Instructions for Schedule H Form 1040 Household IRS Gov 2014

What is the Instructions For Schedule H Form 1040 Household IRS gov

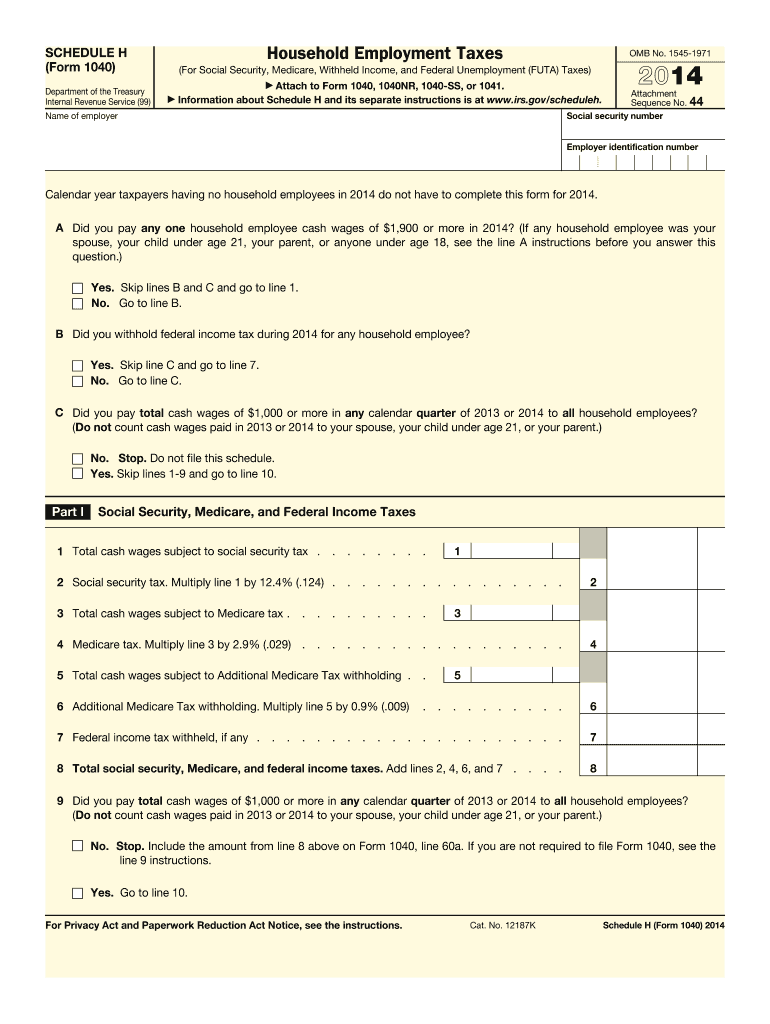

The Instructions for Schedule H Form 1040 Household IRS gov provide essential guidelines for taxpayers who employ household workers. This form allows individuals to report wages paid to these workers and calculate any associated taxes, such as Social Security and Medicare taxes. Understanding these instructions is crucial for compliance with federal tax regulations, ensuring that employers fulfill their obligations while also protecting the rights of household employees.

How to use the Instructions For Schedule H Form 1040 Household IRS gov

To effectively use the Instructions for Schedule H Form 1040 Household IRS gov, taxpayers should first familiarize themselves with the requirements outlined in the document. This includes determining if they are required to file based on the wages paid to household employees. The instructions detail how to complete the form accurately, including providing information about the employer, the employee, and the wages paid. It is important to follow each step carefully to avoid errors that could lead to penalties.

Steps to complete the Instructions For Schedule H Form 1040 Household IRS gov

Completing the Instructions for Schedule H Form 1040 Household IRS gov involves several key steps:

- Gather necessary information about household employees, including names, addresses, and Social Security numbers.

- Determine the total wages paid to each employee during the tax year.

- Calculate the required taxes, such as Social Security and Medicare, based on the wages reported.

- Fill out the Schedule H form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

Legal use of the Instructions For Schedule H Form 1040 Household IRS gov

The legal use of the Instructions for Schedule H Form 1040 Household IRS gov is critical for employers to avoid potential legal issues. By adhering to the guidelines provided, employers ensure compliance with federal tax laws. This includes accurately reporting wages and taxes, which helps protect both the employer and the employee. Misreporting or failing to file can result in penalties or legal action, making it essential to follow these instructions diligently.

Key elements of the Instructions For Schedule H Form 1040 Household IRS gov

Key elements of the Instructions for Schedule H Form 1040 Household IRS gov include:

- Eligibility criteria for filing the form.

- Detailed instructions for calculating wages and taxes owed.

- Information on filing deadlines and submission methods.

- Guidance on record-keeping requirements for employers.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Schedule H Form 1040 Household IRS gov typically align with the federal tax filing deadline. Generally, this is April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for employers to stay informed about any changes to these dates to ensure timely compliance.

Required Documents

When completing the Instructions for Schedule H Form 1040 Household IRS gov, employers should have the following documents ready:

- Wage records for household employees.

- Social Security numbers for all employees.

- Any prior year tax documents that may affect current filings.

- Documentation of any tax payments made throughout the year.

Quick guide on how to complete 2018 instructions for schedule h form 1040 household irsgov

Effortlessly Prepare Instructions For Schedule H Form 1040 Household IRS gov on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Instructions For Schedule H Form 1040 Household IRS gov on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Alter and Electronically Sign Instructions For Schedule H Form 1040 Household IRS gov with Ease

- Locate Instructions For Schedule H Form 1040 Household IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Instructions For Schedule H Form 1040 Household IRS gov while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for schedule h form 1040 household irsgov

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for schedule h form 1040 household irsgov

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are the Instructions For Schedule H Form 1040 Household IRS gov?

The Instructions For Schedule H Form 1040 Household IRS gov provide detailed guidance on how to fill out this form, which is essential for reporting household employment taxes. This form is used to report wages paid to household employees, ensuring compliance with IRS regulations. Understanding these instructions is crucial for any household employer.

-

How can airSlate SignNow simplify the process of submitting Instructions For Schedule H Form 1040 Household IRS gov?

airSlate SignNow allows users to easily create, send, and eSign documents, making it ideal for managing and submitting the Instructions For Schedule H Form 1040 Household IRS gov. With our user-friendly platform, you can quickly fill out your forms and obtain necessary signatures, streamlining the filing process. This convenience can save you time and effort in ensuring compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow for IRS forms like Schedule H?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those who need to submit IRS forms like Schedule H. Whether you are a small household employer or a larger entity, we provide cost-effective solutions that fit your budget. Each plan includes access to our essential features, enabling you to handle your document needs efficiently.

-

Can I integrate airSlate SignNow with other software for handling IRS forms?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your IRS forms like Schedule H effortlessly. These integrations enable you to streamline your workflow, saving you time while ensuring accurate documentation. This functionality helps you stay organized and compliant with the Instructions For Schedule H Form 1040 Household IRS gov.

-

What are the benefits of using airSlate SignNow for submitting tax documents?

Using airSlate SignNow for submitting tax documents, including the Instructions For Schedule H Form 1040 Household IRS gov, offers numerous benefits such as increased efficiency and reduced filing errors. Our platform provides electronic signatures, ensuring that your documents are legally binding and securely stored. This leads to a smoother tax preparation experience for household employers.

-

Is airSlate SignNow compliant with IRS regulations for tax forms?

Absolutely! airSlate SignNow is designed to comply with IRS regulations, including those related to tax forms such as the Instructions For Schedule H Form 1040 Household IRS gov. We prioritize security and compliance, providing users with the confidence that their submissions meet all necessary legal requirements. This commitment helps you stay stress-free while managing household employment taxes.

-

How does eSigning a Schedule H form work with airSlate SignNow?

eSigning a Schedule H form with airSlate SignNow is a straightforward process. Users can upload their document, add signature fields, and send it out for electronic signing. The completed and signed document is securely stored and easily accessible, ensuring that you have all necessary paperwork for the Instructions For Schedule H Form 1040 Household IRS gov at your fingertips.

Get more for Instructions For Schedule H Form 1040 Household IRS gov

- New patient information and consent doctors care

- Cani 805 provider information page

- Kansas inpatient medicaid prior authorization fax form inpatient medicaid prior authorization fax form

- Medical necessity form 404182935

- Medical necessity form 41244003

- Diabetes intake form

- Login form web

- Opioid prior authorization form maryland medicaid

Find out other Instructions For Schedule H Form 1040 Household IRS gov

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal