ST 10 the South Carolina Department of Revenue Sctax Form

What is the ST-10 The South Carolina Department Of Revenue Sctax

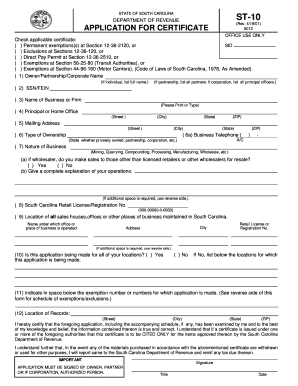

The ST-10 form is a crucial document issued by the South Carolina Department of Revenue. It serves as a sales tax exemption certificate, allowing qualifying entities to make tax-exempt purchases in the state. This form is primarily utilized by organizations such as non-profits, government agencies, and certain educational institutions that meet specific criteria. By presenting the ST-10, eligible buyers can avoid paying sales tax on purchases that are directly related to their exempt purpose.

How to use the ST-10 The South Carolina Department Of Revenue Sctax

Using the ST-10 form involves a straightforward process. First, the eligible entity must complete the form accurately, providing necessary details such as the name, address, and tax identification number. Once filled out, the form should be presented to the seller at the time of purchase. It is essential to ensure that the seller accepts the ST-10 for tax-exempt transactions. Retaining a copy of the completed form for record-keeping is also advisable, as it may be required for future audits or verification.

Steps to complete the ST-10 The South Carolina Department Of Revenue Sctax

Completing the ST-10 form requires careful attention to detail. Follow these steps:

- Obtain the ST-10 form from the South Carolina Department of Revenue website or through authorized channels.

- Fill in the entity's name, address, and tax identification number accurately.

- Specify the type of exemption being claimed and provide any additional information as required.

- Sign and date the form to certify its accuracy.

- Keep a copy for your records and present the original to the seller during the transaction.

Legal use of the ST-10 The South Carolina Department Of Revenue Sctax

The legal use of the ST-10 form is governed by South Carolina sales tax laws. To ensure compliance, the entity using the form must be eligible for tax exemption under state regulations. Misuse of the ST-10, such as using it for ineligible purchases, can lead to penalties and legal repercussions. It is important for users to understand the specific conditions under which the ST-10 can be utilized to avoid potential issues with the South Carolina Department of Revenue.

Key elements of the ST-10 The South Carolina Department Of Revenue Sctax

The ST-10 form includes several key elements that are essential for its validity. These elements consist of:

- The name and address of the purchaser.

- The purchaser's tax identification number.

- A description of the property or services being purchased.

- The specific exemption category being claimed.

- The signature of an authorized representative of the exempt entity.

Eligibility Criteria

To qualify for using the ST-10 form, entities must meet specific eligibility criteria set forth by the South Carolina Department of Revenue. Generally, these criteria include being a non-profit organization, a government entity, or an educational institution that is recognized as tax-exempt. Additionally, the purchases made must be directly related to the exempt purpose of the organization. It is advisable for entities to verify their eligibility before attempting to use the ST-10 form to ensure compliance with state laws.

Quick guide on how to complete st 10 the south carolina department of revenue sctax

Effortlessly Prepare ST 10 The South Carolina Department Of Revenue Sctax on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle ST 10 The South Carolina Department Of Revenue Sctax on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The Easiest Way to Modify and eSign ST 10 The South Carolina Department Of Revenue Sctax Without Stress

- Find ST 10 The South Carolina Department Of Revenue Sctax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose how to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign ST 10 The South Carolina Department Of Revenue Sctax to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 10 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 10 form from The South Carolina Department Of Revenue?

The ST 10 form is a sales tax exemption certificate used by qualifying entities to exempt certain purchases from sales tax. This form is crucial for organizations dealing with tax-exempt purchases in South Carolina. Completing the ST 10 form ensures compliance with the regulations set by The South Carolina Department Of Revenue.

-

How can airSlate SignNow help with filing the ST 10 form?

airSlate SignNow simplifies the process of filling out and submitting the ST 10 form by providing a user-friendly platform for eSigning documents. It allows businesses to easily manage and store their tax documentation securely. This efficient workflow signNowly reduces the risk of errors in paperwork related to The South Carolina Department Of Revenue.

-

What are the pricing options for airSlate SignNow when focusing on the ST 10 needs?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, including those using the ST 10 form. Different tiers provide access to essential features for document management and signing. By choosing the right plan, users can maximize their efficiency while dealing with The South Carolina Department Of Revenue requirements.

-

What features does airSlate SignNow provide that support the use of ST 10 forms?

airSlate SignNow provides various features, such as customizable templates for the ST 10 form, secure eSigning, and document tracking. These features enhance compliance with The South Carolina Department Of Revenue requirements and ensure a seamless document flow. Businesses can also collaborate in real-time to finalize important tax-related documentation.

-

How does airSlate SignNow ensure compliance with The South Carolina Department Of Revenue?

airSlate SignNow adheres to the necessary legal standards for electronic signatures and document management, ensuring compliance with The South Carolina Department Of Revenue regulations. Users benefit from a platform that maintains document integrity and security. This commitment helps organizations avoid penalties and complications when dealing with tax documentation.

-

Can airSlate SignNow integrate with other software relevant to ST 10 form processing?

Yes, airSlate SignNow offers integration with various business software to streamline the ST 10 form processing. Whether it's CRM systems, accounting software, or other document management tools, airSlate SignNow facilitates seamless collaboration. This integration enhances efficiency in managing tax documents required by The South Carolina Department Of Revenue.

-

What are the benefits of using airSlate SignNow for ST 10 form management?

Using airSlate SignNow for ST 10 form management provides benefits such as increased efficiency, reduced paperwork, and enhanced compliance with The South Carolina Department Of Revenue. The platform allows for quick turnaround on document processing and improved accuracy. Businesses can save time and resources, ultimately leading to better operations.

Get more for ST 10 The South Carolina Department Of Revenue Sctax

- Famous footwear w2 form

- Injuries board form b

- Plano mckinney v3 preferred imaging form

- Lease contract guaranty 100084066 form

- Wisconsin uniform dwelling code energy worksheet

- 311a student data form hillviewacademy com

- Option to purchase agreement template form

- Option to purchase shares agreement template form

Find out other ST 10 The South Carolina Department Of Revenue Sctax

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself