Form 1120 Internal Revenue Service 2020

What is the Form 1120?

The Form 1120 is a corporate income tax return used by C corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal tax liability. It is filed annually with the Internal Revenue Service (IRS) and is a critical component of corporate tax compliance. The form requires detailed financial information, including revenue from sales, cost of goods sold, and operating expenses, allowing the IRS to assess the corporation's taxable income.

Steps to Complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and receipts for expenses.

- Fill out the form by entering your corporation's name, address, and Employer Identification Number (EIN).

- Report income from all sources, including sales and investments, on the appropriate lines.

- Calculate deductions for business expenses, such as salaries, rent, and utilities, to determine taxable income.

- Complete the tax computation section to determine the total tax owed.

- Review the form for accuracy and completeness before submission.

Legal Use of the Form 1120

The Form 1120 must be completed accurately and submitted in compliance with IRS regulations to be considered legally valid. This includes adhering to deadlines and ensuring all necessary information is provided. Failure to comply with these requirements can result in penalties or audits. It is important for corporations to maintain proper records and documentation to support the information reported on the form, as this can be crucial in case of an IRS inquiry.

Filing Deadlines / Important Dates

The Form 1120 is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can file for an automatic six-month extension using Form 7004, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the Form 1120, corporations need to gather several key documents:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, including sales and investment income.

- Documentation for all deductions claimed, such as invoices and receipts.

- Prior year tax returns for reference and comparison.

Form Submission Methods

The Form 1120 can be submitted to the IRS through various methods. Corporations may choose to file electronically using IRS e-file options, which can expedite processing times. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether payment is included. In-person submission is generally not available for this form, making electronic and mail submissions the primary methods.

Quick guide on how to complete 2019 form 1120 internal revenue service

Effortlessly Prepare Form 1120 Internal Revenue Service on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delay. Manage Form 1120 Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 1120 Internal Revenue Service with Ease

- Obtain Form 1120 Internal Revenue Service and click Get Form to begin.

- Leverage the tools available to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 1120 Internal Revenue Service and ensure excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 1120 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1120 internal revenue service

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

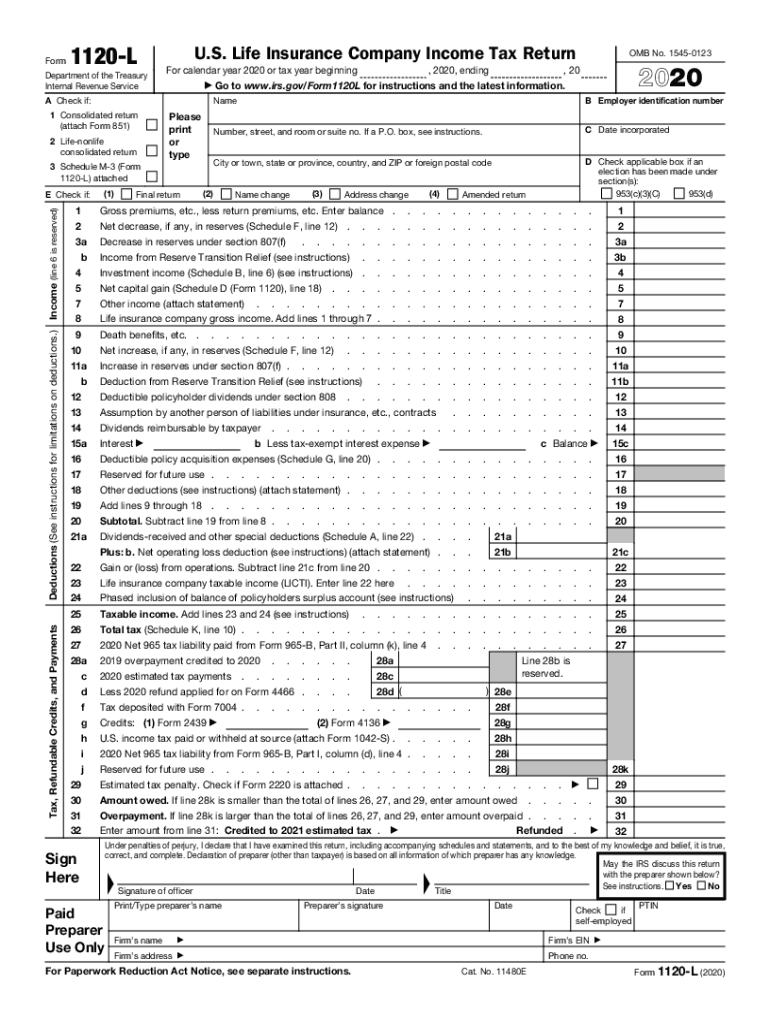

What is the 1120l form and why is it important?

The 1120l form is used by life insurance companies to report their income, deductions, and taxes. For businesses, correctly filing this form is crucial for compliance with IRS regulations, and using services like airSlate SignNow can simplify the process of eSigning and submitting the 1120l documentation.

-

How does airSlate SignNow help with the 1120l filing process?

airSlate SignNow facilitates the eSigning of important documents, including the 1120l form, ensuring that you can complete your filing efficiently. The platform provides an intuitive user interface that helps avoid common mistakes, streamlining your workflow and saving valuable time.

-

What features does airSlate SignNow offer for 1120l form management?

airSlate SignNow offers several features tailored for managing the 1120l form. These include customizable templates, secure storage, and easy sharing options, allowing businesses to keep their tax documents organized and accessible anytime they need them.

-

Is there a cost associated with using airSlate SignNow for 1120l forms?

Yes, there is a pricing model for using airSlate SignNow, but it is designed to be cost-effective. Depending on your needs, you can choose a plan that best fits your business, helping you save money while ensuring proper management and eSigning of your 1120l forms.

-

Can I integrate airSlate SignNow with my current accounting software for 1120l filing?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions, making it easy to prepare and eSign your 1120l forms directly from your existing systems. This integration streamlines your workflow and enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for 1120l documents?

Using airSlate SignNow for 1120l documents provides numerous benefits, such as enhanced security, faster processing times, and reduced paper waste. Additionally, the eSigning feature ensures that your documents are signed quickly, crucial for timely and accurate tax filings.

-

Is airSlate SignNow user-friendly for preparing the 1120l form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The straightforward interface allows users, regardless of technical skill, to easily navigate through the process of preparing and eSigning their 1120l forms without hassle.

Get more for Form 1120 Internal Revenue Service

- Newly divorced individuals package vermont form

- Contractors forms package vermont

- Power of attorney for sale of motor vehicle vermont form

- Wedding planning or consultant package vermont form

- Hunting forms package vermont

- Identity theft recovery package vermont form

- Aging parent package vermont form

- Sale of a business package vermont form

Find out other Form 1120 Internal Revenue Service

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation