Ifta Ontario Form

What is the IFTA Ontario?

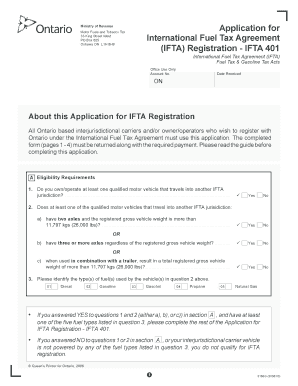

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. In Ontario, the IFTA allows carriers to file a single fuel tax report rather than separate reports for each jurisdiction. This streamlining helps reduce paperwork and administrative burdens for trucking companies.

How to Use the IFTA Ontario

To utilize the IFTA in Ontario, businesses must first register with the Ontario Ministry of Transportation. Once registered, carriers can report their fuel consumption and mileage for each jurisdiction through a single quarterly report. This report consolidates data, making it easier to manage and ensuring compliance with tax obligations across different regions.

Steps to Complete the IFTA Ontario

Completing the IFTA application in Ontario involves several key steps:

- Gather necessary information, including vehicle details, fuel purchases, and mileage records.

- Complete the IFTA quarterly report form, ensuring all data is accurate and up-to-date.

- Calculate the fuel tax owed or the refund due based on the fuel consumption and mileage in each jurisdiction.

- Submit the completed form to the appropriate tax office, either online or via mail.

Legal Use of the IFTA Ontario

The legal framework governing the IFTA in Ontario ensures that all participating jurisdictions recognize the validity of the reports filed. Compliance with IFTA regulations is crucial, as failure to adhere to these guidelines can result in penalties. It is essential for carriers to maintain accurate records and submit their reports on time to avoid legal issues.

Required Documents

To complete the IFTA application in Ontario, certain documents are required:

- Proof of registration with the Ontario Ministry of Transportation.

- Records of fuel purchases and usage.

- Mileage logs for each jurisdiction traveled.

- Any previous IFTA reports filed.

Form Submission Methods (Online / Mail / In-Person)

Carriers in Ontario have several options for submitting their IFTA reports. The forms can be filed online through the Ontario Ministry of Transportation's website, mailed to the appropriate tax office, or submitted in person at designated locations. Each method has specific guidelines and deadlines that must be followed to ensure compliance.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is important for carriers to adhere to filing deadlines and maintain accurate records to mitigate the risk of non-compliance and its associated consequences.

Quick guide on how to complete ifta ontario

Effortlessly Prepare Ifta Ontario on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without complications. Manage Ifta Ontario on any device using the airSlate SignNow Android or iOS applications, and streamline your document processes today.

How to Modify and Electronically Sign Ifta Ontario with Ease

- Locate Ifta Ontario and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which requires seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ifta Ontario while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta ontario

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the IFTA office in Oshawa, Ontario offer?

The IFTA office in Oshawa, Ontario provides various services including assistance with the International Fuel Tax Agreement (IFTA) reporting, guidance for fuel tax compliance, and support with document submissions. This office caters to the needs of trucking companies and freight operators, ensuring they meet their tax obligations seamlessly.

-

How can I contact the IFTA office in Oshawa, Ontario?

You can contact the IFTA office in Oshawa, Ontario via their official phone number or email provided on the government website. They also offer in-person consultations, where you can receive assistance regarding your fuel tax queries and compliance requirements.

-

What are the benefits of eSigning documents at the IFTA office in Oshawa, Ontario?

eSigning documents at the IFTA office in Oshawa, Ontario simplifies the filing process, reduces paperwork, and speeds up approvals. This cost-effective solution allows for secure signing from anywhere, ensuring that you can comply with IFTA requirements promptly and efficiently.

-

What pricing options are available for services at the IFTA office in Oshawa, Ontario?

Pricing for services at the IFTA office in Oshawa, Ontario may vary based on the specific assistance needed, such as document preparation or consultations. For a more accurate estimate, it is recommended to contact the office directly to inquire about their fees and available packages.

-

Is there any integration with digital tools at the IFTA office in Oshawa, Ontario?

Yes, the IFTA office in Oshawa, Ontario incorporates digital solutions to streamline the filing process. Businesses can utilize integrated tools that make document submission and signing quick and efficient, enhancing the overall user experience.

-

What types of documents can be signed electronically at the IFTA office in Oshawa, Ontario?

You can eSign various documents at the IFTA office in Oshawa, Ontario, including fuel tax reports, compliance forms, and related agreements. The ability to electronically sign these documents signNowly expedites the preparation and submission processes.

-

What are the hours of operation for the IFTA office in Oshawa, Ontario?

The IFTA office in Oshawa, Ontario typically operates during standard business hours, from Monday to Friday. It is advisable to check their official website for the most current hours, as they may vary during holidays or special circumstances.

Get more for Ifta Ontario

Find out other Ifta Ontario

- Share eSignature PDF Simple

- Share eSignature Presentation Free

- Share eSignature Presentation Secure

- Share eSignature Form iPad

- How To Share eSignature Form

- Edit eSignature PDF Simple

- Edit eSignature PDF Android

- Edit eSignature Document Online

- Edit eSignature Word Free

- Edit eSignature Document Free

- Edit eSignature Form Android

- Submit eSignature Word Mobile

- Submit eSignature Document Fast

- Submit eSignature Document Simple

- Submit eSignature Document Easy

- How To Submit eSignature Form

- Convert eSignature PDF Online

- Convert eSignature PDF Free

- Convert eSignature Word Online

- Convert eSignature Document Online