BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 2022

Understanding the Business Tangible Personal Property Return Form 10

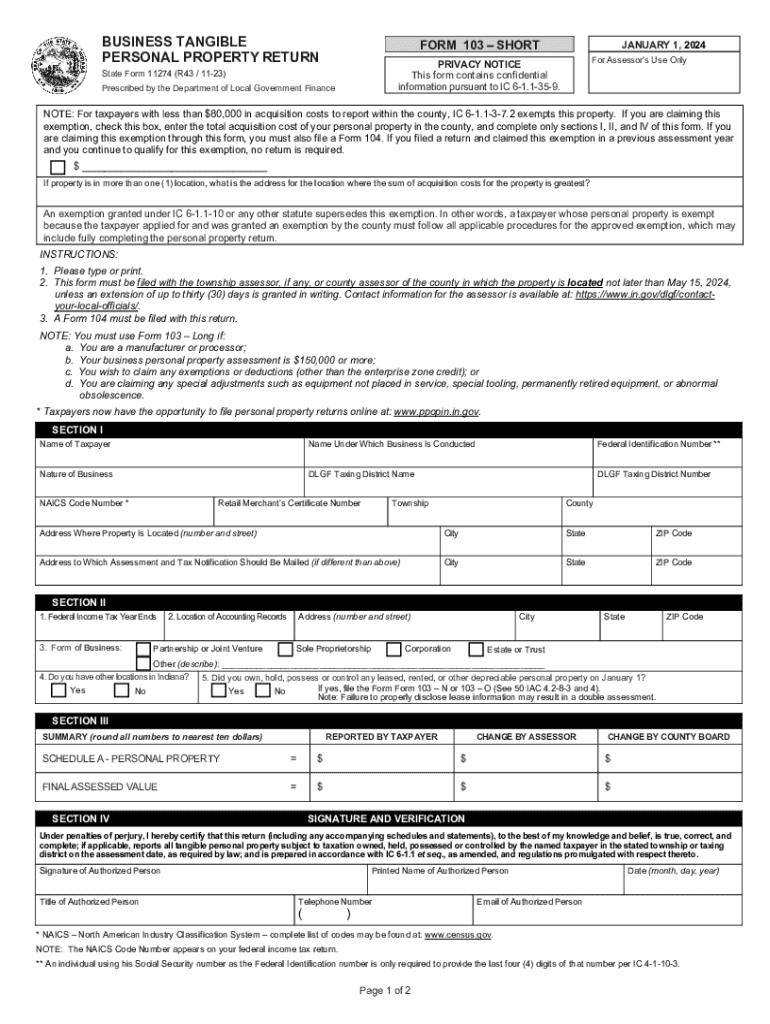

The Business Tangible Personal Property Return Form 10 is a crucial document for businesses operating in Indiana. This form is used to report the tangible personal property owned by a business, which includes items such as machinery, equipment, furniture, and other physical assets. Accurate reporting is essential for tax assessment purposes, as local governments use this information to determine property taxes owed by businesses.

Steps to Complete the Business Tangible Personal Property Return Form 10

Completing the Business Tangible Personal Property Return Form 10 involves several key steps:

- Gather Information: Collect details about all tangible personal property owned by the business, including purchase dates, costs, and descriptions.

- Fill Out the Form: Enter the collected information into the appropriate sections of the form. Ensure accuracy to avoid potential penalties.

- Review the Form: Double-check all entries for correctness and completeness. Mistakes can lead to delays or issues with tax assessments.

- Submit the Form: File the completed form by the deadline, using the preferred submission method.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Business Tangible Personal Property Return Form 10. Typically, the form must be submitted by May 15 each year. If the deadline falls on a weekend or holiday, it is usually extended to the next business day. Businesses should mark their calendars to ensure timely submission and avoid penalties.

Required Documents for Submission

When completing the Business Tangible Personal Property Return Form 10, businesses may need to provide supporting documentation. This can include:

- Purchase invoices for tangible personal property.

- Previous years' property tax returns.

- Any relevant financial statements that detail asset values.

Having these documents ready can facilitate a smoother filing process and help ensure compliance with local regulations.

Penalties for Non-Compliance

Failure to file the Business Tangible Personal Property Return Form 10 by the deadline can result in significant penalties. These may include fines or increased property tax assessments. Additionally, businesses that fail to report their tangible personal property accurately may face audits or other enforcement actions from local tax authorities. It is crucial to adhere to all filing requirements to avoid these consequences.

Form Submission Methods

The Business Tangible Personal Property Return Form 10 can be submitted through various methods, including:

- Online Submission: Many jurisdictions offer online filing options for convenience.

- Mail: Businesses can print the completed form and send it via postal service to the appropriate tax authority.

- In-Person: Some businesses may prefer to deliver the form directly to the local tax office.

Choosing the right submission method can depend on the business's preferences and the specific requirements of their local tax authority.

Quick guide on how to complete business tangible personal property return form 10

Complete BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 with minimal effort

- Obtain BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require you to print new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your selected device. Edit and electronically sign BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tangible personal property return form 10

Create this form in 5 minutes!

How to create an eSignature for the business tangible personal property return form 10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the state of Indiana form 11274 and its purpose?

The state of Indiana form 11274 is used for specific tax-related purposes within the state. It helps taxpayers report necessary information and ensure compliance with state regulations. Understanding this form is essential for accurate tax filing.

-

How can airSlate SignNow assist with the state of Indiana form 11274?

airSlate SignNow streamlines the process of completing and eSigning the state of Indiana form 11274. With its user-friendly interface, you can fill out forms digitally and securely share them with necessary stakeholders. This ensures that your documents are processed efficiently.

-

Is airSlate SignNow compliant with Indiana eSignature laws for form 11274?

Yes, airSlate SignNow complies with Indiana's eSignature laws, making it a secure choice for signing the state of Indiana form 11274. Our platform ensures that all electronic signatures are legally binding and enforceable, providing peace of mind for users.

-

What are the costs associated with using airSlate SignNow for the state of Indiana form 11274?

airSlate SignNow offers affordable pricing plans that cater to different business needs. You can choose from various tiers based on your usage requirements, ensuring you get great value while managing forms like the state of Indiana form 11274 efficiently.

-

Can I integrate airSlate SignNow with other tools for managing the state of Indiana form 11274?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to manage the state of Indiana form 11274 alongside your existing workflow. This versatility ensures seamless data transfer and improved productivity.

-

What features does airSlate SignNow offer that benefit users dealing with form 11274?

airSlate SignNow provides features like easy document sharing, templates for quick completion, and real-time tracking of the state of Indiana form 11274. These tools help streamline the signing process, saving valuable time and effort.

-

How secure is airSlate SignNow for handling sensitive documents like the state of Indiana form 11274?

Security is a top priority at airSlate SignNow. Our platform utilizes end-to-end encryption to protect your documents, including the state of Indiana form 11274, from unauthorized access. You can confidently manage sensitive data knowing that it’s secure.

Get more for BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10

- Hoa certification form

- Mass residential lease agreement pdf form

- Declaration of homestead norfolk county ma norfolkdeeds form

- 27 printable rental inspection checklist forms and templates

- Fillable online mbhp hcvp family certification form mtw

- Hcvp family certification form mtw mbhp

- Blumberg form a55

- Generic condo rental agreement 1996 form

Find out other BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 10

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online