Form 1120 RIC Internal Revenue Service 2020

What is the Form 1120 RIC

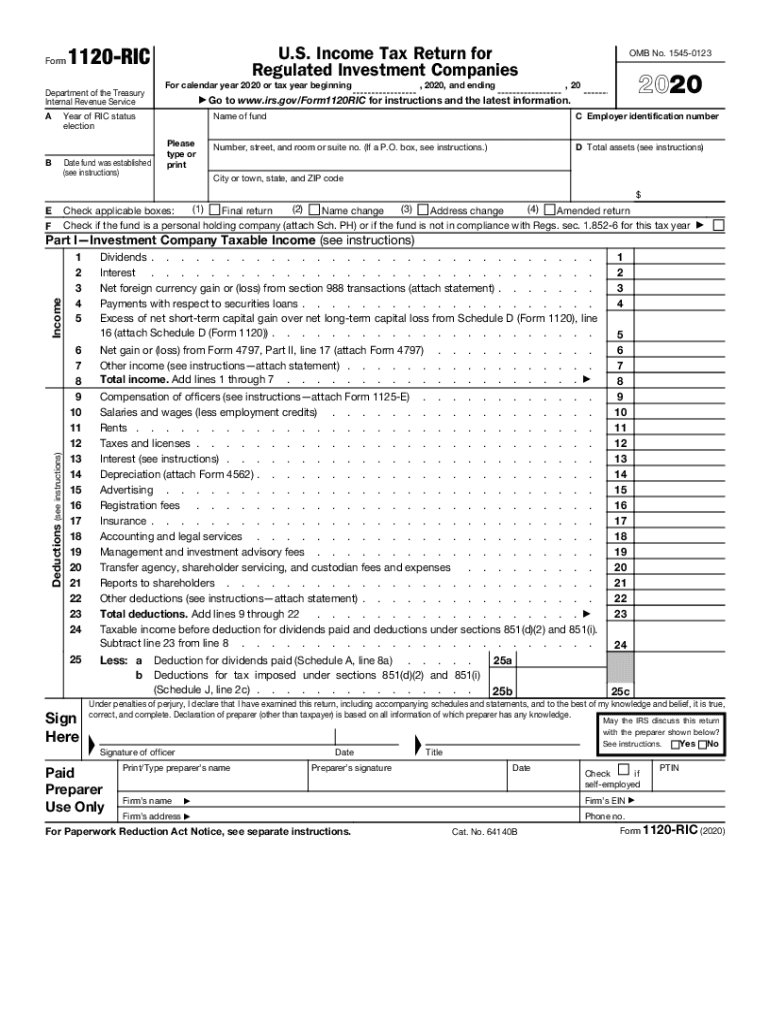

The Form 1120 RIC is a tax return specifically designed for registered investment companies (RICs) in the United States. This form is utilized by RICs to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). It is essential for RICs to file this form to maintain their status and ensure compliance with federal tax regulations. The 1120 RIC allows these entities to benefit from special tax treatment, provided they adhere to specific requirements outlined by the IRS.

How to use the Form 1120 RIC

Using the Form 1120 RIC involves several steps to ensure accurate reporting. RICs must gather financial data, including income from investments, expenses, and distributions to shareholders. The form requires detailed information about the RIC's operations, including the types of investments held and the income generated. After completing the form, RICs must submit it to the IRS by the designated deadline, ensuring all calculations are accurate to avoid penalties. Utilizing digital tools can streamline the process, making it easier to fill out and e-file the form securely.

Steps to complete the Form 1120 RIC

Completing the Form 1120 RIC involves a structured approach:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, including the RIC's name, address, and Employer Identification Number (EIN).

- Report income and deductions accurately in the appropriate sections of the form.

- Calculate the tax liability based on the income reported.

- Ensure all required schedules are attached, including Schedule G, which details the RIC's investments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

RICs must adhere to specific filing deadlines to avoid penalties. The Form 1120 RIC is typically due on the fifteenth day of the third month following the end of the RIC's tax year. For RICs operating on a calendar year basis, this means the form is due by March 15. If additional time is needed, RICs can file for an extension, which grants an additional six months to submit the form. It is crucial for RICs to keep track of these dates to maintain compliance with IRS regulations.

Legal use of the Form 1120 RIC

The legal use of the Form 1120 RIC is governed by IRS regulations that define the requirements for registered investment companies. To qualify as a RIC, companies must meet specific criteria, including distributing at least ninety percent of their taxable income to shareholders. Filing the 1120 RIC correctly ensures that the company retains its tax-advantaged status. Non-compliance can lead to significant tax liabilities and loss of RIC status, which underscores the importance of accurate and timely filing.

Required Documents

To complete the Form 1120 RIC, several documents are essential:

- Financial statements, including income and balance sheets.

- Records of all investment transactions and distributions made to shareholders.

- Supporting documentation for any deductions claimed, such as management fees and operational costs.

- Previous year’s tax returns, if applicable, for reference.

Quick guide on how to complete 2020 form 1120 ric internal revenue service

Prepare Form 1120 RIC Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form 1120 RIC Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The most efficient way to alter and electronically sign Form 1120 RIC Internal Revenue Service without any hassle

- Locate Form 1120 RIC Internal Revenue Service and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1120 RIC Internal Revenue Service and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1120 ric internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1120 ric internal revenue service

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the RIC 1120 form?

The RIC 1120 form is a tax document used by Regulated Investment Companies to report their income, expenses, and tax liabilities. It's essential for compliance with IRS regulations and helps ensure accurate tax filings. Utilizing airSlate SignNow can streamline the eSigning process of your RIC 1120, making it easier to manage and submit your documentation.

-

How can airSlate SignNow help me with filing the RIC 1120?

AirSlate SignNow provides an easy-to-use interface for eSigning and managing the RIC 1120 form. You can quickly gather signatures from stakeholders while ensuring your documents are legally binding and securely stored. This signNowly speeds up the filing process and minimizes the chances of errors.

-

Are there any costs associated with using airSlate SignNow for RIC 1120 signing?

AirSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. With transparent pricing structures, you can choose a plan that fits your needs without overspending. This ensures you have the right tools to manage the RIC 1120 process efficiently at an affordable rate.

-

What features does airSlate SignNow offer for signing RIC 1120 documents?

AirSlate SignNow includes features like document templates, a user-friendly eSignature tool, and tracking capabilities for your RIC 1120 forms. These features allow you to create, send, and manage your tax documents effortlessly. Plus, the platform integrates with various applications to enhance your workflow.

-

Can airSlate SignNow integrate with other software to assist in RIC 1120 filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and business applications to help facilitate the RIC 1120 filing process. This means you can easily import your data and export completed documents without hassle. Integrating these tools enhances efficiency and accuracy in your tax management.

-

Is airSlate SignNow secure for managing RIC 1120 forms?

Absolutely, airSlate SignNow prioritizes document security with advanced encryption and compliance with data protection regulations. You can confidently manage and sign your RIC 1120 documents knowing they are secure and protected from unauthorized access. This peace of mind is crucial for maintaining your financial information.

-

Can multiple users collaborate on RIC 1120 forms using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on RIC 1120 forms efficiently. You can assign tasks, track progress, and collect eSignatures from various stakeholders in real time. This collaborative feature helps streamline the entire signing process, ensuring timely submission of your tax documents.

Get more for Form 1120 RIC Internal Revenue Service

- Living trust for husband and wife with no children wyoming form

- Living trust for individual who is single divorced or widow or widower with no children wyoming form

- Wyoming trust form

- Living trust for husband and wife with one child wyoming form

- Wyoming trust 497432513 form

- Amendment to living trust wyoming form

- Living trust property record wyoming form

- Financial account transfer to living trust wyoming form

Find out other Form 1120 RIC Internal Revenue Service

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself