Form 28a

What is the Form 28a

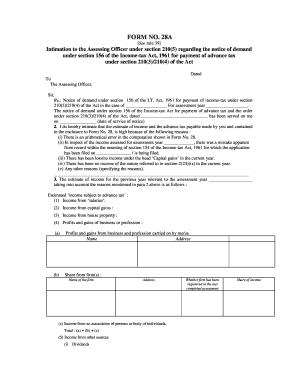

The Form 28a is a crucial document within the income tax framework, specifically designed for taxpayers to report certain financial information. This form is often referred to as the 28a fixation statement and is part of the income tax act. It serves as a declaration of income and deductions, allowing the Internal Revenue Service (IRS) to assess an individual's tax liability accurately. Understanding the purpose and requirements of the Form 28a is essential for compliance and effective tax planning.

How to use the Form 28a

Using the Form 28a involves several steps to ensure accurate reporting. Taxpayers should first gather all necessary financial documents, including income statements and receipts for deductions. Once all relevant information is collected, the form can be filled out, detailing income sources and applicable deductions. After completing the form, it must be submitted to the IRS by the specified deadline. Utilizing electronic filing options can streamline this process and enhance accuracy.

Steps to complete the Form 28a

Completing the Form 28a requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary financial documents, including W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- List deductions and credits applicable to your situation.

- Review the completed form for accuracy.

- Submit the form electronically or by mail before the deadline.

Legal use of the Form 28a

The legal use of the Form 28a is governed by specific regulations set forth by the IRS. To ensure that the form is legally binding, it must be filled out accurately and submitted on time. Additionally, electronic submissions must comply with eSignature laws to be considered valid. Understanding these legal requirements helps taxpayers avoid penalties and ensures that their filings are accepted by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 28a are critical for taxpayers to note. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may request, which can provide additional time for filing. Keeping track of these important dates is essential for maintaining compliance and avoiding late fees.

Required Documents

To complete the Form 28a accurately, several documents are required. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Previous year's tax return for reference.

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Quick guide on how to complete form 28a

Complete Form 28a effortlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without interruptions. Manage Form 28a on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and electronically sign Form 28a easily

- Find Form 28a and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 28a and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 28a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 28 income tax, and why is it important?

The form 28 income tax is a crucial document used for filing income tax for specific financial scenarios. It helps ensure that your tax information is accurately reported to the authorities. Understanding how to properly fill out this form can help you avoid potential penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow integrate with form 28 income tax submissions?

airSlate SignNow offers seamless integration options that make it easy to eSign and send your form 28 income tax digitally. This eliminates the need for physical paperwork, saving time and minimizing errors. With its user-friendly interface, you can streamline your tax document management process effectively.

-

What are the benefits of using airSlate SignNow for form 28 income tax processing?

Using airSlate SignNow for your form 28 income tax processing allows you to complete your documents quickly and securely. It provides features like electronic signatures, document tracking, and customizable templates that enhance efficiency. Overall, it simplifies compliance and enhances your filing process.

-

Is there a cost associated with using airSlate SignNow for form 28 income tax?

Yes, airSlate SignNow has various pricing plans to cater to different business sizes and needs. These plans offer features that facilitate the eSigning of your form 28 income tax, making it an affordable choice for individuals and organizations alike. You can choose a plan that fits your budget while ensuring that your tax processes are efficient.

-

What features does airSlate SignNow offer for managing form 28 income tax documents?

airSlate SignNow provides a range of features for managing form 28 income tax documents, including customizable templates, automated workflows, and secure cloud storage. These features ensure that your documents are easily accessible and can be processed efficiently. This streamlines your tax filing, allowing you to focus on more important tasks.

-

Can I use airSlate SignNow to collaborate with others on my form 28 income tax?

Absolutely! airSlate SignNow allows multiple users to collaborate on your form 28 income tax documents. You can easily share documents, collect eSignatures, and communicate with team members or tax professionals directly within the platform, making tax season more collaborative and less stressful.

-

How secure is airSlate SignNow when handling form 28 income tax documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security measures to protect your form 28 income tax documents from unauthorized access. You can confidently manage and store sensitive tax information knowing that it is safeguarded against threats.

Get more for Form 28a

- Ok frx 200 2020 2022 fill out tax template online us legal forms

- 2023 form 994 application for property valuation limitation and additional homestead exemption

- Form or 65 v oregon partnership return of income payment voucher 150

- Montana individual income tax payment voucher form it

- Payment vouchersarizona department of revenue azdor form

- District of columbia nonresident request for refund taxformfinder

- Amended returns ampamp form 1040xinternal revenue service

- Oregon form 40 ext application for automatic extension of time to file

Find out other Form 28a

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement