Schedule B Form 1040 Internal Revenue Service 2020

What is the Schedule B Form 1040

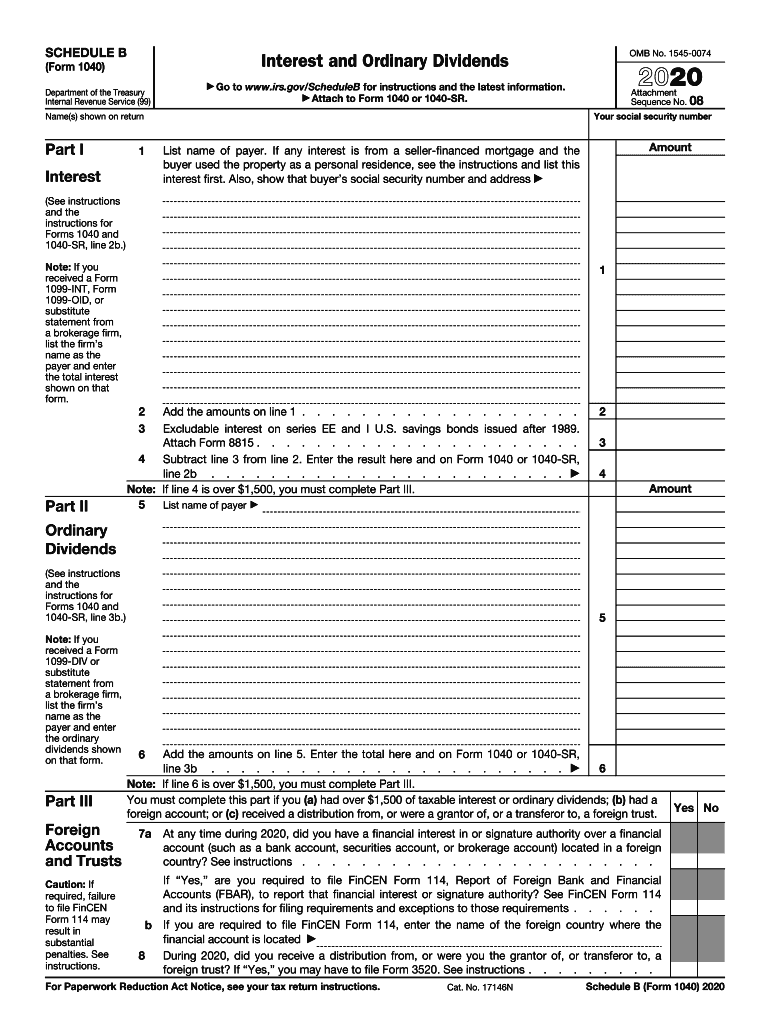

The Schedule B Form 1040 is a crucial document used by taxpayers in the United States to report interest and dividend income. This form is part of the IRS Form 1040, which is the standard individual income tax return. Taxpayers must complete Schedule B if they have more than $1,500 in taxable interest or dividends, or if they have certain foreign accounts. The information provided on this form helps the IRS ensure accurate reporting of income and compliance with tax laws.

How to use the Schedule B Form 1040

Using the Schedule B Form 1040 involves several steps. First, gather all relevant financial documents, including bank statements and investment reports that detail interest and dividends received. Next, accurately fill out the form, listing each source of income and the corresponding amounts. If applicable, you will also need to answer questions regarding foreign accounts. Once completed, attach Schedule B to your Form 1040 before submitting your tax return to the IRS.

Steps to complete the Schedule B Form 1040

Completing the Schedule B Form 1040 requires careful attention to detail. Follow these steps:

- Start by entering your name and Social Security number at the top of the form.

- In Part I, list all sources of interest income, including the name of the payer and the amount received.

- In Part II, report dividend income similarly, including details for each source.

- If you have foreign accounts, answer the questions in Part III, providing necessary details about those accounts.

- Review the form for accuracy before attaching it to your Form 1040.

Legal use of the Schedule B Form 1040

The Schedule B Form 1040 is legally binding when filled out correctly and submitted to the IRS. It is essential to ensure that all reported income is accurate and complete, as discrepancies can lead to penalties or audits. The form must be signed and dated, confirming that the information provided is true to the best of the taxpayer's knowledge. Compliance with IRS regulations regarding income reporting is critical to avoid legal issues.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing their Schedule B Form 1040. Typically, the deadline for submitting individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file on time to avoid late fees and penalties. Taxpayers can also request an extension, but any taxes owed must still be paid by the original deadline.

Required Documents

To complete the Schedule B Form 1040 accurately, certain documents are necessary. These include:

- Bank statements showing interest income.

- Investment statements detailing dividends received.

- Any Form 1099-INT or 1099-DIV received from financial institutions.

- Records of foreign accounts, if applicable.

Having these documents ready will streamline the process of filling out the form and ensure compliance with IRS requirements.

Quick guide on how to complete 2020 schedule b form 1040 internal revenue service

Effortlessly prepare Schedule B Form 1040 Internal Revenue Service on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Schedule B Form 1040 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

The easiest way to edit and electronically sign Schedule B Form 1040 Internal Revenue Service with ease

- Locate Schedule B Form 1040 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that function.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Schedule B Form 1040 Internal Revenue Service and ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule b form 1040 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule b form 1040 internal revenue service

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the IRS 1040 Schedule B?

The IRS 1040 Schedule B is a tax form used to report interest and ordinary dividends. It is essential for taxpayers who have received over a certain amount of interest income or dividends during the tax year. Filling out Schedule B accurately ensures compliance with U.S. tax laws.

-

How does airSlate SignNow help with IRS 1040 Schedule B?

AirSlate SignNow streamlines the process of obtaining signatures on IRS 1040 Schedule B forms. With our secure eSignature solution, you can effortlessly send, sign, and store your tax documents electronically, saving you time and ensuring accuracy.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers features such as customizable templates, workflow automation, and real-time tracking for IRS 1040 Schedule B documents. These features ensure that all your tax-related paperwork is managed efficiently and securely, reducing the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses filing IRS 1040 Schedule B?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Small businesses can leverage our cost-effective eSignature solutions to file their IRS 1040 Schedule B efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for tax filing?

Absolutely! AirSlate SignNow supports integration with various platforms such as accounting software and CRMs, enhancing your tax filing experience for IRS 1040 Schedule B. This connectivity ensures a seamless flow of information across your financial systems.

-

How secure is airSlate SignNow when handling IRS 1040 Schedule B forms?

Security is a top priority for airSlate SignNow. We utilize industry-leading encryption and compliance protocols to protect your IRS 1040 Schedule B forms, ensuring that your sensitive data remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for managing your IRS 1040 Schedule B provides numerous benefits, including faster turnaround times, reduced paper waste, and enhanced accuracy. Our platform simplifies the signing process, enabling you to focus on your financial strategy rather than paperwork.

Get more for Schedule B Form 1040 Internal Revenue Service

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497429002 form

- Vermont annual 497429003 form

- Notices resolutions simple stock ledger and certificate vermont form

- Minutes for organizational meeting vermont vermont form

- Vt office form

- Lead based paint disclosure for sales transaction vermont form

- Lead based paint disclosure for rental transaction vermont form

- Notice of lease for recording vermont form

Find out other Schedule B Form 1040 Internal Revenue Service

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation