Form G 4 Rev 1209

What is the Form G-4 Rev 1209

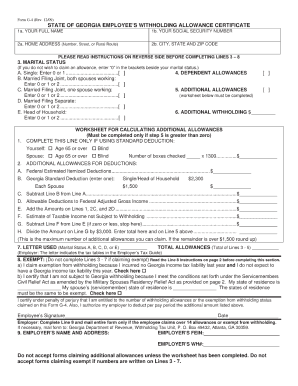

The Form G-4 Rev 1209 is a tax form used primarily in the United States for withholding allowances. It is essential for employees to accurately report their personal exemptions and withholding preferences to their employers. This form plays a critical role in determining the amount of federal income tax withheld from an employee's paycheck, ensuring compliance with tax regulations. Understanding the purpose and implications of the Form G-4 Rev 1209 is vital for both employers and employees to maintain accurate payroll processes.

How to use the Form G-4 Rev 1209

Using the Form G-4 Rev 1209 involves several straightforward steps. First, employees need to obtain the form from their employer or the official tax authority website. After filling out the required information, including personal details and the number of allowances claimed, it should be submitted to the employer. It is important to review the form for accuracy before submission, as incorrect information can lead to improper tax withholding. Employees should also keep a copy for their records.

Steps to complete the Form G-4 Rev 1209

Completing the Form G-4 Rev 1209 involves a few key steps:

- Obtain the form from your employer or download it from the official site.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the number of withholding allowances you are claiming.

- Review the completed form for accuracy.

- Submit the form to your employer and retain a copy for your records.

Legal use of the Form G-4 Rev 1209

The Form G-4 Rev 1209 is legally recognized as a valid document for reporting withholding allowances. For the form to be legally binding, it must be completed accurately and submitted to the appropriate employer. Compliance with IRS regulations is crucial, as failure to use the form correctly may result in incorrect tax withholding, leading to potential penalties or legal issues. Employers are responsible for ensuring that they process the form in accordance with federal and state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form G-4 Rev 1209 typically align with the start of employment or when an employee wishes to update their withholding allowances. It is advisable to submit the form as soon as possible to ensure that the correct amount of tax is withheld from the first paycheck. Employees should also be aware of any changes in their personal circumstances that may require them to update their withholding information throughout the year.

Required Documents

To complete the Form G-4 Rev 1209, employees typically need to provide certain documents. These may include:

- Social Security number for identification.

- Personal identification documents, such as a driver's license or state ID.

- Any previous tax forms that may provide context for withholding allowances.

Having these documents on hand can facilitate a smooth completion process and ensure that the information provided is accurate.

Quick guide on how to complete form g 4 rev 1209

Complete Form G 4 Rev 1209 effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form G 4 Rev 1209 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest way to revise and eSign Form G 4 Rev 1209 without hassle

- Find Form G 4 Rev 1209 and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any chosen device. Edit and eSign Form G 4 Rev 1209 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form g 4 rev 1209

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form G 4 Rev 1209?

Form G 4 Rev 1209 is a document used for specific compliance and reporting requirements. airSlate SignNow allows businesses to easily fill, sign, and send Form G 4 Rev 1209 securely online. This enhances efficiency and ensures that your documents are properly executed and filed.

-

How can airSlate SignNow help with Form G 4 Rev 1209?

airSlate SignNow simplifies the process of managing Form G 4 Rev 1209 by providing users with tools to create, edit, and eSign the document electronically. This cloud-based solution ensures that your form is accessible from anywhere, streamlining workflow and reducing the chances of errors. With SignNow, you can finalize your forms quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form G 4 Rev 1209?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary based on features and user needs, ensuring that you only pay for what you need in relation to managing Form G 4 Rev 1209. Investing in this tool will likely save you time and money in the long run.

-

What features does airSlate SignNow offer for Form G 4 Rev 1209?

airSlate SignNow offers a variety of features for managing Form G 4 Rev 1209, including customizable templates, automated workflows, and real-time tracking of document status. The platform also supports multiple file formats and integrates with various business tools, making it a versatile solution for your documentation needs. Additionally, eSigning capabilities enhance the speed of getting Form G 4 Rev 1209 completed.

-

Can I integrate airSlate SignNow with other applications for Form G 4 Rev 1209?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Salesforce, and more. These integrations allow you to automate your workflow and ensure that Form G 4 Rev 1209 works in conjunction with your existing processes. This connectivity enhances productivity by keeping all your necessary tools in one accessible location.

-

How secure is airSlate SignNow when handling Form G 4 Rev 1209?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Form G 4 Rev 1209. The platform employs advanced encryption and follows compliance standards to protect your data. You can have peace of mind knowing that your documents are secure and accessible only by authorized users.

-

Is training available for using airSlate SignNow for Form G 4 Rev 1209?

Yes, airSlate SignNow provides comprehensive training resources and customer support to help you effectively use the platform for Form G 4 Rev 1209. This includes tutorials, webinars, and a knowledge base to answer your questions. The support team is also available to assist you with any specific queries you may have as you navigate the tool.

Get more for Form G 4 Rev 1209

- Church member information sheet

- Heating disclosure form

- Submittal template word form

- Hdg hotels employment application form

- 2091 sellers bdisclosureb v7 09 sampleqxp real estate license form

- Dh4012 application for septage disposal service permit form

- Florida biomedical permit 2009 2019 form

- Rn lpn exemption application 1212 florida department of health form

Find out other Form G 4 Rev 1209

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online