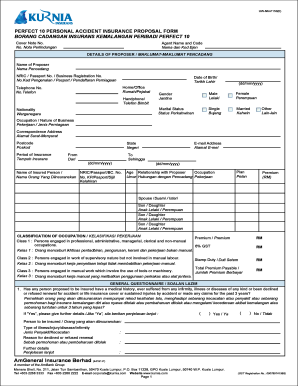

Cover Note in Insurance Form

What is the cover note in insurance?

A cover note in insurance serves as a temporary proof of insurance coverage until the formal policy is issued. It is often used in situations where immediate proof of insurance is required, such as when purchasing a vehicle or securing a loan. The cover note includes essential details such as the insured party's name, the type of coverage, the effective date, and any specific terms or conditions associated with the policy. This document is particularly important for individuals and businesses that need to demonstrate insurance coverage quickly.

How to use the cover note in insurance

Using a cover note in insurance involves presenting it as proof of coverage during transactions that require immediate verification. For example, when buying a car, the dealership may request a cover note to confirm that the vehicle is insured. It is important to ensure that the cover note is issued by a licensed insurance provider and contains accurate information. Keep a copy of the cover note for your records until the formal policy is received, as it serves as a legal document during the interim period.

Steps to complete the cover note in insurance

Completing a cover note in insurance typically involves several key steps:

- Contact your insurance provider to request a cover note.

- Provide necessary information, including your name, address, and details about the coverage needed.

- Review the details on the cover note to ensure accuracy.

- Obtain a digital or printed copy of the cover note for your records.

Following these steps will help ensure that you have the necessary documentation to demonstrate your insurance coverage effectively.

Key elements of the cover note in insurance

Understanding the key elements of a cover note is essential for its effective use. Important components typically include:

- Insured party's name: The individual or entity covered by the insurance.

- Policy number: A temporary number assigned to the cover note until the formal policy is issued.

- Coverage details: A description of the type and extent of coverage provided.

- Effective date: The date when the coverage begins.

- Expiration date: The date when the cover note becomes invalid, typically when the formal policy is issued.

These elements ensure that the cover note serves its purpose as a valid proof of insurance.

Legal use of the cover note in insurance

The legal use of a cover note in insurance is recognized under various regulations, which stipulate that it can serve as a valid document for proof of insurance. It is crucial that the cover note meets specific criteria, including being issued by a licensed insurer and containing accurate information. In legal contexts, such as during vehicle registration or loan applications, the cover note can protect the insured by demonstrating compliance with insurance requirements until the formal policy is in place.

Examples of using the cover note in insurance

Cover notes can be utilized in various scenarios, including:

- Vehicle purchases: Buyers may need to show proof of insurance to complete the sale.

- Loan applications: Lenders often require evidence of insurance coverage before approving a loan.

- Real estate transactions: Buyers may need to present a cover note when securing a mortgage.

These examples illustrate the practical applications of a cover note in different situations where immediate proof of insurance is necessary.

Quick guide on how to complete cover note in insurance

Complete Cover Note In Insurance effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Cover Note In Insurance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Cover Note In Insurance without any hassle

- Obtain Cover Note In Insurance and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Cover Note In Insurance and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cover note in insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance cover note sample?

An insurance cover note sample is a temporary document issued by an insurance company, confirming that a policyholder has insurance coverage in place. It serves as proof of insurance until the formal policy documents are issued. Using a sample can help businesses understand how to structure their own cover notes.

-

How can airSlate SignNow help with insurance cover notes?

airSlate SignNow offers a seamless eSigning solution that allows businesses to create, send, and manage insurance cover notes efficiently. With airSlate SignNow, you can digitally sign insurance cover note samples, saving time while ensuring legal compliance. This easy-to-use platform streamlines the process of obtaining necessary signatures.

-

Is there a cost associated with using airSlate SignNow for insurance cover notes?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Customers can choose from flexible pricing options that provide access to the features required for handling insurance cover note samples. Evaluating these plans allows you to find the best fit for your budget and operational requirements.

-

What features does airSlate SignNow offer for insurance documents?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking, specifically for handling insurance documents like cover notes. You can easily edit and personalize insurance cover note samples to meet your specific needs. Additionally, integration with various business applications enhances workflow efficiency.

-

Can I integrate airSlate SignNow with other software for handling insurance documents?

Yes, airSlate SignNow can be easily integrated with numerous applications, allowing you to streamline your document management processes. This capability ensures seamless communication between systems when working with insurance cover note samples. Integrating with tools such as CRM systems enhances overall productivity and efficiency.

-

What benefits do I get from using airSlate SignNow for insurance cover notes?

Using airSlate SignNow for insurance cover notes provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform enables swift document processing, minimizing delays in obtaining signatures. Overall, it makes managing insurance cover note samples more efficient and reliable.

-

How secure is airSlate SignNow when handling sensitive insurance documents?

airSlate SignNow prioritizes the security of your documents, employing advanced encryption protocols and secure servers. When handling sensitive documents like insurance cover note samples, user data is kept confidential and protected from unauthorized access. You can trust airSlate SignNow to safeguard your important information.

Get more for Cover Note In Insurance

- Anatomy of the constitution fill in the blank answers form

- From to city link express form

- American beauty screenplay pdf form

- H r diagram gizmo answer key form

- Finance application form pdf

- Sample confined space program form

- The directory of ftl amp ltl shippers form

- Compliance matrix contract template form

Find out other Cover Note In Insurance

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast