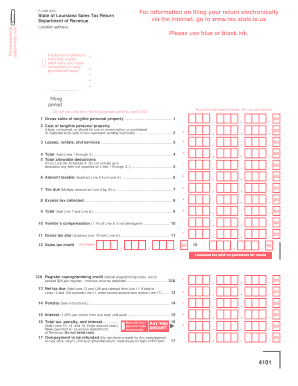

Louisiana Department of Revenue Form

What is the Louisiana Department of Revenue

The Louisiana Department of Revenue (LDR) is the state agency responsible for administering and enforcing the state's tax laws. This includes the collection of various taxes, such as income, sales, and property taxes. The LDR also oversees tax compliance, audits, and the issuance of tax refunds. By providing resources and guidance, the department aims to ensure that taxpayers understand their obligations and rights under Louisiana tax law.

Steps to complete the Louisiana Department of Revenue

Completing forms for the Louisiana Department of Revenue involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant financial documents, such as income statements, deductions, and previous tax filings.

- Choose the correct form: Identify the appropriate form for your specific tax situation, such as the Louisiana R-1029 for individual income tax.

- Fill out the form: Carefully enter your information, ensuring all fields are completed accurately to avoid delays.

- Review for errors: Double-check your entries for any mistakes or omissions before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Louisiana Department of Revenue

The legal use of forms and processes associated with the Louisiana Department of Revenue is governed by state tax laws. To ensure compliance, taxpayers must adhere to the guidelines set forth by the LDR. This includes using the correct forms, providing accurate information, and meeting deadlines. Electronic submissions are legally recognized, provided they comply with relevant eSignature laws, ensuring that digital documents hold the same validity as paper forms.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting forms to the Louisiana Department of Revenue:

- Online: Many forms can be completed and submitted electronically through the LDR's online portal, which offers a convenient option for taxpayers.

- Mail: Forms can be printed, completed, and mailed to the appropriate address as specified by the LDR.

- In-Person: Taxpayers may also visit local LDR offices to submit forms directly and receive assistance if needed.

Required Documents

When completing forms for the Louisiana Department of Revenue, certain documents are typically required to support your submission. These may include:

- Proof of income, such as W-2s or 1099s.

- Documentation for deductions and credits, like receipts or statements.

- Previous tax returns, which may be necessary for reference.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with the Louisiana Department of Revenue. Key dates typically include:

- Individual income tax returns: Usually due by May fifteenth of each year.

- Extensions: If you need more time, filing an extension request is essential to avoid penalties.

Quick guide on how to complete louisiana department of revenue

Complete Louisiana Department Of Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Louisiana Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Louisiana Department Of Revenue with ease

- Find Louisiana Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Louisiana Department Of Revenue and ensure outstanding communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow help with the Louisiana Department of Revenue documents?

airSlate SignNow streamlines the process of sending and eSigning documents related to the Louisiana Department of Revenue. Our platform provides an easy-to-use interface that allows businesses to efficiently manage tax forms and other official documents, ensuring compliance and timely submissions.

-

What features does airSlate SignNow offer for Louisiana tax compliance?

airSlate SignNow comes equipped with features such as document templates, audit trails, and secure storage, specifically tailored to meet the needs of the Louisiana Department of Revenue. These tools help businesses ensure that their documents are not only compliant but also easily retrievable for future reference.

-

Is airSlate SignNow cost-effective for handling Louisiana Department of Revenue forms?

Yes, airSlate SignNow is a cost-effective solution for managing Louisiana Department of Revenue forms. With competitive pricing plans and the ability to save on printing and shipping costs, businesses can efficiently handle all their eSigning needs without breaking the bank.

-

Can airSlate SignNow integrate with existing software for Louisiana Department of Revenue processes?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms that are commonly used in conjunction with the Louisiana Department of Revenue processes. This ensures you can enhance your workflow without compromising on the tools you already rely on.

-

What are the security features of airSlate SignNow for documents related to the Louisiana Department of Revenue?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents for the Louisiana Department of Revenue. Our platform features encryption, multi-factor authentication, and comprehensive audit trails to ensure your documents remain secure and compliant.

-

How can airSlate SignNow benefit small businesses dealing with the Louisiana Department of Revenue?

airSlate SignNow provides small businesses with the tools needed to efficiently manage their interactions with the Louisiana Department of Revenue. Our user-friendly platform simplifies the eSigning process, enabling small businesses to focus on what matters most—growing their operations.

-

What kind of customer support does airSlate SignNow offer for Louisiana Department of Revenue users?

We offer dedicated customer support for all airSlate SignNow users, including those dealing with the Louisiana Department of Revenue. Our knowledgeable team is available via chat, email, or phone to assist with any questions or issues related to your eSigning and document management needs.

Get more for Louisiana Department Of Revenue

- Zions cross sell mortgage certificate elite form

- Financial group distribution form

- Axa guaranteed growth annuity form

- Fatrak borrower information form ameris bank

- Verification of child support support paid form

- Inter governmental agreement declaration form

- Image keybank account statement form

- Student financial services forms hofstra new york

Find out other Louisiana Department Of Revenue

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast