File 941 Online Form 2017

What is the File 941 Online Form

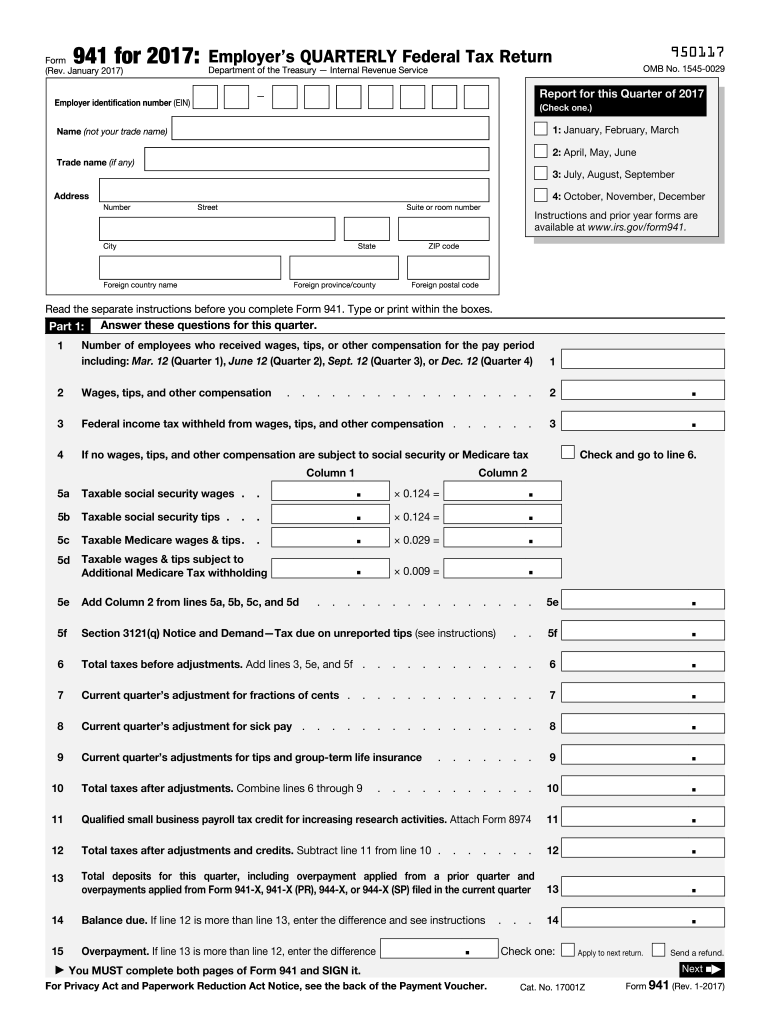

The File 941 Online Form, officially known as Form 941, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is essential for businesses to ensure compliance with federal tax regulations. It is typically filed quarterly and provides the IRS with information about the employer's payroll tax obligations. Understanding the purpose and requirements of Form 941 is vital for maintaining accurate tax records and avoiding potential penalties.

Steps to complete the File 941 Online Form

Completing the File 941 Online Form involves several key steps to ensure accuracy and compliance. The following process outlines how to fill out the form effectively:

- Gather necessary information: Collect employee wage data, tax withheld, and any adjustments that may affect the current quarter.

- Access the form: Navigate to a reliable online platform that offers the File 941 Online Form for completion.

- Fill in employer information: Enter your business name, address, and Employer Identification Number (EIN).

- Report wages and taxes: Input the total wages paid, taxable Medicare wages, and the total taxes withheld for the quarter.

- Complete signature section: Ensure that an authorized person signs the form electronically to validate the submission.

- Review and submit: Double-check all entries for accuracy before submitting the form electronically to the IRS.

Legal use of the File 941 Online Form

The legal use of the File 941 Online Form is governed by IRS regulations, which stipulate that employers must accurately report payroll taxes. Failing to file this form on time or providing incorrect information can lead to penalties. Electronic filing of Form 941 is recognized as a legitimate method of submission, provided that it complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Adhering to these legal requirements ensures that the form is considered valid and enforceable.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the File 941 Online Form to avoid penalties. The form is due four times a year, with specific deadlines for each quarter:

- First Quarter: Due by April 30 for wages paid in January, February, and March.

- Second Quarter: Due by July 31 for wages paid in April, May, and June.

- Third Quarter: Due by October 31 for wages paid in July, August, and September.

- Fourth Quarter: Due by January 31 for wages paid in October, November, and December.

Employers should also be aware of any extensions or changes in deadlines that may occur due to special circumstances.

Required Documents

To complete the File 941 Online Form accurately, employers need to gather several documents and pieces of information:

- Employee wage records: Detailed records of wages paid to employees during the reporting period.

- Tax withholding information: Data regarding federal income tax, Social Security tax, and Medicare tax withheld from employee paychecks.

- Employer Identification Number (EIN): A unique identifier assigned to your business for tax purposes.

- Prior quarter's Form 941: This can provide a reference for consistency in reporting.

Having these documents ready will streamline the process of completing and submitting the form.

Form Submission Methods (Online / Mail / In-Person)

The File 941 Online Form can be submitted through various methods, allowing employers flexibility in how they file:

- Online submission: The most efficient method, allowing for immediate processing and confirmation of receipt.

- Mail submission: Employers can print the completed form and send it via postal service to the appropriate IRS address. This method may take longer for processing.

- In-person submission: While less common, employers may choose to deliver the form directly to an IRS office, ensuring immediate handoff and confirmation.

Choosing the right submission method can depend on the employer's preferences and the urgency of the filing.

Quick guide on how to complete file 941 online 2017 form

Complete File 941 Online Form seamlessly on any device

Online document management has become widely adopted by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage File 941 Online Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign File 941 Online Form effortlessly

- Find File 941 Online Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign File 941 Online Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file 941 online 2017 form

Create this form in 5 minutes!

How to create an eSignature for the file 941 online 2017 form

How to make an eSignature for the File 941 Online 2017 Form online

How to generate an electronic signature for your File 941 Online 2017 Form in Chrome

How to make an electronic signature for signing the File 941 Online 2017 Form in Gmail

How to generate an eSignature for the File 941 Online 2017 Form straight from your smartphone

How to make an electronic signature for the File 941 Online 2017 Form on iOS devices

How to make an electronic signature for the File 941 Online 2017 Form on Android devices

People also ask

-

What is the process to File 941 Online Form using airSlate SignNow?

To File 941 Online Form with airSlate SignNow, simply upload your completed document, add the required recipient emails, and customize your signing workflow. Our intuitive platform guides you through each step, ensuring a smooth and efficient filing experience. Once all signatures are collected, you can submit your Form 941 directly to the IRS.

-

How much does it cost to File 941 Online Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. You can choose from monthly or annual subscriptions, which include unlimited document signing and the ability to File 941 Online Form effortlessly. Visit our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for filing the 941 Online Form?

When you File 941 Online Form using airSlate SignNow, you benefit from features such as customizable templates, real-time tracking, and secure cloud storage. These tools simplify the filing process, enhance document management, and ensure compliance with IRS requirements. Additionally, you can easily integrate with other software for seamless workflow.

-

Can I store my completed 941 Forms using airSlate SignNow?

Yes, airSlate SignNow allows you to store all your completed 941 Forms securely in the cloud. This feature ensures that your documents are easily accessible whenever you need them while maintaining compliance and security. You can also organize your files with custom folders for efficient management.

-

Is it easy to integrate airSlate SignNow with other applications for filing the 941 Form?

Absolutely! airSlate SignNow integrates smoothly with various applications like Google Drive, Zapier, and more. This integration capability allows you to streamline your workflow and efficiently File 941 Online Form without switching between different platforms.

-

What are the benefits of using airSlate SignNow to File 941 Online Form?

Using airSlate SignNow to File 941 Online Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our user-friendly interface simplifies the signing process, while electronic storage ensures that you stay organized. Plus, you can save time and resources by eliminating the need for physical document handling.

-

Is airSlate SignNow secure for filing sensitive documents like the 941 Form?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption and authentication measures to ensure that your data remains confidential and protected while you File 941 Online Form. You can trust our platform for secure document management and electronic signatures.

Get more for File 941 Online Form

- Dmv form oa150i

- Rems program form

- Georgia mineral society inc holly camp form

- Gms mine maintenance form

- Office of aids housing opportunities for persons with aids hopwa cdph ca form

- Cca uniform allowance grievance

- Nmls individual fill in form

- Request for service credit cost information leave of absence calpers ca

Find out other File 941 Online Form

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF