Form 0 1

What is the Form 0 1

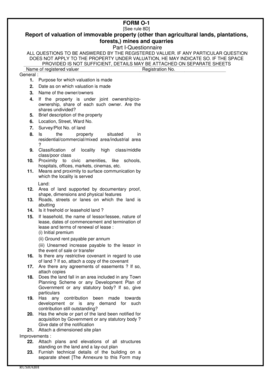

The Form 0 1, also known as the NJ Inheritance Tax Waiver Form 0 1, is a crucial document used in the state of New Jersey. It serves to facilitate the transfer of property ownership after the death of an individual. This form is specifically designed to waive the inheritance tax obligations for certain beneficiaries, ensuring a smoother transition of assets. Understanding the purpose and implications of this form is essential for anyone involved in estate planning or property transfer in New Jersey.

How to use the Form 0 1

Using the Form 0 1 involves several steps to ensure compliance with state regulations. First, the form must be accurately completed with all required information, including details about the deceased and the beneficiaries. It is important to provide accurate valuations of the property involved, as this will affect tax obligations. Once completed, the form should be submitted to the appropriate state authorities, typically the New Jersey Division of Taxation, for review and processing.

Steps to complete the Form 0 1

Completing the Form 0 1 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including the death certificate and property valuations.

- Fill out the form with accurate information regarding the deceased and beneficiaries.

- Ensure that all required signatures are obtained, including those of the executor or administrator of the estate.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the New Jersey Division of Taxation, either online or by mail.

Legal use of the Form 0 1

The legal validity of the Form 0 1 is paramount for ensuring that the transfer of property is recognized by the state. To be legally binding, the form must be filled out correctly and submitted in accordance with New Jersey laws. Additionally, it is essential to comply with eSignature regulations if the form is submitted electronically. This ensures that the form is accepted by the relevant authorities and that the beneficiaries can receive their inheritance without unnecessary delays.

Key elements of the Form 0 1

Several key elements must be included in the Form 0 1 for it to be valid. These include:

- The full name and address of the deceased.

- The names and addresses of all beneficiaries.

- A detailed description of the property being transferred.

- The valuation of the property, which must be supported by documentation.

- Signatures of all relevant parties, including the executor of the estate.

Required Documents

When submitting the Form 0 1, several documents are required to support the application. These typically include:

- The death certificate of the deceased.

- Proof of property ownership, such as a deed.

- Valuation reports for the property involved.

- Any prior tax returns related to the estate, if applicable.

Quick guide on how to complete form 0 1

Complete Form 0 1 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Form 0 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Form 0 1 with ease

- Obtain Form 0 1 and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Mark relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, the frustration of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 0 1 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 0 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 0 1 form and how can it benefit my business?

A 0 1 form is a digital document that allows for easy electronic signing and sending of critical paperwork. By using airSlate SignNow's 0 1 form feature, businesses can streamline their document workflows, increase efficiency, and reduce turnaround times. This modern solution enhances productivity while maintaining security and compliance.

-

How does airSlate SignNow handle the pricing for using the 0 1 form feature?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when using the 0 1 form feature. Plans are designed to be cost-effective and provide access to essential features without hefty upfront costs. This ensures businesses can effectively utilize the 0 1 form functionality within their budget.

-

What features are available with the 0 1 form option?

The 0 1 form option includes a user-friendly interface, templates for quick document creation, and robust eSignature capabilities. You can also track document status, send reminders, and integrate with various applications. These features make the 0 1 form a powerful tool for simplifying document management.

-

Are there integration options for the 0 1 form within other software tools?

Yes, airSlate SignNow provides seamless integration capabilities for the 0 1 form with a variety of popular software tools. This includes CRM systems, document storage platforms, and project management apps, allowing you to streamline your processes. Integrating these tools enables a more cohesive workflow and better collaboration.

-

Can I customize the 0 1 form to fit my business requirements?

Absolutely! The 0 1 form in airSlate SignNow can be customized to meet your specific business requirements. You can add your branding, adjust the fields included in the form, and create custom workflows. This personalization ensures that the 0 1 form aligns perfectly with your organization's needs.

-

What security measures are in place with the 0 1 form?

With the 0 1 form, airSlate SignNow prioritizes the security of your documents. It employs encryption protocols, secure data storage, and access control measures to protect sensitive information. This commitment to security ensures that your documents remain safe throughout the signing process.

-

How do I get started with using the 0 1 form on airSlate SignNow?

Getting started with the 0 1 form on airSlate SignNow is simple. You can sign up for a free trial to explore the features and capabilities, including the 0 1 form functionality. Once you're set up, you’ll find user-friendly tools to create, send, and manage your forms effectively.

Get more for Form 0 1

Find out other Form 0 1

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF