Exemptions Asr Sccgov Org Form

What is the Exemptions Asr Sccgov Org

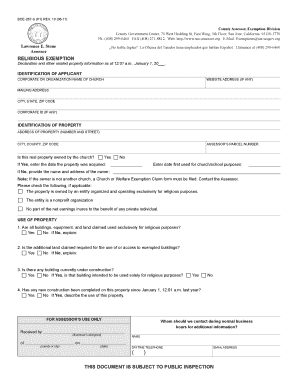

The exemptions asr sccgov org form is a document utilized within specific administrative processes, particularly in the context of exemptions related to local government regulations. This form is essential for individuals or entities seeking to apply for or verify their eligibility for certain exemptions that may apply to them. It serves as a formal request to the relevant authorities and must be filled out accurately to ensure compliance with local laws and regulations.

How to use the Exemptions Asr Sccgov Org

Using the exemptions asr sccgov org form involves several straightforward steps. First, gather all necessary information and documentation that supports your request for exemption. Next, access the form through the appropriate online portal or local government office. Fill out the form with accurate details, ensuring that all required fields are completed. Finally, submit the form electronically or in person, depending on the submission guidelines provided by the issuing authority.

Steps to complete the Exemptions Asr Sccgov Org

Completing the exemptions asr sccgov org form requires careful attention to detail. Follow these steps:

- Review eligibility criteria to ensure you qualify for the exemption.

- Collect supporting documents, such as identification, proof of residency, or financial statements.

- Access the form and fill it out completely, ensuring accuracy in all entries.

- Double-check the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online or in person.

Legal use of the Exemptions Asr Sccgov Org

The legal use of the exemptions asr sccgov org form is governed by specific regulations that dictate how exemptions are granted and verified. It is crucial to understand that the form must be filled out in compliance with local laws to be considered valid. Any inaccuracies or incomplete information may lead to delays or denial of the exemption request. Therefore, it is advisable to consult legal guidelines or seek assistance if needed to ensure proper use of the form.

Eligibility Criteria

Eligibility for the exemptions asr sccgov org form typically depends on various factors, including the applicant's status and the nature of the exemption being requested. Common criteria may include:

- Residency requirements, such as living within the jurisdiction.

- Specific qualifications related to income, age, or other demographic factors.

- Compliance with prior regulations or conditions set forth by the local government.

Required Documents

When filling out the exemptions asr sccgov org form, certain documents are often required to support your application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation verifying residency, like utility bills or lease agreements.

- Financial statements or tax returns, if applicable to the exemption type.

Form Submission Methods

The exemptions asr sccgov org form can typically be submitted through multiple methods, depending on the local government's regulations. Common submission methods include:

- Online submission through the official government website.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Quick guide on how to complete exemptions asr sccgov org

Prepare Exemptions Asr Sccgov Org effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without delays. Handle Exemptions Asr Sccgov Org on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Exemptions Asr Sccgov Org without hassle

- Locate Exemptions Asr Sccgov Org and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Exemptions Asr Sccgov Org and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemptions asr sccgov org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are exemptions asr sccgov org?

Exemptions asr sccgov org refers to specific tax exemption classifications managed by the Santa Clara County Assessor's Office. Understanding these exemptions is crucial for businesses seeking to save on taxes and maximize benefits. With airSlate SignNow, you can easily manage documents related to these exemptions seamlessly.

-

How can airSlate SignNow help with managing exemptions asr sccgov org?

AirSlate SignNow streamlines the process of submitting and tracking documentation for exemptions asr sccgov org. Our eSigning solution allows you to efficiently manage the necessary paperwork, ensuring that applications are filed accurately and on time. This can signNowly reduce administrative burdens and enhance compliance.

-

What features does airSlate SignNow offer for eSigning exemption documents?

AirSlate SignNow provides features like customizable templates, real-time tracking, and team collaboration tools that simplify managing exemptions asr sccgov org. These features enable users to ensure that all the required documents are properly filled and submitted. Additionally, our secure storage guarantees the safety of sensitive information.

-

Is airSlate SignNow affordable for businesses focusing on exemptions asr sccgov org?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, especially those dealing with exemptions asr sccgov org. Our cost-effective solutions ensure you get the necessary eSigning capabilities without breaking the bank. You can choose a plan that fits your budget while maximizing efficiency.

-

How does airSlate SignNow enhance workflow for exemption applications?

By integrating airSlate SignNow into your workflow, you can signNowly enhance the process for exemptions asr sccgov org. Automated notifications and document routing ensure that every stakeholder is kept in the loop. This accelerates approval times and ensures compliance with local regulations.

-

Can airSlate SignNow integrate with other tools for managing exemptions asr sccgov org?

Absolutely! AirSlate SignNow seamlessly integrates with various business applications to help you manage exemptions asr sccgov org more effectively. Whether you use CRM systems or document management software, our integrations help streamline the entire process, enhancing productivity and collaboration.

-

What benefits does airSlate SignNow provide for small businesses seeking exemptions asr sccgov org?

Small businesses can greatly benefit from airSlate SignNow's user-friendly interface and powerful features designed for managing exemptions asr sccgov org. Our platform helps reduce time spent on document logistics, allowing you to focus on your core business operations. This ultimately leads to cost savings and improved business efficiency.

Get more for Exemptions Asr Sccgov Org

Find out other Exemptions Asr Sccgov Org

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free