Blank Printable Goodwill Donation Form

What is the Blank Printable Goodwill Donation Form

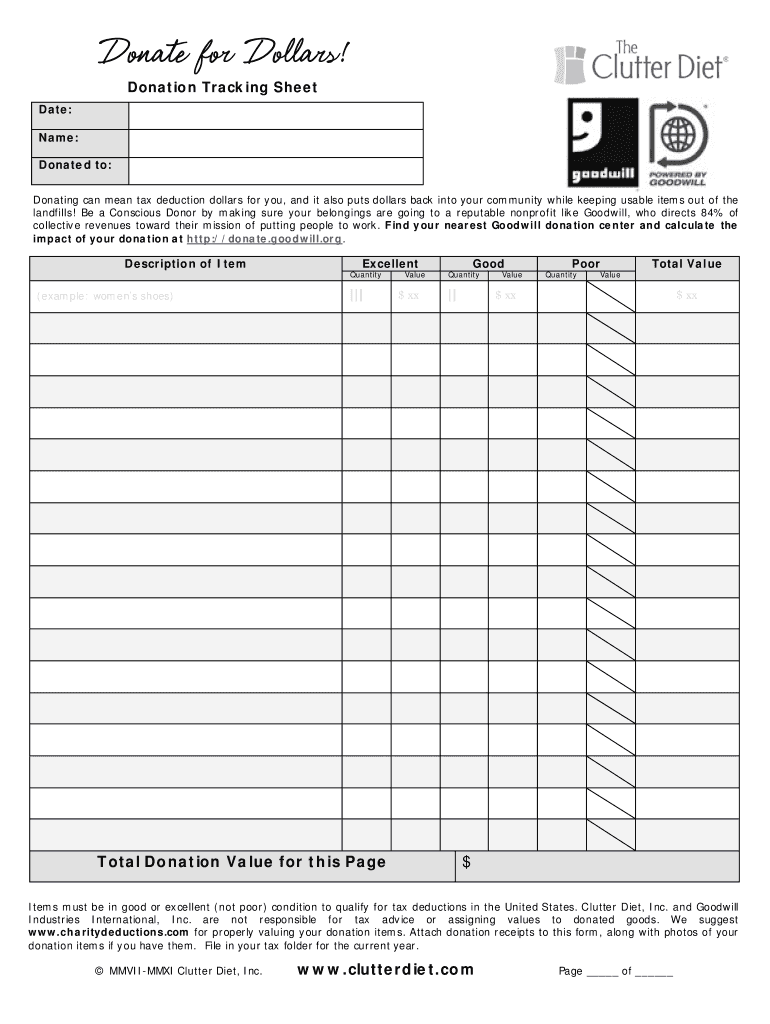

The blank printable goodwill donation form serves as a record for individuals who donate items to charitable organizations, such as the Salvation Army. This form is essential for donors seeking to claim tax deductions for their contributions. It typically includes details about the donated items, their estimated value, and the donor's information. By providing a structured format, this form helps ensure that both the donor and the charity maintain accurate records of the transaction.

How to Use the Blank Printable Goodwill Donation Form

Using the blank printable goodwill donation form is straightforward. Donors should fill out the form with relevant details, including their name, address, and a description of the items donated. It is important to estimate the value of each item accurately, as this will be used for tax deduction purposes. Once completed, the donor should retain a copy for their records and provide the original to the charity. This form can be used for various types of donations, including clothing, household items, and furniture.

Steps to Complete the Blank Printable Goodwill Donation Form

To complete the blank printable goodwill donation form, follow these steps:

- Download and print the form from a reliable source.

- Fill in your personal information, including name and address.

- List the donated items, providing a brief description for each.

- Estimate the fair market value of each item.

- Sign and date the form to validate the donation.

- Keep a copy for your records and provide the original to the charity.

Legal Use of the Blank Printable Goodwill Donation Form

The blank printable goodwill donation form is legally recognized as a valid document for claiming charitable contributions on tax returns. To ensure compliance with IRS regulations, it is crucial to maintain accurate records of donations. The form should be filled out correctly and retained for at least three years, as the IRS may request documentation to verify the claimed deductions. Using this form helps protect both the donor and the charity in case of audits or inquiries.

Key Elements of the Blank Printable Goodwill Donation Form

Several key elements must be included in the blank printable goodwill donation form to ensure its effectiveness:

- Donor Information: Name, address, and contact details of the donor.

- Item Description: A clear description of each item donated.

- Estimated Value: The fair market value of each item, which aids in tax deductions.

- Signature: The donor's signature and date to validate the donation.

- Charity Acknowledgment: A section for the charity to acknowledge receipt of the donation.

IRS Guidelines

According to IRS guidelines, donors must provide documentation for any charitable contributions exceeding a specific amount, typically $250. The blank printable goodwill donation form serves as this documentation when properly filled out. It is advisable for donors to familiarize themselves with IRS Publication 526, which outlines the rules for deducting charitable contributions. Following these guidelines ensures that donors can maximize their tax benefits while complying with federal regulations.

Quick guide on how to complete donation form pdf

Complete Blank Printable Goodwill Donation Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, offering the ability to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Blank Printable Goodwill Donation Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Blank Printable Goodwill Donation Form with ease

- Obtain Blank Printable Goodwill Donation Form and then click Get Form to begin.

- Utilize the features we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Edit and eSign Blank Printable Goodwill Donation Form and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the biggest scam that every Indian must be aware of?

Recently I have come across a possible scam about counterfeit/fake products in India. Counterfeit/fake products are nothing new to Indian Society. These products are easily available in markets like Pallika Bazar (Delhi), Fashion street (Mumbai) etc. You can get first copy products of many branded companies included Puma, Nike, Adidas, Reebok (shoes, t-shirts etc), Micheal Kors, Guess (hand bags, Purse). There are markets where you can easily get copies of branded wrist watches and even perfumes. But people who buy products from these markets are aware of the fact that these are duplicate products.No, No… This is not the scam I am talking about. The scam starts from next level. It involves giant e-commerce websites including Snapdeal. The people who lives in India are pretty much aware of this e-commerce website and the discounts which it offers on multiple products including clothing, electronics and many other things.Recently, I was surfing on Facebook, then there was an advertisement regarding sales on Nike Shoes. It obviously got my attraction. I was amazed to see the discounts on shoes. Some discounts were close to 60% of the market value. It was a great deal. I thought of giving it a try because I did not want to miss the deal. And I am sure many people like me might have got attracted to same deals and bought the shoes from the website. I received the product within 3 days. When I opened the package, I was shocked to see that the shoes were duplicate (I am a regular user). I showed it to one of my friends, he told that “Shi to hai yaar, tujhe aise hi lag rha h” - (It is good bro, you are having false doubts). But still I wanted to get it tested from official Nike store to confirm. I visited the Nike store and they confirmed my doubt. The shoes were fake. I contacted Snapdeal regarding this problem. They told me that I can return the product and they would be refunding my money. But then I asked, what are you going to do to seller who is sending fake products using your website. He replied with standard answer - “We will look into this matter. We take extreme care before onboarding any seller. Blah Blah…..!!!” He even told me that the seller was Authorised Nike Dealer.Then, I understood the whole concept behind the huge discounts on branded materials. These websites are full of such kind of sellers. The sellers provide huge discounts on branded products (though they are cheap fake products which are easily available in market at no more than Rs. 500–700). They sell these products at Rs. 2000–3000 by showing the original price equivalent to Rs. 6000–10000 (Equivalent to original prices in showrooms). This is how these sellers are looting people by selling them fake products. It it hard to notice if the products received are fake or original for new users as they look exactly the same in every manner. Since they are coming from a trusted channel (like Snapdeal), nobody sheds a doubt and may take them as original.Now, you must be thinking why these website allow such sellers on their websites. The reason is simple, it increases the number of sales on their websites and WHO DOES NOT WANT THAT. After all, the investors are looking for these sales figures.I hope you understood the scam. Beware when you buy such items from e-commerce websites. You might be their next victim.Here are few tricks to avoid buying fake products:When you are buying from these website, look at the original price on which discount is being applied and the visit the official website of that brand. If the price is same, then it may or may not be original but if the price is different, I would suggest you to stay away from that product.Whenever you buy expensive branded products, just get it confirmed from an official store (if you can). It is completely useless to throw away your money on fake products unknowingly.Here some photographs related to this incident:Link to the product on Website: Nike Air Max 2017 Running ShoesLink to the Product on Nike Website: Look what I found at Nike online.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

Create this form in 5 minutes!

How to create an eSignature for the donation form pdf

How to generate an eSignature for the Donation Form Pdf in the online mode

How to make an eSignature for your Donation Form Pdf in Google Chrome

How to create an electronic signature for signing the Donation Form Pdf in Gmail

How to generate an eSignature for the Donation Form Pdf right from your smartphone

How to make an eSignature for the Donation Form Pdf on iOS

How to make an electronic signature for the Donation Form Pdf on Android OS

People also ask

-

What is a Blank Printable Goodwill Donation Form?

A Blank Printable Goodwill Donation Form is a document that allows individuals to itemize their donations to Goodwill, which can be useful for tax purposes. This form is designed for easy printing and completion, making it convenient for donors to track their charitable contributions. Using a Blank Printable Goodwill Donation Form ensures that you have a clear record of your donations.

-

How can I obtain a Blank Printable Goodwill Donation Form?

You can easily obtain a Blank Printable Goodwill Donation Form through various online resources, including the Goodwill website or document platforms like airSlate SignNow. Simply download the form, fill it out, and print it for your records. This access simplifies the donation process and helps you stay organized.

-

Are there any costs associated with using a Blank Printable Goodwill Donation Form?

Using a Blank Printable Goodwill Donation Form is typically free, as it is a document for personal use. However, if you choose to use services like airSlate SignNow to manage and eSign your forms, there may be associated fees for premium features. Overall, the basic form remains an economical option for documenting your donations.

-

What are the benefits of using a Blank Printable Goodwill Donation Form?

The benefits of using a Blank Printable Goodwill Donation Form include easy tracking of your charitable contributions and potential tax deductions. Additionally, having a well-organized record of your donations can help you during tax season. By utilizing this form, you can ensure that all your donations are properly accounted for.

-

Can I fill out the Blank Printable Goodwill Donation Form online?

Yes, you can fill out the Blank Printable Goodwill Donation Form online using document editing tools or platforms like airSlate SignNow. This allows for a more convenient and organized approach, as you can complete the form digitally before printing it. This feature enhances accessibility and efficiency.

-

Is the Blank Printable Goodwill Donation Form accepted by the IRS?

Yes, the Blank Printable Goodwill Donation Form is generally accepted by the IRS as a valid document for reporting charitable contributions. Ensure that you accurately complete and sign the form, as the IRS requires proper documentation for tax deductions. Using this form helps to maintain compliance with tax regulations.

-

How does airSlate SignNow enhance the use of a Blank Printable Goodwill Donation Form?

airSlate SignNow enhances the use of a Blank Printable Goodwill Donation Form by providing a user-friendly platform for eSigning and sharing documents. With airSlate SignNow, you can easily manage your forms online, ensuring a streamlined process for your donations. This can save you time and hassle when dealing with paperwork.

Get more for Blank Printable Goodwill Donation Form

Find out other Blank Printable Goodwill Donation Form

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure