Form 8863 Education Credits American Opportunity and Lifetime Learning Credits 2012

What is the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

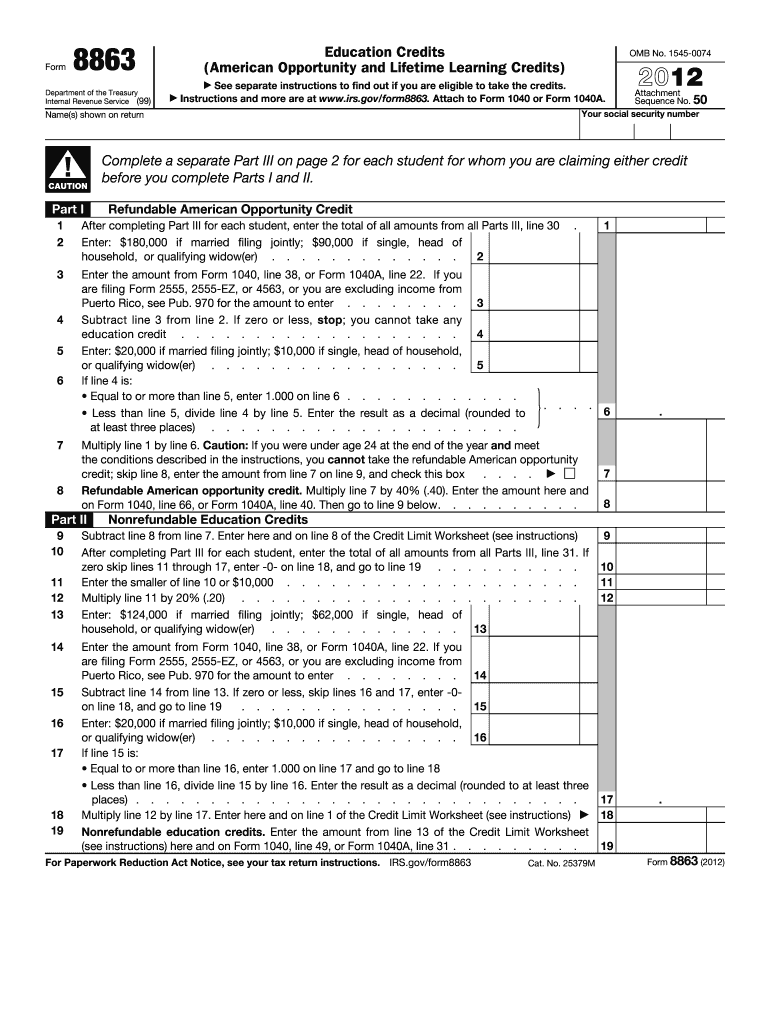

The Form 8863 is a crucial document used by taxpayers in the United States to claim education credits. These credits include the American Opportunity Credit and the Lifetime Learning Credit, which help offset the costs of higher education. The American Opportunity Credit is available for eligible students in their first four years of higher education, providing a credit of up to two thousand five hundred dollars per student. The Lifetime Learning Credit, on the other hand, offers a credit of up to two thousand dollars per tax return for qualified tuition and related expenses, applicable for any post-secondary education and courses to acquire or improve job skills.

How to use the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

To use Form 8863, taxpayers must first determine their eligibility for the education credits. This involves assessing their enrollment status, income level, and the type of expenses incurred. Once eligibility is confirmed, the form must be filled out accurately, detailing the qualified expenses and the number of eligible students. After completing the form, it should be submitted along with the taxpayer's federal income tax return, either electronically or via mail. It is essential to retain supporting documentation, such as tuition statements and receipts, in case of an audit.

Steps to complete the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

Completing Form 8863 involves several steps:

- Gather necessary documents, including Form 1098-T, which reports tuition payments.

- Determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit based on enrollment and income criteria.

- Fill out the form, providing details about the education expenses incurred and the number of qualifying students.

- Calculate the total credits based on the provided information.

- Attach the completed form to your federal tax return and submit it.

Legal use of the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

Form 8863 is legally recognized for claiming education credits as long as it is completed accurately and submitted within the IRS guidelines. Taxpayers must ensure that all information provided is truthful and substantiated by proper documentation. Misrepresentation or errors on the form can lead to penalties or disqualification from receiving the credits. It is advisable to consult IRS guidelines or a tax professional for clarity on legal obligations when using this form.

Eligibility Criteria

Eligibility for the education credits claimed on Form 8863 is based on several factors:

- The taxpayer must have incurred qualified education expenses for an eligible student.

- The student must be enrolled at least half-time in a degree or certificate program.

- Income limits apply, which may reduce or eliminate the credits for higher-income taxpayers.

- For the American Opportunity Credit, the student must not have completed four years of higher education before the tax year.

Required Documents

To complete Form 8863, taxpayers must gather specific documents, including:

- Form 1098-T from the educational institution, which reports tuition payments.

- Receipts for qualified expenses, such as books and supplies.

- Previous tax returns, if applicable, to reference prior credits claimed.

- Social Security numbers for both the taxpayer and the student.

Quick guide on how to complete 2012 form 8863education credits american opportunity and lifetime learning credits

Handle Form 8863 Education Credits American Opportunity And Lifetime Learning Credits effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the required form and securely archive it online. airSlate SignNow provides all the resources necessary to generate, modify, and eSign your documents quickly without interruptions. Manage Form 8863 Education Credits American Opportunity And Lifetime Learning Credits on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The optimal method to modify and eSign Form 8863 Education Credits American Opportunity And Lifetime Learning Credits with ease

- Obtain Form 8863 Education Credits American Opportunity And Lifetime Learning Credits and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or black out confidential information with tools that airSlate SignNow offers specifically for those needs.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Alter and eSign Form 8863 Education Credits American Opportunity And Lifetime Learning Credits to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8863education credits american opportunity and lifetime learning credits

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8863education credits american opportunity and lifetime learning credits

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8863 and how does it relate to education credits?

Form 8863 is used to claim the American Opportunity and Lifetime Learning Credits. These education credits can help reduce your tax liability for qualified educational expenses. Utilizing Form 8863 ensures you maximize your financial benefits and helps in streamlining the process of obtaining education-related tax credits.

-

Who is eligible to file Form 8863 for education credits?

Eligibility for Form 8863 Education Credits American Opportunity And Lifetime Learning Credits extends to students enrolled in eligible educational institutions. Generally, tax filers, their spouses, or dependents can claim these credits if they meet the income limitations and other criteria set by the IRS.

-

How can airSlate SignNow assist with filing Form 8863?

airSlate SignNow simplifies the process of preparing and eSigning documents, including tax forms like Form 8863 Education Credits American Opportunity And Lifetime Learning Credits. By using airSlate SignNow, users can easily complete, send, and securely sign their tax documents, ensuring they are filed accurately and on time.

-

What features does airSlate SignNow offer for educational institutions?

airSlate SignNow offers features designed to streamline the management of documentation for educational institutions, such as eSigning capabilities and secure storage. This makes it easier for institutions to provide students with clear instructions on how to fill out Form 8863 Education Credits American Opportunity And Lifetime Learning Credits and other related documents.

-

Can I track the status of my Form 8863 submissions with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow users to monitor the status of their submitted documents, including Form 8863 Education Credits American Opportunity And Lifetime Learning Credits. This ensures that you are informed of any actions taken on your document and can follow up as necessary.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers a variety of pricing plans to cater to different needs, ensuring cost-effectiveness for users needing to file forms like Form 8863 Education Credits American Opportunity And Lifetime Learning Credits. Whether you're an individual or a business, you'll find a plan that suits your budget while providing essential document management features.

-

How do integrations work with airSlate SignNow for Form 8863?

airSlate SignNow integrates seamlessly with many popular applications allowing you to import and export information easily. This means that when preparing Form 8863 Education Credits American Opportunity And Lifetime Learning Credits, you can pull data from your existing tools or automatically send signed documents to your desired platforms for further processing.

Get more for Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

- Ttuhsc immigration questionnaires ampamp formstexas tech

- Office of human resources maternitypaternityadoption form

- Moody bible institute reference forms

- Non driver pre employment application pdf thomas concrete form

- Termination of employment letter texas tech university ttuhsc form

- 2300 940 clearance of personnel for separation or transfer form

- Withdrawal request for fixed annuities pacific life form

- Retirement formdocx

Find out other Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors