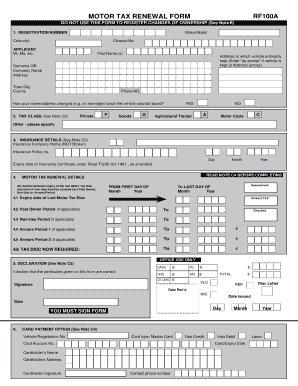

Rs100a Form

What is the Rs100a Form

The Rs100a form is a tax-related document used in the United States for various purposes, including reporting income and claiming deductions. It is essential for individuals and businesses to understand its significance, as it helps ensure compliance with federal tax regulations. The form is particularly relevant for those who need to report specific types of income or claim certain tax benefits.

How to use the Rs100a Form

Using the Rs100a form involves accurately filling out the required sections based on your financial situation. Begin by gathering all necessary documentation, including income statements and receipts for deductions. Carefully follow the instructions provided on the form to ensure that all information is complete and correct. Once filled out, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Rs100a Form

Completing the Rs100a form requires several key steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Read the instructions carefully to understand each section of the form.

- Fill out the form with accurate information, ensuring that all entries match your supporting documents.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through a tax software or by mailing it to the appropriate IRS address.

Legal use of the Rs100a Form

The Rs100a form is legally binding when completed and submitted in accordance with IRS guidelines. It is crucial to provide truthful and accurate information, as any discrepancies can lead to penalties or audits. The form must be signed and dated to validate its contents, ensuring that it meets all legal requirements for tax submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Rs100a form typically align with the annual tax filing period in the United States. Generally, individual taxpayers must submit their forms by April 15 of each year. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines to avoid potential late fees or penalties.

Required Documents

To successfully complete the Rs100a form, specific documents are required. These may include:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs or charitable donations.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Rs100a form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically using tax software, which often simplifies the process.

- Mail: The form can be printed and sent via postal service to the designated IRS address.

- In-Person: Some individuals may opt to file in person at local IRS offices, though this is less common.

Quick guide on how to complete rs100a form

Effortlessly Prepare Rs100a Form on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Rs100a Form on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-related process today.

The Most Efficient Method to Modify and eSign Rs100a Form Seamlessly

- Locate Rs100a Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks, from any device you prefer. Modify and eSign Rs100a Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rs100a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rs100a form and how can airSlate SignNow help?

The rs100a form is a document used for various purposes, including legal and financial transactions. airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning rs100a forms efficiently, ensuring your documents are legally binding and securely stored.

-

How much does it cost to use airSlate SignNow for the rs100a form?

airSlate SignNow offers a variety of pricing plans suitable for different business needs. By subscribing to one of our plans, you can benefit from unlimited eSigning capabilities for your rs100a form and other documents, making it a cost-effective choice for managing your paperwork.

-

What features does airSlate SignNow offer for the rs100a form?

With airSlate SignNow, you can easily create, customize, and send the rs100a form. Our platform includes features like template creation, reminders for signers, and audit trails to track document status, enhancing your workflow and efficiency.

-

Can I integrate airSlate SignNow with other software for the rs100a form?

Yes, airSlate SignNow offers seamless integrations with popular software applications such as Google Drive, Salesforce, and Dropbox. This allows users to manage the rs100a form alongside their existing tools, streamlining the entire document management process.

-

Is it safe to use airSlate SignNow for the rs100a form?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect your rs100a form and any sensitive data. You can trust us to keep your documents safe and compliant with industry standards.

-

Can I customize the rs100a form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your rs100a form to fit your specific needs. Whether you want to add fields, adjust formatting or include branding elements, our intuitive editor makes it easy to personalize your documents.

-

What advantages does airSlate SignNow provide for managing the rs100a form?

Using airSlate SignNow to manage your rs100a form minimizes paper usage and accelerates turnaround time for signatures. The platform's user-friendly interface and robust features cater to businesses of all sizes, improving efficiency and communication.

Get more for Rs100a Form

- Affidavit and agreement for reissuance of warrant form

- Ia 1040esiowa department of revenueindividual inco form

- Summary of tax year form changesiowa department

- Ia 2848 iowa power of attorney form httpstax iowa gov

- City state zip decedents social security number ssn form

- For calendar year or tax year beginning form

- Form ct 200 v payment voucher for e filed corporation tax

- Form mta 305 employers quarterly metropolitan commuter transportation mobility tax return revised 723

Find out other Rs100a Form

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe