Non Residents and Income Tax 2022-2026

Understanding Non-Residents and Income Tax

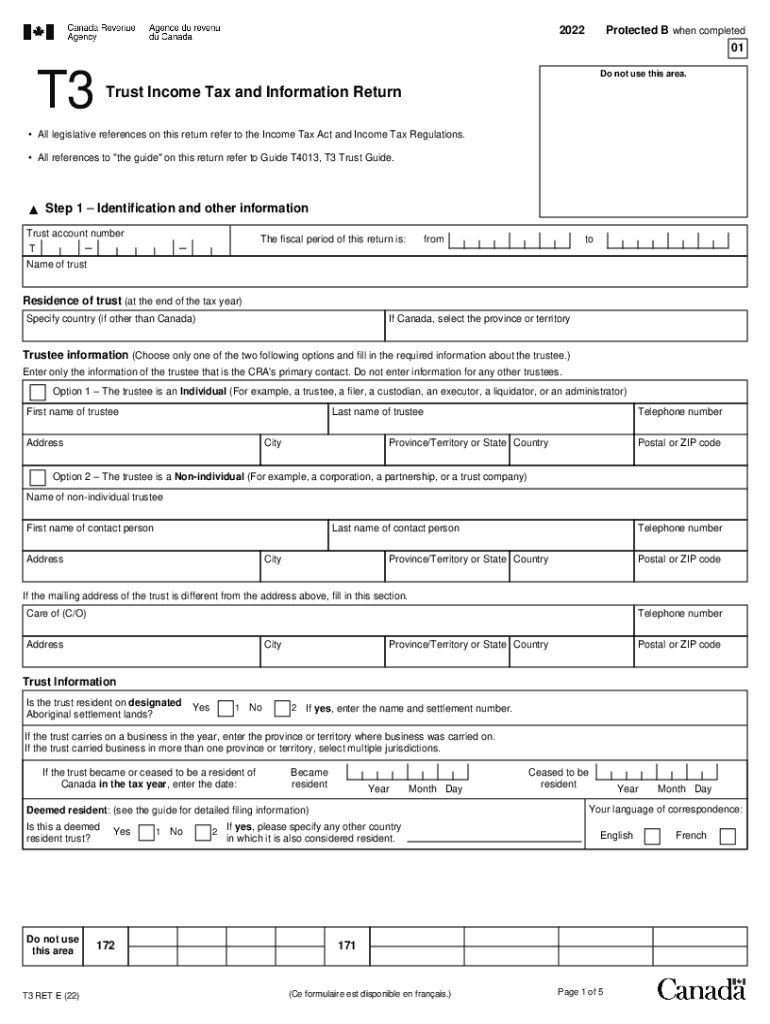

The T3 slip is crucial for non-residents in understanding their income tax obligations in the United States. Non-residents may be subject to different tax rules compared to residents, especially concerning income sourced from U.S. entities. It is essential to recognize that non-residents must file taxes on income earned within the U.S. and may also be eligible for certain deductions or credits. This understanding helps in ensuring compliance with U.S. tax laws and avoiding potential penalties.

Steps to Complete the Non-Residents and Income Tax

Completing the T3 slip requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents, including any U.S. income statements.

- Identify the specific income types that are taxable for non-residents.

- Fill out the T3 slip accurately, ensuring all income is reported.

- Check for any applicable deductions or credits that may reduce your taxable income.

- Submit the completed T3 slip to the appropriate tax authority by the designated deadline.

Key Elements of the Non-Residents and Income Tax

Several key elements must be understood when dealing with the T3 slip for non-residents:

- Income Sources: Non-residents are taxed only on U.S.-sourced income.

- Filing Requirements: Not all non-residents are required to file, but those with taxable income must do so.

- Tax Rates: Non-residents may face different tax rates compared to residents, often higher.

- Deductions: Limited deductions are available, and it's important to know what applies.

Examples of Using the Non-Residents and Income Tax

Understanding practical examples can clarify how the T3 slip functions for non-residents. For instance, a non-resident earning rental income from a U.S. property must report this on the T3 slip. Another example involves a non-resident working for a U.S. company, who must report their wages and any applicable withholding taxes. These scenarios illustrate the importance of accurately reporting income and understanding tax obligations.

Filing Deadlines and Important Dates

Timely filing of the T3 slip is essential to avoid penalties. Generally, non-residents must file their income tax returns by April fifteenth of the following year. However, if an extension is needed, it is crucial to file for an extension before the deadline. Knowing these dates helps ensure compliance and prevents unnecessary complications.

Required Documents for Non-Residents

When preparing to file the T3 slip, several documents are necessary:

- Income statements from U.S. sources.

- Any previous tax returns, if applicable.

- Documentation supporting deductions or credits claimed.

- Identification documents, such as a Social Security Number or Individual Taxpayer Identification Number.

Legal Use of the Non-Residents and Income Tax

Understanding the legal framework surrounding the T3 slip is vital for non-residents. The Internal Revenue Service (IRS) outlines specific regulations that govern the taxation of non-residents. Compliance with these regulations is essential to avoid legal issues and ensure that all tax obligations are met. Non-residents should be aware of their rights and responsibilities under U.S. tax law.

Quick guide on how to complete non residents and income tax

Easily Prepare Non Residents And Income Tax on Any Device

Digital document management has become popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Non Residents And Income Tax on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Method to Modify and eSign Non Residents And Income Tax Effortlessly

- Find Non Residents And Income Tax and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Non Residents And Income Tax to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non residents and income tax

Create this form in 5 minutes!

How to create an eSignature for the non residents and income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a T3 slip and why is it important?

A T3 slip is a tax document that reports income earned from a trust or certain investment funds. Understanding the importance of the T3 slip is crucial for accurate tax reporting and compliance. This document ensures that taxpayers receive the correct information to report earnings, thus avoiding potential penalties.

-

How can airSlate SignNow help with T3 slip management?

airSlate SignNow streamlines the process of managing T3 slips by allowing businesses to securely send and eSign these important documents. Our platform simplifies document handling, ensuring that tax-related documents such as the T3 slip are efficiently processed and tracked. This enhances productivity while maintaining compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow to handle T3 slips?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those dealing with T3 slips. Our pricing structure is designed to be cost-effective while providing full access to features that enhance document security and ease of use. You can choose a plan that fits your budget and scale as needed.

-

Can I integrate airSlate SignNow with other software for T3 slip processing?

Yes, airSlate SignNow easily integrates with various software applications that can help streamline T3 slip processing. This includes accounting and tax software, which ensures that your financial data remains synchronized. Our integration capabilities enhance your workflow, saving time and reducing errors.

-

Is eSigning a T3 slip legally binding?

Absolutely! eSigning a T3 slip using airSlate SignNow is legally binding and complies with international eSignature laws. Our secure platform provides verification and compliance features, ensuring that signed documents, including T3 slips, hold up in court and meet regulatory standards.

-

What benefits does airSlate SignNow offer for T3 slip preparation?

Using airSlate SignNow for T3 slip preparation offers numerous benefits, including enhanced document security and faster turnaround times for eSignatures. Our intuitive interface makes it easy for users to prepare and send T3 slips, improving overall efficiency. By automating parts of your workflow, you can focus more on your core business activities.

-

Can I customize T3 slips when using airSlate SignNow?

Yes, airSlate SignNow allows users to customize T3 slips to cater to specific needs. You can modify templates, include fields for required information, and ensure that all necessary elements are present. Customization helps in presenting a professional image and ensures compliance with requirements.

Get more for Non Residents And Income Tax

Find out other Non Residents And Income Tax

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast