Formulario 480 2 Ec

What is the Formulario 480 2 Ec

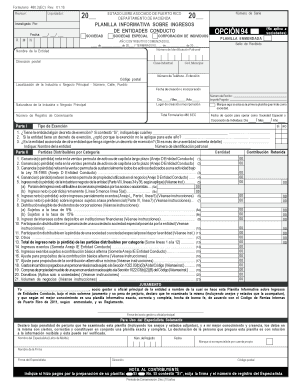

The Formulario 480 2 Ec, also known as the 480 2 ec form, is a tax form used in Puerto Rico for reporting income from various sources. This form is essential for entities that conduct business in Puerto Rico and need to disclose specific information regarding their income and expenses. It serves as a declaration to the Hacienda, the Puerto Rican Department of the Treasury, ensuring compliance with local tax regulations. Understanding the purpose and requirements of this form is crucial for businesses and individuals alike to maintain accurate records and fulfill their tax obligations.

Steps to complete the Formulario 480 2 Ec

Completing the Formulario 480 2 Ec involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense receipts. Next, begin filling out the form by entering the required information, such as the entity's name, tax identification number, and the income amounts from different sources. It is important to double-check all figures for accuracy. Once completed, review the form thoroughly to ensure all sections are filled out correctly. Finally, submit the form to the Hacienda by the designated deadline to avoid penalties.

Legal use of the Formulario 480 2 Ec

The legal use of the Formulario 480 2 Ec is governed by Puerto Rican tax laws, which mandate that businesses report their income and expenses accurately. This form must be completed in accordance with the guidelines provided by the Hacienda to ensure that it is considered valid. Failure to comply with these regulations can result in penalties and legal repercussions. It is crucial for entities to understand the legal implications of submitting this form, as it plays a significant role in tax compliance and financial transparency.

Key elements of the Formulario 480 2 Ec

The Formulario 480 2 Ec includes several key elements that must be accurately reported. These elements typically consist of the entity's identification details, a breakdown of income sources, and any applicable deductions or credits. Additionally, the form requires information regarding the entity's tax identification number and the fiscal year being reported. Each section must be completed with precision to ensure that the form meets the requirements set forth by the Hacienda, thereby maintaining its validity and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 2 Ec are crucial for compliance. Typically, the form must be submitted annually by the specified date set by the Hacienda. It is essential for businesses and individuals to keep track of these deadlines to avoid late fees and penalties. Important dates may vary each year, so staying informed about any changes in the tax calendar is advisable to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Formulario 480 2 Ec can be submitted through various methods, including online filing, mailing, or in-person submission at designated Hacienda offices. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. For those opting to file by mail, it is important to send the form well in advance of the deadline to ensure it arrives on time. In-person submissions can provide immediate confirmation but may require waiting in line at the Hacienda office.

Quick guide on how to complete formulario 480 2 ec

Effortlessly prepare Formulario 480 2 Ec on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without hurdles. Manage Formulario 480 2 Ec on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

An effortless approach to edit and electronically sign Formulario 480 2 Ec

- Obtain Formulario 480 2 Ec and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Formulario 480 2 Ec and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 480 2 ec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 480 2 ec form and how is it used?

The 480 2 ec form is a specific tax document required in certain jurisdictions for reporting income and valid deductions. This form helps streamline the eSigning process within airSlate SignNow, ensuring you can securely send and sign important tax documents.

-

How does airSlate SignNow simplify the process of handling the 480 2 ec form?

airSlate SignNow simplifies the 480 2 ec form process through its user-friendly interface that allows for easy document preparation and eSigning. You can upload your 480 2 ec form, share it seamlessly, and collect signatures from multiple parties in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the 480 2 ec form?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet different business needs, including features specifically designed for handling the 480 2 ec form. You can choose from several subscription options, ensuring you find a plan that fits your budget.

-

What features does airSlate SignNow offer for the 480 2 ec form?

AirSlate SignNow provides various features for the 480 2 ec form, including customizable templates, secure cloud storage, and automated workflows. These features enhance efficiency, ensuring your documents are easy to manage and track.

-

Can I integrate airSlate SignNow with other software for managing the 480 2 ec form?

Absolutely! airSlate SignNow supports a wide range of integrations with popular software applications, helping you streamline the management of your 480 2 ec form. Integrations with CRM and accounting software make it easy to sync data and enhance productivity.

-

How secure is the 480 2 ec form when using airSlate SignNow?

Security is a top priority with airSlate SignNow. All transactions involving the 480 2 ec form are protected through advanced encryption, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

What benefits can businesses expect from using airSlate SignNow for the 480 2 ec form?

Businesses can expect to save time and increase efficiency by using airSlate SignNow for the 480 2 ec form. The platform reduces the need for physical paperwork, speeds up the signing process, and provides a legally binding solution for document management.

Get more for Formulario 480 2 Ec

- Shipping release form 393106119

- Accident statement besip ibesip form

- Model psi v3 0 4 5 vdc out rf specialties group form

- Bioidentical hormone replacement therapy female consent form

- Delaware income taxes and de state tax forms

- Get a sample irs determination letter form

- Fyi 320 new mexico taxation and revenue department form

- Il 1041 instructions illinois department of revenue form

Find out other Formulario 480 2 Ec

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online