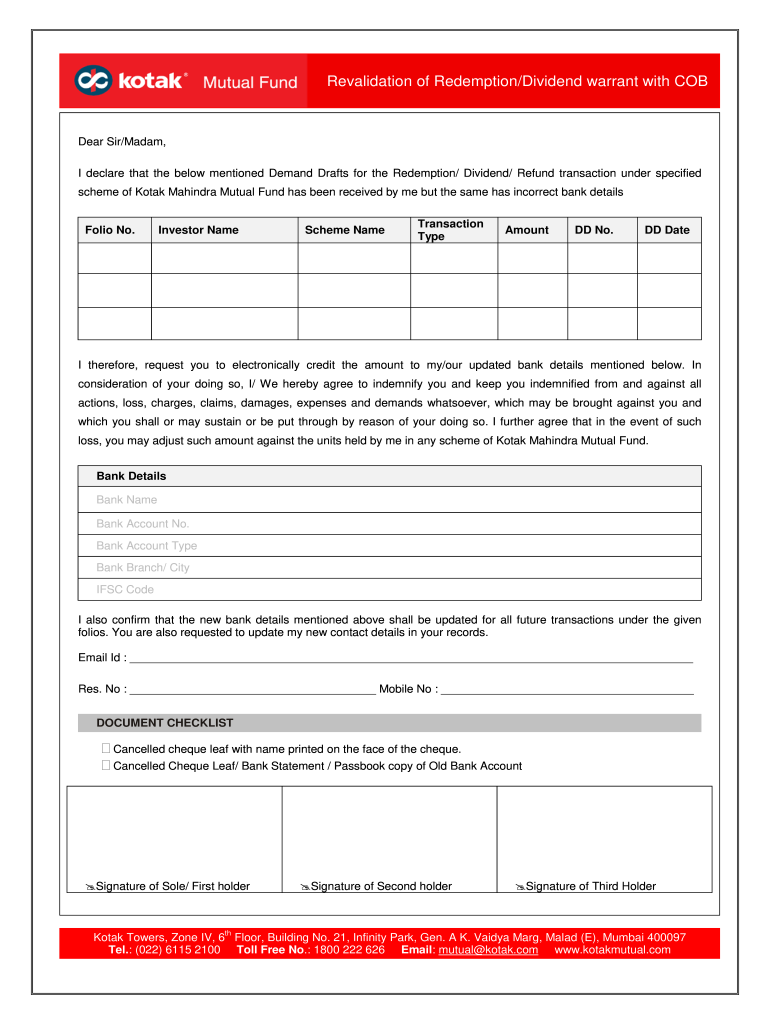

The Kotak Mutual Fund Unclaimed Dividend Form is a specific document designed for investors who have not received their dividend payouts from Kotak Mutual Fund. This form allows investors to formally request the release of unclaimed dividends that may have accumulated over time. It is essential for ensuring that investors can access their rightful earnings and maintain accurate records of their investments. Understanding the purpose of this form is crucial for anyone who has invested in Kotak Mutual Funds and has not received dividends as expected.

How to use the Kotak Mutual Fund Unclaimed Dividend Form

Using the Kotak Mutual Fund Unclaimed Dividend Form involves several straightforward steps. First, you need to obtain the form, which can typically be downloaded from the Kotak Mutual Fund website or requested from their customer service. Once you have the form, fill it out with accurate details, including your personal information and the specifics of your investment. After completing the form, submit it according to the instructions provided, either online or via mail. This process ensures that your request for unclaimed dividends is processed efficiently.

Steps to complete the Kotak Mutual Fund Unclaimed Dividend Form

Completing the Kotak Mutual Fund Unclaimed Dividend Form requires careful attention to detail. Follow these steps for successful completion:

- Download the form from the official Kotak Mutual Fund website or obtain a physical copy.

- Provide your personal information, including your name, address, and contact details.

- Include your investment details, such as the scheme name and your account number.

- Clearly state the amount of unclaimed dividends you are requesting.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form as per the guidelines, ensuring you keep a copy for your records.

Legal use of the Kotak Mutual Fund Unclaimed Dividend Form

The Kotak Mutual Fund Unclaimed Dividend Form is legally binding when completed and submitted correctly. It serves as a formal request for the release of funds that belong to the investor. To ensure its legal validity, the form must be filled out accurately and submitted in accordance with Kotak's guidelines. Additionally, compliance with relevant regulations, such as the ESIGN Act, is important when submitting the form electronically. This legal framework ensures that electronic signatures and documents are recognized as valid in the United States.

Key elements of the Kotak Mutual Fund Unclaimed Dividend Form

Understanding the key elements of the Kotak Mutual Fund Unclaimed Dividend Form can facilitate smoother processing of your request. Important components include:

- Investor Information: Personal details such as name, address, and contact number.

- Investment Details: Information about the mutual fund scheme and account number.

- Dividend Amount: The specific amount of unclaimed dividends being requested.

- Signature: A signature is required to validate the request and confirm the information provided.

Form Submission Methods

The Kotak Mutual Fund Unclaimed Dividend Form can be submitted through various methods, catering to different preferences. Investors can choose to submit the form online via the Kotak Mutual Fund portal, ensuring a quick and efficient process. Alternatively, the form can be mailed to the designated address provided by Kotak. For those who prefer in-person interactions, visiting a local Kotak branch is also an option. Each submission method has its own advantages, so choose the one that best fits your needs.

Quick guide on how to complete kotak mutual fund unclaimed dividend form

Effortlessly Prepare Kotak Mutual Fund Unclaimed Dividend Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Kotak Mutual Fund Unclaimed Dividend Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Kotak Mutual Fund Unclaimed Dividend Form Without Stress

- Find Kotak Mutual Fund Unclaimed Dividend Form and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Kotak Mutual Fund Unclaimed Dividend Form and ensure outstanding communication throughout every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kotak mutual fund unclaimed dividend form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dividend warrant?

A dividend warrant is a document issued by a company to its shareholders, enabling them to receive dividends. It serves as a formal declaration of the dividend amount due and can be cashed or deposited by shareholders. Understanding how dividend warrants work is essential for investors managing their portfolios.

-

How does airSlate SignNow facilitate the management of dividend warrants?

airSlate SignNow streamlines the electronic signing process for dividend warrants, allowing companies to send and receive important documents quickly. This efficiency minimizes delays in distribution, helping shareholders receive their dividends on time. With our platform, signing dividend warrants becomes seamless and secure.

-

What are the benefits of using airSlate SignNow for dividend warrants?

Using airSlate SignNow for dividend warrants enhances productivity by simplifying the signing process. Our solution eliminates the need for paper documents and manual signatures, signNowly reducing administrative burdens. Also, it provides a clear audit trail for each dividend warrant, ensuring compliance and transparency.

-

Is there a cost associated with sending dividend warrants through airSlate SignNow?

Yes, there is a cost for using airSlate SignNow, but it is designed to be cost-effective, especially for businesses handling numerous dividend warrants. Our pricing plans are flexible and cater to various business needs, ensuring you get the most value for your investment. With our solution, the benefits outweigh the costs associated with sending dividend warrants.

-

Can airSlate SignNow integrate with other financial software for dividend warrant management?

Absolutely, airSlate SignNow integrates seamlessly with various financial software solutions, enhancing dividend warrant management. These integrations allow for streamlined data flow and efficient document handling. By connecting your tools, you can further simplify the process of issuing and managing dividend warrants.

-

How secure is airSlate SignNow when handling sensitive dividend warrant information?

airSlate SignNow prioritizes security and compliance, ensuring that all information related to dividend warrants is encrypted and protected. Our platform adheres to industry-leading security standards, giving users peace of mind when managing sensitive data. With our robust security measures, your dividend warrants are in safe hands.

-

Does airSlate SignNow provide support for digital dividend warrants?

Yes, airSlate SignNow fully supports digital dividend warrants, offering an efficient solution for modern businesses. Our platform allows you to create, send, and sign dividend warrants electronically, providing a fast and secure process. Digital options for dividend warrants not only save time but also reduce the environmental impact of printing and mailing.

Get more for Kotak Mutual Fund Unclaimed Dividend Form

- Treasury rule 92 challan form

- Affidavit for distribution of property iowa form

- Form 35 44593865

- Mississippi birth certificate application pdf form

- Ovfa form

- End user statementcertification triman industries form

- Domestic relations financial affidavit home ogeecheecircuit form

- Requirement minimum distribution rmd election form

Find out other Kotak Mutual Fund Unclaimed Dividend Form

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document