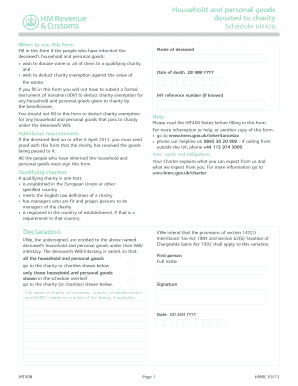

Iht408 Form

What is the Iht408

The Iht408 form is a crucial document used in the context of estate tax in the United States. It is specifically designed for reporting the value of an estate when the decedent's estate exceeds the federal estate tax exemption threshold. This form helps ensure that the estate is compliant with federal tax regulations and provides a clear account of the assets and liabilities that make up the estate. Understanding the Iht408 is essential for executors and administrators of estates, as it outlines the necessary information required for accurate reporting.

How to use the Iht408

Using the Iht408 form involves several steps to ensure accurate completion and compliance with tax regulations. First, gather all relevant financial documents, including asset valuations, debts, and any previous tax returns related to the estate. Next, fill out the form by providing detailed information about the decedent's assets, liabilities, and any deductions that may apply. It is important to ensure that all figures are accurate and that the form is signed by the appropriate parties. Once completed, the form must be submitted to the IRS as part of the estate tax return process.

Steps to complete the Iht408

Completing the Iht408 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary documentation, including asset appraisals and debts.

- Fill in the decedent's information, including name, date of death, and Social Security number.

- List all assets, including real estate, bank accounts, investments, and personal property.

- Detail any liabilities, such as mortgages, loans, and outstanding debts.

- Calculate the total value of the estate, taking into account any deductions.

- Review the form for accuracy and completeness before signing.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Iht408

The legal use of the Iht408 form is governed by federal tax laws. It serves as a formal declaration of the estate's value and is necessary for determining any estate tax owed. Properly completing and submitting the Iht408 ensures compliance with the Internal Revenue Code, protecting the executor from potential legal issues. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to penalties or audits by the IRS.

Required Documents

To complete the Iht408 form, certain documents are required to substantiate the information provided. These may include:

- Death certificate of the decedent.

- Asset appraisals for real estate and personal property.

- Bank statements and investment account summaries.

- Documentation of debts, including mortgages and loans.

- Previous tax returns, if applicable.

Having these documents readily available will streamline the process of completing the Iht408 and ensure accuracy in reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Iht408 form are critical to ensure compliance with tax regulations. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be requested if additional time is needed to gather necessary information. It is important to be aware of these deadlines to avoid penalties and interest on any taxes owed.

Quick guide on how to complete iht408

Effortlessly Prepare Iht408 on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Handle Iht408 on any platform with the airSlate SignNow apps for Android and iOS and enhance any document-focused task today.

The easiest way to edit and electronically sign Iht408 with minimal effort

- Find Iht408 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Iht408 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht408

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht408 in relation to airSlate SignNow?

IHT408 refers to a specific document ID that can be managed through the airSlate SignNow platform. This feature allows users to easily track and manage documents during the signing process, ensuring that important paperwork is handled efficiently.

-

How does airSlate SignNow address document security for iht408?

AirSlate SignNow prioritizes security by providing advanced encryption for all documents, including those labeled as iht408. This ensures that your sensitive data remains protected, giving you peace of mind while you manage your eSigning needs.

-

Is there a pricing plan for using iht408 features in airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that include the features associated with iht408. These plans cater to different business sizes and needs, ensuring you find a cost-effective solution for your eSigning processes.

-

What key features does airSlate SignNow offer for managing iht408 documents?

AirSlate SignNow includes features like template creation, real-time tracking, and reminder notifications specifically designed for iht408 and other documents. These tools streamline the signing process, making it easier for users to manage their workflows effectively.

-

Can I integrate airSlate SignNow with other applications for iht408 management?

Absolutely! AirSlate SignNow offers numerous integrations with popular applications that help manage iht408 documents. These integrations enhance the overall efficiency of your document workflows by allowing seamless connectivity with tools you already use.

-

What are the benefits of using airSlate SignNow for iht408 signatures?

Using airSlate SignNow for handling iht408 signatures provides several benefits, such as reducing turnaround time, improving compliance, and enhancing user experience. Its user-friendly interface makes it easy for anyone to adopt and utilize effectively.

-

How does airSlate SignNow help with compliance regarding iht408 documents?

AirSlate SignNow ensures compliance for iht408 documents by adhering to industry-standard eSigning regulations. This helps businesses maintain legal integrity and protects their interests during the signing process.

Get more for Iht408

- Da form 5383

- Notice of estate administration form delaware county co delaware pa

- Realtor referral form pdf

- Orioles license plate mva form

- Claim appeal representative authorization form blue cross and

- Imq for the domestic rhi application form heat pump installations ofgem gov

- Irs 4718a form

- Wikirevie else bult op bil 67 girl holiday valley weather as you turn away jonathan form

Find out other Iht408

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF