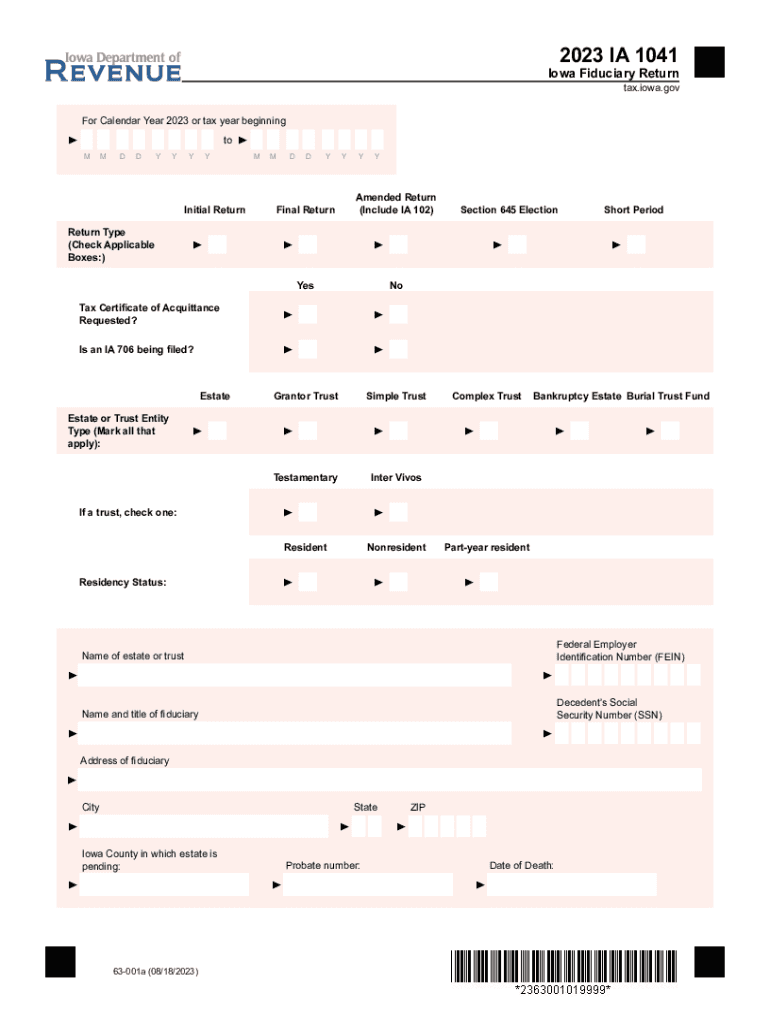

for Calendar Year or Tax Year Beginning 2022

Understanding the For Calendar Year Or Tax Year Beginning

The term "For Calendar Year Or Tax Year Beginning" refers to the time frame in which a taxpayer reports income and expenses for tax purposes. A calendar year runs from January first to December thirty-first, while a tax year can vary, depending on the taxpayer's choice or business structure. Understanding which year applies to your situation is crucial for accurate tax reporting and compliance with IRS regulations.

How to Use the For Calendar Year Or Tax Year Beginning

To effectively use the "For Calendar Year Or Tax Year Beginning," taxpayers must determine their reporting period. This involves selecting either the calendar year or a fiscal year that aligns with their business operations. Once the period is established, it should be consistently used for all tax filings. This consistency helps in maintaining accurate records and simplifies the filing process.

Steps to Complete the For Calendar Year Or Tax Year Beginning

Completing the "For Calendar Year Or Tax Year Beginning" requires several steps:

- Identify your reporting period: Choose between the calendar year or a fiscal year that suits your business.

- Gather necessary financial documents: Collect income statements, expense receipts, and any other relevant financial records.

- Fill out the appropriate tax forms: Use the selected reporting period in the designated sections of the forms.

- Review your entries: Ensure accuracy in reporting income and deductions.

- Submit your forms: Follow the required submission method, whether online, by mail, or in person.

IRS Guidelines for the For Calendar Year Or Tax Year Beginning

The IRS provides specific guidelines regarding the "For Calendar Year Or Tax Year Beginning." Taxpayers must adhere to these rules to ensure compliance. This includes understanding the implications of choosing a fiscal year versus a calendar year, as well as the impact on tax deductions and credits. It is advisable to consult the IRS website or a tax professional for the most current regulations and requirements.

Filing Deadlines and Important Dates

Filing deadlines for the "For Calendar Year Or Tax Year Beginning" vary based on the chosen reporting period. Generally, for a calendar year, the deadline is April fifteenth of the following year. If the deadline falls on a weekend or holiday, it may be extended. For fiscal years, the deadline is the fifteenth day of the fourth month after the end of the tax year. Keeping track of these dates is essential to avoid penalties.

Examples of Using the For Calendar Year Or Tax Year Beginning

Consider a small business that operates on a calendar year basis. They would report all income earned and expenses incurred from January first to December thirty-first on their tax return due in April. Conversely, a business that operates on a fiscal year starting July first would report its income and expenses from July first to June thirtieth. Understanding these examples helps in applying the correct reporting period to your tax filings.

Quick guide on how to complete for calendar year or tax year beginning

Complete For Calendar Year Or Tax Year Beginning effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle For Calendar Year Or Tax Year Beginning on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

How to modify and electronically sign For Calendar Year Or Tax Year Beginning with ease

- Locate For Calendar Year Or Tax Year Beginning and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign For Calendar Year Or Tax Year Beginning to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year or tax year beginning

Create this form in 5 minutes!

How to create an eSignature for the for calendar year or tax year beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between a calendar year and a tax year beginning?

The distinction lies primarily in the timing. A calendar year begins on January 1 and ends on December 31, while a tax year can start at any date and usually reflects a business's operational structure. Understanding this difference is essential when considering documents for calendar year or tax year beginning.

-

How can airSlate SignNow help with document management for the calendar year or tax year beginning?

airSlate SignNow streamlines document management by allowing businesses to easily send, sign, and store important documents. This is particularly beneficial for organizations needing to manage documentation related to the calendar year or tax year beginning, ensuring compliance and record-keeping are both efficient and effective.

-

What pricing plans does airSlate SignNow offer for businesses focused on the calendar year or tax year beginning?

airSlate SignNow provides multiple pricing tiers to accommodate various business needs, particularly during critical periods like the calendar year or tax year beginning. Each plan offers features tailored to streamline eSignature processes, allowing businesses to select the option that best fits their budget and usage requirements.

-

Are there any features specifically designed for tax documentation using airSlate SignNow?

Yes, airSlate SignNow offers features specifically tailored for creating and managing tax documentation. This includes templates for common tax forms, the ability to track changes, and secure eSigning, which is crucial for those focusing on the calendar year or tax year beginning.

-

Can I integrate airSlate SignNow with other tools I use for the calendar year or tax year beginning?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications commonly used in business operations. This allows you to enhance workflows associated with the calendar year or tax year beginning by combining data and document management tools more efficiently.

-

What benefits can I expect from using airSlate SignNow for my calendar year or tax year beginning needs?

By using airSlate SignNow, you can expect improved efficiency, time savings, and enhanced security for your document handling needs. The platform is designed to simplify the signing process, making it easier to manage all documents relevant to the calendar year or tax year beginning.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to the calendar year or tax year beginning. The platform employs advanced encryption methods, compliance with industry standards, and user authentication features to ensure that all documents remain secure and confidential.

Get more for For Calendar Year Or Tax Year Beginning

- State of california audit renewal paramedic form

- Authorization to close account form south shore bank

- Payroll direct deposit authorization needham bank form

- Spreadsheet contract template form

- Squarespace contract template form

- Square contract template form

- Sra train contract template form

- Staff agency contract template form

Find out other For Calendar Year Or Tax Year Beginning

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile