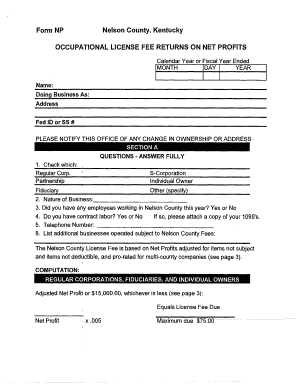

Nelson County Occupational Tax Form

What is the Nelson County Occupational Tax

The Nelson County Occupational Tax is a specific tax levied on individuals and businesses operating within Nelson County. This tax is designed to fund local services and infrastructure, ensuring that those who work in the county contribute to its upkeep and development. The tax applies to various occupations and may vary based on income levels or business types. Understanding this tax is essential for compliance and financial planning for both employees and employers within the county.

Steps to complete the Nelson County Occupational Tax

Completing the Nelson County Occupational Tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and identification details. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, whether online, by mail, or in person. Each step is crucial to avoid penalties and ensure proper processing.

Legal use of the Nelson County Occupational Tax

The legal use of the Nelson County Occupational Tax is governed by local regulations and state laws. It is essential to ensure that the tax is applied correctly to avoid any legal repercussions. Compliance with the tax regulations not only supports local services but also protects individuals and businesses from potential fines or audits. Understanding the legal framework surrounding this tax can provide clarity and peace of mind for taxpayers.

Required Documents

To successfully complete the Nelson County Occupational Tax form, certain documents are required. These typically include proof of income, such as pay stubs or tax returns, and identification documents like a driver’s license or Social Security number. Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is provided to the authorities.

Form Submission Methods

Submitting the Nelson County Occupational Tax form can be done through various methods, catering to different preferences. Individuals can choose to file online, which offers convenience and speed. Alternatively, forms can be submitted by mail, ensuring that all documentation is sent securely. For those who prefer face-to-face interaction, in-person submissions are also accepted at designated locations. Each method has its own advantages, making it important to choose the one that best fits individual needs.

Penalties for Non-Compliance

Failure to comply with the Nelson County Occupational Tax regulations can result in various penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial for both individuals and businesses to understand the importance of timely and accurate submissions to avoid these consequences. Staying informed about compliance requirements can help mitigate risks associated with non-compliance.

Quick guide on how to complete nelson county occupational tax

Effortlessly Prepare Nelson County Occupational Tax on Any Device

Online document organization has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Nelson County Occupational Tax across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Nelson County Occupational Tax With Ease

- Find Nelson County Occupational Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically made for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign Nelson County Occupational Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nelson county occupational tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nelson county occupational tax?

The nelson county occupational tax is a tax levied on income earned by individuals working within Nelson County. This tax is aimed at funding local services and infrastructure. To comply, residents and businesses need to accurately report their earnings in accordance with the county tax regulations.

-

How can airSlate SignNow help with the nelson county occupational tax compliance?

airSlate SignNow offers an efficient way to sign and send tax-related documents electronically. By using our platform, you can ensure timely submission of the necessary documentation related to the nelson county occupational tax. This streamlines your tax processes and helps maintain compliance effortlessly.

-

What features does airSlate SignNow offer for handling the nelson county occupational tax documentation?

airSlate SignNow provides features such as eSigning, document tracking, and templates tailored for tax filings like the nelson county occupational tax. These tools simplify the process, making it easier to manage your documents and maintain an accurate record of submissions. Enhance your tax filing efficiency with our robust platform.

-

Is airSlate SignNow cost-effective for small businesses managing the nelson county occupational tax?

Yes, airSlate SignNow is designed to be an affordable solution for businesses of all sizes, including small enterprises managing the nelson county occupational tax. With flexible pricing plans, you can choose the one that best fits your budget while benefiting from powerful document management features. Save time and money with our cost-effective services.

-

Can I integrate airSlate SignNow with other accounting software for nelson county occupational tax management?

Absolutely! airSlate SignNow can be seamlessly integrated with various accounting and tax software, enhancing your ability to manage the nelson county occupational tax more effectively. This integration allows for streamlined workflows and improved accuracy in financial record keeping, keeping your business compliant when filing your taxes.

-

What are the benefits of using airSlate SignNow for tax documents related to the nelson county occupational tax?

Using airSlate SignNow for handling documents related to the nelson county occupational tax offers numerous benefits, including increased efficiency, security, and accessibility. Digital document management reduces the chances of errors and misplaced paperwork. This ensures that your tax submissions are handled safely and in compliance with local regulations.

-

How secure is my information when using airSlate SignNow for nelson county occupational tax forms?

Your information is highly secure with airSlate SignNow, especially when dealing with sensitive documents such as those related to the nelson county occupational tax. Our platform utilizes high-level encryption and security protocols to protect your data. Trust in our commitment to keeping your information private and secure while you manage your tax filings.

Get more for Nelson County Occupational Tax

Find out other Nelson County Occupational Tax

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure