1099 Int Form 2015

What is the 1099 Int Form

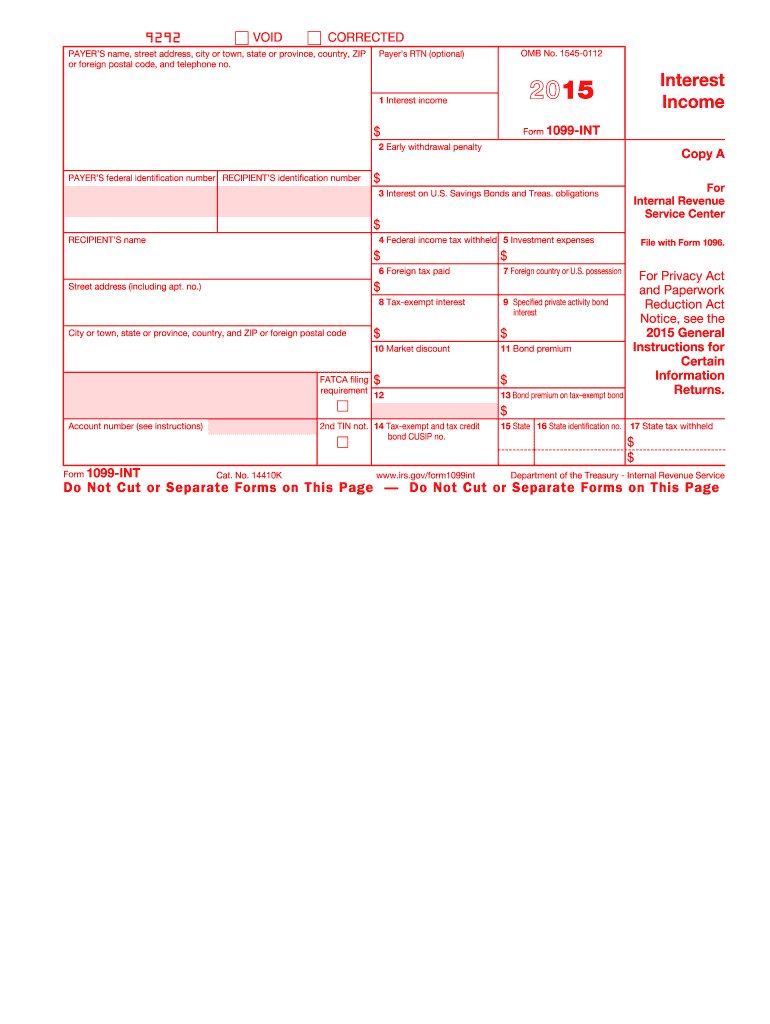

The 1099 Int Form is a tax document used in the United States to report interest income received by individuals and entities. Financial institutions, such as banks and credit unions, issue this form to account holders who earn more than ten dollars in interest during the tax year. This form is essential for taxpayers to accurately report their income to the Internal Revenue Service (IRS) and ensure compliance with tax regulations.

How to use the 1099 Int Form

To effectively use the 1099 Int Form, taxpayers should first verify that they have received the form from their financial institution. Once obtained, individuals must accurately enter the reported interest income on their tax return. This income is typically reported on Form 1040, Schedule B, which details interest and dividend income. It is important to retain the 1099 Int Form for personal records, as it serves as proof of income when filing taxes.

Steps to complete the 1099 Int Form

Completing the 1099 Int Form involves several straightforward steps:

- Gather necessary information, including the taxpayer's name, address, and Social Security number.

- Input the payer's information, which includes the financial institution's name, address, and Employer Identification Number (EIN).

- Enter the total interest income received in the designated box on the form.

- Review the form for accuracy, ensuring all details are correct.

- Submit the completed form to the IRS by the specified deadline, typically by January thirty-first of the following year.

Legal use of the 1099 Int Form

The 1099 Int Form is legally binding when filled out correctly and submitted on time. It is crucial for taxpayers to report all interest income to avoid penalties from the IRS. Failure to report income accurately can lead to audits, fines, or other legal repercussions. Using a reliable electronic signature solution can enhance the security and validity of the document, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the 1099 Int Form. The form must be mailed to recipients by January thirty-first, allowing individuals sufficient time to prepare their tax returns. Additionally, the IRS requires that all forms be filed by February twenty-eighth if submitted by mail or by March thirty-first if filed electronically. Meeting these deadlines is essential to avoid penalties and ensure a smooth tax filing process.

Who Issues the Form

The 1099 Int Form is typically issued by banks, credit unions, and other financial institutions that pay interest to account holders. These entities are responsible for accurately reporting the interest income earned by their customers. Taxpayers should ensure they receive this form from any institution where they have earned interest, as it is vital for proper tax reporting.

Quick guide on how to complete 1099 int 2015 form

Complete 1099 Int Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage 1099 Int Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign 1099 Int Form effortlessly

- Locate 1099 Int Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Decide how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 1099 Int Form and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 int 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 int 2015 form

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 1099 Int Form, and who needs to use it?

The 1099 Int Form is used to report interest income earned by individuals or businesses. If you have earned $10 or more in interest during the tax year, you are required to report this income using the 1099 Int Form. As such, it’s essential for freelancers, small business owners, and anyone receiving interest payments to be aware of this form.

-

How can airSlate SignNow help with filling out the 1099 Int Form?

airSlate SignNow simplifies the process of filling out the 1099 Int Form by allowing you to create, edit, and eSign documents easily and securely. With our user-friendly interface, you can quickly input the necessary information and send it to relevant parties without hassle. Our solution ensures that your documentation process is both efficient and compliant with tax requirements.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Our plans include options for individual users and teams, providing features like eSigning, document sharing, and templates, including those for the 1099 Int Form. We aim to offer a cost-effective solution that empowers all sizes of businesses to streamline their document processes.

-

Is it safe to use airSlate SignNow for my 1099 Int Form?

Yes, using airSlate SignNow for your 1099 Int Form is safe and secure. We employ advanced encryption and security measures to protect sensitive information and ensure compliance with applicable regulations. You can trust that your documents are handled with the highest level of security throughout the signing process.

-

Can I integrate airSlate SignNow with other applications to manage my 1099 Int Form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to manage your 1099 Int Form and other documents seamlessly. This means you can streamline your workflow and connect with tools you already use, enhancing your efficiency in managing financial documents.

-

What features does airSlate SignNow offer for document management related to 1099 Int Form?

airSlate SignNow includes essential features for managing the 1099 Int Form, such as template creation, automatic reminders for signatures, and secure cloud storage. These tools help ensure that your documents are easy to access, fill out, and sign, facilitating a smoother and quicker filing process. Our platform is designed to cater to all your document needs.

-

How can airSlate SignNow improve my workflow when dealing with the 1099 Int Form?

By utilizing airSlate SignNow, you can automate and streamline your workflow related to the 1099 Int Form, reducing time spent on documentation. The sign and send features enable you to quickly obtain necessary signatures while keeping track of document status. This results in a more efficient process, allowing you to focus on other crucial aspects of your business.

Get more for 1099 Int Form

- Non studentclinical observer application cover sheet seton cds seton form

- Mutual of omaha enrollment form

- Podiatry new patient intake form

- Absolute assignment form

- Transfer hospital form

- Healthsouth patient data amp insurance verification sheet form

- Physician application search locum tenens jobs form

- Outpatient adult lymphedema physical therapy referral form rusk med nyu

Find out other 1099 Int Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document