Form 1120 F Schedules M 1, M 2 2020

What is the Form 1120 F Schedules M 1, M 2

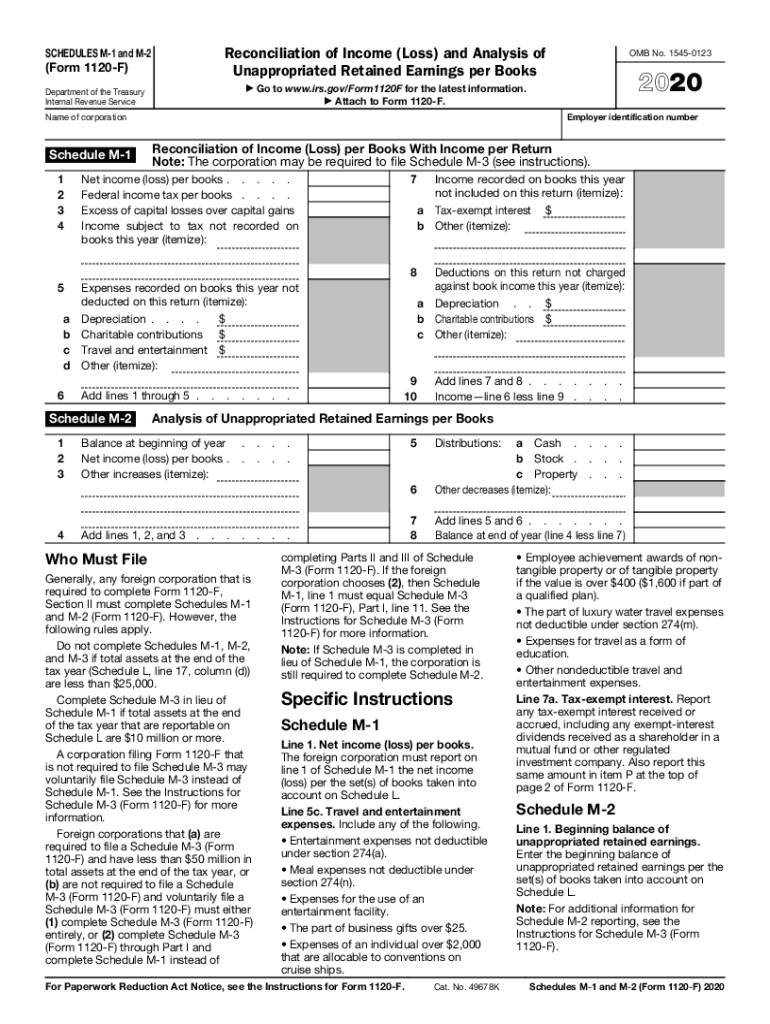

The Form 1120 F Schedules M 1 and M 2 are essential components of the U.S. tax return for foreign corporations operating in the United States. Schedule M-1 reconciles the income (loss) reported on the corporation's financial statements with the income (loss) reported on the tax return. It addresses discrepancies between financial accounting and tax reporting, ensuring that all income is accurately reported to the IRS. Schedule M-2, on the other hand, provides a summary of the corporation's retained earnings and other adjustments, offering a clear picture of the corporation's financial position over time.

Steps to complete the Form 1120 F Schedules M 1, M 2

Completing the Form 1120 F Schedules M 1 and M 2 involves several key steps:

- Gather financial statements to provide accurate figures for the income and expenses.

- Fill out Schedule M-1 by reconciling the net income from the financial statements with the taxable income reported on the tax return.

- Complete Schedule M-2 by detailing the changes in retained earnings and any other adjustments that affect the corporation's equity.

- Review all entries for accuracy and compliance with IRS guidelines.

- Submit the completed schedules along with the Form 1120 F to the IRS by the specified deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1120 F Schedules M 1 and M 2. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The instructions detail how to report various types of income, adjustments, and deductions. Additionally, the IRS emphasizes the importance of accurate record-keeping and documentation to support the figures reported on the schedules. Familiarizing yourself with these guidelines can help streamline the filing process and reduce the risk of errors.

Filing Deadlines / Important Dates

Timely submission of the Form 1120 F Schedules M 1 and M 2 is critical. The standard deadline for filing is the fifteenth day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on June 15. Extensions may be available, but it is important to file the necessary forms to avoid late penalties. Keeping track of these deadlines ensures that the corporation remains in good standing with the IRS.

Required Documents

To complete the Form 1120 F Schedules M 1 and M 2, certain documents are required:

- Financial statements, including balance sheets and income statements.

- Prior year tax returns for reference and comparison.

- Documentation of any adjustments or discrepancies that may affect income reporting.

- Records of retained earnings and other equity adjustments.

Having these documents readily available can facilitate a smoother completion process and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 1120 F Schedules M 1 and M 2 can result in significant penalties. The IRS may impose fines for late filings, inaccuracies, or failure to file altogether. These penalties can accumulate quickly, impacting the corporation's financial health. It is essential to understand the importance of timely and accurate submissions to avoid these consequences.

Quick guide on how to complete form 1120 f schedules m 1 m 2

Complete Form 1120 F Schedules M 1, M 2 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Form 1120 F Schedules M 1, M 2 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Form 1120 F Schedules M 1, M 2 with ease

- Obtain Form 1120 F Schedules M 1, M 2 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow caters to your document management needs in a few clicks from any device you prefer. Adjust and eSign Form 1120 F Schedules M 1, M 2 for seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 f schedules m 1 m 2

Create this form in 5 minutes!

How to create an eSignature for the form 1120 f schedules m 1 m 2

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the m1 2017 form and why is it important?

The m1 2017 form is a tax form used to report individual income tax for the state of Minnesota. It is important because it ensures compliance with state tax laws and helps individuals calculate their tax liabilities accurately, avoiding potential penalties.

-

How can airSlate SignNow help me with the m1 2017 form?

airSlate SignNow allows you to easily eSign and send the m1 2017 form efficiently. With our solution, you can streamline the signing process, ensuring that your documentation is completed and submitted without delays.

-

Is there a cost associated with using airSlate SignNow for the m1 2017 form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solution enables you to manage your documents, including the m1 2017 form, at a competitive rate that provides value to your organization.

-

What features does airSlate SignNow offer for managing the m1 2017 form?

airSlate SignNow provides a range of features that simplify document management for the m1 2017 form. These include easy eSigning, document storage, customizable templates, and the ability to collaborate in real-time, enhancing your workflow.

-

Can I integrate airSlate SignNow with my existing software for the m1 2017 form?

Yes, airSlate SignNow integrates seamlessly with many popular software applications, making it easy to manage the m1 2017 form alongside your existing tools. This ensures a smooth workflow without the need for extensive changes to your current processes.

-

What are the benefits of using airSlate SignNow for the m1 2017 form?

Using airSlate SignNow for the m1 2017 form offers several benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced compliance with state regulations. Our platform helps you ensure that your forms are processed promptly and securely.

-

How secure is my information when using airSlate SignNow for the m1 2017 form?

airSlate SignNow prioritizes the security of your information, employing advanced encryption and security protocols to protect your data while managing the m1 2017 form. You can rest assured that your documents are handled safely and in compliance with data protection regulations.

Get more for Form 1120 F Schedules M 1, M 2

- Assignment to living trust wyoming form

- Notice of assignment to living trust wyoming form

- Revocation of living trust wyoming form

- Letter to lienholder to notify of trust wyoming form

- Consent personal representative form

- Wyoming timber sale contract wyoming form

- Wyoming forest products timber sale contract wyoming form

- Assumption agreement of mortgage and release of original mortgagors wyoming form

Find out other Form 1120 F Schedules M 1, M 2

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure