IL 1041 Instructions Illinois Department of Revenue 2018

IRS Guidelines

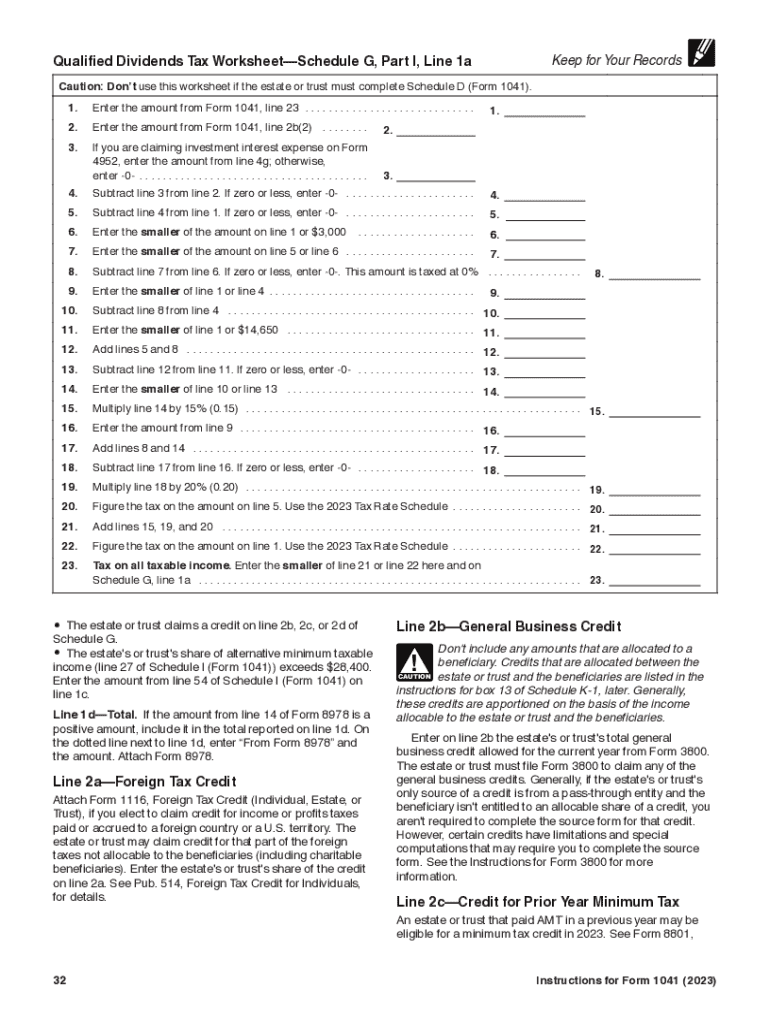

The IRS provides specific guidelines for completing the tax act form 1041, which is used for reporting income, deductions, gains, losses, and other tax-related information for estates and trusts. It is essential to follow these guidelines to ensure compliance and accurate reporting. The form must be filled out according to the instructions provided by the IRS, which detail the necessary information required for each section of the form. Understanding these guidelines can help avoid common mistakes and ensure that the form is completed correctly.

Filing Deadlines / Important Dates

For the tax act form 1041, the due date typically falls on the fifteenth day of the fourth month after the end of the estate's or trust's tax year. If the estate or trust’s tax year ends on December 31, the form is due on April 15 of the following year. However, it is important to check for any changes or extensions that may apply. Filing the form on time is crucial to avoid penalties and interest on any taxes owed.

Required Documents

When preparing to file the tax act form 1041, several documents are necessary to ensure accurate completion. These include records of income received by the estate or trust, documentation of deductions, and any relevant tax forms such as the 1041-K1 for beneficiaries. It is also important to gather any prior year tax returns if applicable. Having all required documents organized and accessible can streamline the filing process and reduce the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

The tax act form 1041 can be submitted in various ways, including online, by mail, or in person. For electronic filing, taxpayers can use IRS-authorized e-file providers, which can simplify the submission process. For those choosing to mail the form, it is essential to send it to the correct address specified by the IRS, which may vary based on the state of residence. In-person submissions are less common but may be available at certain IRS offices. Understanding the available submission methods can help ensure timely and secure filing.

Penalties for Non-Compliance

Failure to file the tax act form 1041 on time or inaccuracies in the form can lead to significant penalties imposed by the IRS. These penalties may include late filing fees, interest on unpaid taxes, and potential legal repercussions for willful neglect. It is crucial to adhere to all filing requirements and deadlines to avoid these penalties. Taxpayers should also be aware of the circumstances under which penalties may be waived, such as reasonable cause for late filing.

Eligibility Criteria

Eligibility to file the tax act form 1041 generally applies to estates and trusts that have gross income exceeding a specified threshold, as well as those that have made distributions to beneficiaries. Understanding the eligibility criteria is important to determine whether the form must be filed. This includes reviewing the nature of the income received and the legal structure of the estate or trust. Ensuring compliance with eligibility requirements can help avoid unnecessary complications during the filing process.

Application Process & Approval Time

The application process for filing the tax act form 1041 involves gathering the necessary documentation, completing the form accurately, and submitting it by the established deadline. Once the form is submitted, the IRS typically processes it within a few weeks, although this can vary based on the volume of submissions. Taxpayers should keep a record of their submission and any correspondence with the IRS for future reference. Understanding the application process and expected timelines can help manage expectations and ensure compliance.

Quick guide on how to complete il 1041 instructions illinois department of revenue

Effortlessly prepare IL 1041 Instructions Illinois Department Of Revenue on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage IL 1041 Instructions Illinois Department Of Revenue on any device using the airSlate SignNow apps for Android or iOS and simplify any document-centric workflow today.

The simplest way to alter and eSign IL 1041 Instructions Illinois Department Of Revenue with ease

- Locate IL 1041 Instructions Illinois Department Of Revenue and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Alter and eSign IL 1041 Instructions Illinois Department Of Revenue to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1041 instructions illinois department of revenue

Create this form in 5 minutes!

How to create an eSignature for the il 1041 instructions illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax act form 1041?

The tax act form 1041 is used by fiduciaries to report income for estates and trusts. This form is crucial for complying with federal tax laws and ensures proper taxation of the income generated within an estate or trust. Understanding how to accurately complete the tax act form 1041 is essential for effective tax management.

-

How can airSlate SignNow help with the tax act form 1041?

airSlate SignNow provides a streamlined solution to eSign and send the tax act form 1041 securely. This tool simplifies the document workflow, making it easy to collaborate with stakeholders and have the forms signed in a timely manner. Efficient document management is key when filing the tax act form 1041 to avoid delays.

-

Is there a cost associated with using airSlate SignNow for the tax act form 1041?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling the tax act form 1041. These plans are designed to be cost-effective, allowing users to access essential features without overspending. Review our pricing page for details on which plan suits your requirements for the tax act form 1041.

-

What features does airSlate SignNow offer for managing the tax act form 1041?

airSlate SignNow includes features such as eSigning, document sharing, and customizable templates specifically for the tax act form 1041. These tools enhance the user experience and ensure compliance with legal standards. Utilizing these features makes it easier to manage paperwork and maintain focus on your tax obligations.

-

Can I track the status of my tax act form 1041 documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your tax act form 1041 documents in real-time. This means you can see when your forms are sent, viewed, and signed, which helps maintain transparency throughout the process. Tracking ensures that your important tax documents are handled efficiently.

-

Does airSlate SignNow integrate with other software for the tax act form 1041?

Yes, airSlate SignNow offers integrations with various software applications that can aid in managing the tax act form 1041. These integrations facilitate a seamless workflow, allowing you to combine tools and streamline your document handling process. Check our integrations page to see all compatible services.

-

What are the benefits of using airSlate SignNow for the tax act form 1041?

The benefits of using airSlate SignNow for the tax act form 1041 include improved efficiency, enhanced security, and ease of use. By digitizing the signing process, you reduce the time spent on paperwork and minimize the risk of errors. This contributes to better compliance with tax regulations and a smoother filing experience.

Get more for IL 1041 Instructions Illinois Department Of Revenue

- Michigan installments fixed rate promissory note secured by residential real estate michigan form

- Michigan installments fixed rate promissory note secured by personal property michigan form

- Michigan note form

- Notice of option for recording michigan form

- Life documents planning package including will power of attorney and living will michigan form

- General durable power of attorney for property and finances or financial effective upon disability michigan form

- Essential legal life documents for baby boomers michigan form

- Michigan general form

Find out other IL 1041 Instructions Illinois Department Of Revenue

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template