Birt Ez Form

What is the Birt Ez

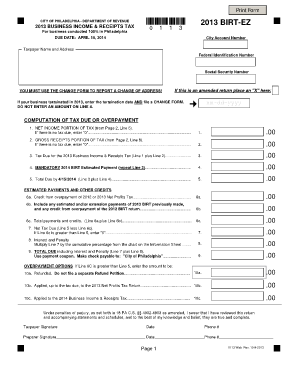

The 2015 BIRT EZ form is a simplified version of the Business Income and Receipts Tax (BIRT) form, specifically designed for businesses operating in Philadelphia. This form is utilized by entities to report their gross receipts and calculate the tax owed to the city. The BIRT EZ is intended for smaller businesses that meet certain criteria, making it easier to comply with local tax regulations.

How to use the Birt Ez

Using the 2015 BIRT EZ form involves several straightforward steps. First, gather all necessary financial information, including total gross receipts for the year. Next, accurately fill out the form, ensuring that all sections are completed. After filling out the form, review it for accuracy before submitting it. The BIRT EZ can be filed online or mailed to the appropriate tax authority, depending on your preference.

Steps to complete the Birt Ez

Completing the 2015 BIRT EZ form requires careful attention to detail. Follow these steps for a smooth process:

- Collect your financial records, including income statements and receipts.

- Access the BIRT EZ form online or obtain a physical copy.

- Fill in your business information, including name, address, and tax identification number.

- Report your total gross receipts accurately.

- Calculate the tax owed based on the provided rates.

- Sign and date the form, confirming the information is true and accurate.

- Submit the completed form either electronically or via mail.

Legal use of the Birt Ez

The 2015 BIRT EZ form is legally recognized as a valid method for reporting business income in Philadelphia. To ensure compliance, businesses must adhere to the specific guidelines outlined by the city’s tax authority. This includes filing the form by the designated deadlines and providing accurate information. Failure to comply with these regulations can lead to penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the 2015 BIRT EZ form. Typically, the form must be submitted by the end of April for the previous tax year. Keeping track of these important dates helps avoid late fees and ensures compliance with local tax laws. Businesses should also be aware of any changes in deadlines that may occur due to local regulations.

Who Issues the Form

The 2015 BIRT EZ form is issued by the City of Philadelphia’s Department of Revenue. This department is responsible for overseeing tax collection and compliance within the city. Businesses can obtain the form directly from the Department of Revenue’s website or through their physical offices. It is important to use the most current version of the form to ensure compliance with local tax laws.

Quick guide on how to complete birt ez

Complete Birt Ez effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Manage Birt Ez on any gadget with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Birt Ez with ease

- Obtain Birt Ez and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Birt Ez and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the birt ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2015 birt ez and how does it relate to airSlate SignNow?

2015 birt ez is a popular tool used for generating sophisticated reports and documents. airSlate SignNow integrates seamlessly with 2015 birt ez, allowing users to eSign and manage their documents effortlessly. This combination enhances productivity by streamlining the document workflow.

-

What are the pricing options for airSlate SignNow that supports 2015 birt ez?

airSlate SignNow offers various pricing tiers to accommodate different business needs, all of which support 2015 birt ez. You can choose from monthly or annual plans, ensuring flexibility as your business scales. Each plan comes with a range of features tailored to enhance document signing and management.

-

How does airSlate SignNow enhance the features of 2015 birt ez?

airSlate SignNow enhances 2015 birt ez by adding functionalities like advanced eSignature options, document sharing, and real-time tracking of document status. This integration makes it easy for users to manage their reports while ensuring the highest level of security and compliance. Ultimately, it simplifies the entire process of document handling.

-

What are the benefits of using airSlate SignNow with 2015 birt ez for businesses?

By using airSlate SignNow with 2015 birt ez, businesses can dramatically reduce the time spent on document management. The user-friendly interface facilitates quick document preparation and eSigning, allowing for faster turnaround times. Additionally, the integration ensures that legal and compliance standards are maintained.

-

Can I integrate airSlate SignNow with other applications alongside 2015 birt ez?

Yes, airSlate SignNow allows for seamless integration with numerous applications alongside 2015 birt ez. This flexibility enables businesses to connect their existing workflows and maximize efficiency. Integrating multiple platforms can streamline processes and improve overall productivity.

-

What types of documents can I eSign using airSlate SignNow and 2015 birt ez?

You can eSign a variety of documents using the combination of airSlate SignNow and 2015 birt ez, including contracts, agreements, and reports. This versatility is crucial for businesses that handle different types of documents in their operations. The integration ensures that all documents are handled securely and efficiently.

-

Is airSlate SignNow suitable for small businesses using 2015 birt ez?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses using 2015 birt ez. The cost-effective solutions provided by airSlate SignNow make it accessible for smaller enterprises looking to enhance their document workflows without breaking the bank.

Get more for Birt Ez

Find out other Birt Ez

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online