Form 941 Ss 2017

What is the Form 941 Ss

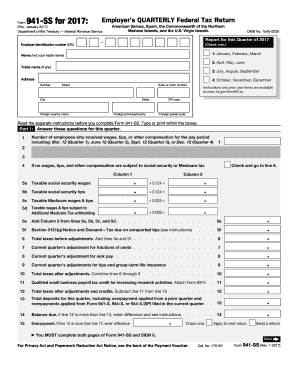

The Form 941 Ss is a specialized tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers who operate in U.S. territories, providing a streamlined process for reporting payroll taxes. Understanding the purpose and requirements of this form is crucial for compliance with federal tax obligations.

How to use the Form 941 Ss

To use the Form 941 Ss effectively, employers must first gather all necessary payroll information for the reporting period. This includes total wages paid, tips received, and any adjustments for prior periods. Employers should accurately fill out each section of the form, ensuring that all calculations are correct to avoid discrepancies. Once completed, the form can be submitted either electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to complete the Form 941 Ss

Completing the Form 941 Ss involves several key steps:

- Gather payroll records for the reporting quarter.

- Calculate total wages, tips, and other compensation.

- Determine the amount of federal income tax withheld.

- Calculate Social Security and Medicare taxes owed.

- Complete all relevant sections of the form, ensuring accuracy.

- Review the form for any errors before submission.

Following these steps helps ensure that the form is completed accurately and submitted on time.

Legal use of the Form 941 Ss

The legal use of the Form 941 Ss is governed by federal tax regulations. Employers must file this form quarterly to remain compliant with the Internal Revenue Service (IRS) requirements. Failure to file or inaccuracies in the form can result in penalties and interest charges. It is essential for employers to understand their legal obligations regarding payroll tax reporting to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Form 941 Ss. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Timely submission is crucial to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941 Ss. The form can be filed electronically through the IRS e-file system, which is often faster and more secure. Alternatively, employers can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available for this form, making electronic filing or mailing the primary methods of submission.

Quick guide on how to complete form 941 ss 2017

Complete Form 941 Ss seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely maintain it online. airSlate SignNow equips you with all the resources you require to create, adjust, and eSign your documents quickly without delays. Manage Form 941 Ss on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to adjust and eSign Form 941 Ss effortlessly

- Locate Form 941 Ss and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Adjust and eSign Form 941 Ss and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss 2017

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss 2017

How to generate an electronic signature for the Form 941 Ss 2017 online

How to make an electronic signature for the Form 941 Ss 2017 in Google Chrome

How to make an eSignature for putting it on the Form 941 Ss 2017 in Gmail

How to generate an electronic signature for the Form 941 Ss 2017 straight from your smart phone

How to make an eSignature for the Form 941 Ss 2017 on iOS devices

How to make an electronic signature for the Form 941 Ss 2017 on Android devices

People also ask

-

What is Form 941 Ss and how is it used?

Form 941 Ss is a quarterly tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is crucial for compliance with IRS regulations. Using airSlate SignNow, you can easily eSign and manage your Form 941 Ss, ensuring timely submission and accuracy.

-

How does airSlate SignNow help with Form 941 Ss?

airSlate SignNow simplifies the process of handling Form 941 Ss by allowing you to send, sign, and store the document electronically. Our platform ensures that your form is securely signed and easily accessible whenever you need it, streamlining your workflow and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 941 Ss?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that suits your budget while benefiting from features that help you efficiently eSign and manage your Form 941 Ss and other documents.

-

Can I integrate airSlate SignNow with my existing payroll software for Form 941 Ss?

Absolutely! airSlate SignNow integrates seamlessly with various payroll software solutions, making it easy to manage your Form 941 Ss alongside your payroll processes. This integration helps ensure that your tax forms are accurate and submitted on time.

-

What features does airSlate SignNow offer for managing Form 941 Ss?

airSlate SignNow offers features like eSigning, document templates, and cloud storage that enhance the management of Form 941 Ss. With our user-friendly interface, you can quickly create, send, and sign your forms, improving efficiency and reducing errors.

-

How secure is airSlate SignNow when handling Form 941 Ss?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your Form 941 Ss and other sensitive documents, ensuring that your information remains confidential and secure throughout the signing process.

-

Can I track the status of my Form 941 Ss with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 941 Ss. You will receive notifications when the document is viewed, signed, and completed, giving you peace of mind throughout the process.

Get more for Form 941 Ss

- Riding instruction and liability release form for

- Icdics 705 form

- Chilis printable job application form

- Nih 527 form

- Art institute of washington transcript request form

- Hmaa credentialing application form

- United healthcare insurance online w 9 form

- Application for additional classification contractor fill form

Find out other Form 941 Ss

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation