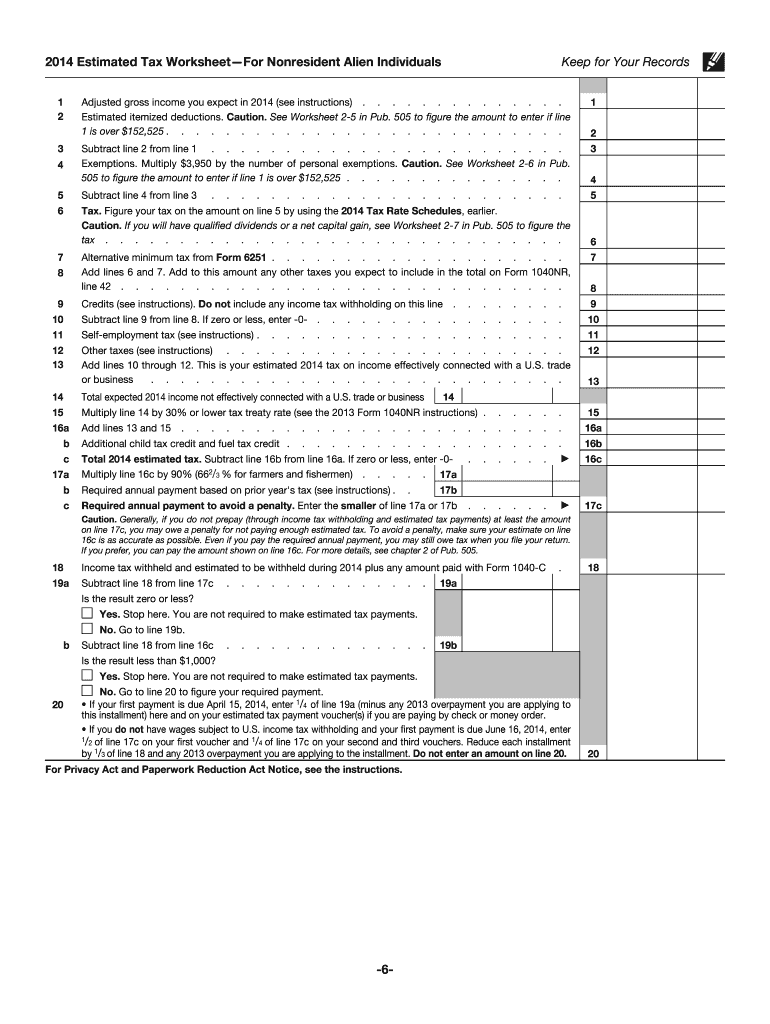

Irs Form Tax 2014

What is the IRS Form Tax

The IRS Form Tax refers to various tax forms issued by the Internal Revenue Service (IRS) that individuals and businesses must complete for tax reporting purposes. These forms are essential for declaring income, calculating tax liability, and claiming deductions or credits. Each form serves a specific purpose, such as the 1040 for individual income tax or the W-2 for wage and tax statements. Understanding the purpose of each form is crucial for compliance with U.S. tax laws.

How to use the IRS Form Tax

Using the IRS Form Tax involves several steps to ensure accurate completion and submission. First, identify the correct form based on your tax situation. Gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Complete the form by entering your information accurately, following the instructions provided. After filling out the form, review it for errors, sign it, and submit it to the IRS by the specified deadline, either electronically or by mail.

Steps to complete the IRS Form Tax

Completing the IRS Form Tax requires careful attention to detail. Start by selecting the appropriate form for your tax situation. Next, collect all relevant documents, including income statements and deduction records. Fill out the form methodically, ensuring that all entries are accurate. It is advisable to double-check calculations and verify that all required information is included. Once completed, sign the form and choose your submission method—either electronically or via postal mail. Keep a copy for your records.

Legal use of the IRS Form Tax

The legal use of the IRS Form Tax is governed by U.S. tax laws and regulations. To ensure compliance, taxpayers must accurately report their income and deductions as required by the IRS. Forms must be signed and dated, and electronic submissions must adhere to eSignature laws. Using a reliable digital platform can enhance the security and legality of the form submission process. Understanding the legal implications of incorrect or fraudulent submissions is essential to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Tax vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments and extensions. Keeping track of these important dates is crucial to avoid late fees and penalties.

Required Documents

When completing the IRS Form Tax, several documents are typically required. These may include income statements such as W-2s or 1099s, records of deductible expenses, and prior year tax returns. Additional documentation may be necessary for specific deductions or credits. Gathering all required documents before starting the form will streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form Tax can be submitted through various methods, including online, by mail, or in person. Electronic filing is often the fastest and most efficient method, allowing for quicker processing and confirmation. Taxpayers can also print their completed forms and mail them to the IRS. In some cases, individuals may choose to submit forms in person at designated IRS offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete 2014 irs form tax

Complete Irs Form Tax effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Irs Form Tax on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to modify and eSign Irs Form Tax without hassle

- Obtain Irs Form Tax and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for this intent.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form tax

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form tax

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the best way to eSign an IRS Form Tax using airSlate SignNow?

To eSign an IRS Form Tax using airSlate SignNow, simply upload your document, add the necessary signature fields, and send it out for signing. The process is user-friendly and ensures that your IRS Form Tax is signed securely and efficiently. You'll receive notifications when the document is signed, keeping your tax documents organized.

-

How does airSlate SignNow ensure the security of IRS Form Tax transactions?

airSlate SignNow employs robust encryption protocols to protect all transactions, including IRS Form Tax documents. We adhere to industry standards for data security to ensure that your sensitive information remains confidential. With our platform, you can confidently manage your tax documents without compromising on security.

-

Can I integrate my IRS Form Tax eSign processes with other software using airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various software tools, enabling you to streamline your IRS Form Tax eSigning processes. Whether you're using CRM systems, cloud storage options, or other business applications, our integrations help consolidate your workflow. This means you can manage all your documents in one place.

-

What features does airSlate SignNow offer for handling IRS Form Tax documents?

airSlate SignNow provides features such as customizable templates, in-person signing, and automated reminders to enhance your efficiency when working with IRS Form Tax documents. Our user-friendly interface allows you to easily track the status of each document. This ensures timely completion of your tax-related tasks.

-

Is airSlate SignNow budget-friendly for small businesses handling IRS Form Tax?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to small businesses managing IRS Form Tax. Our cost-effective solutions are designed to help businesses save time and money without sacrificing quality. You can choose a plan that fits your budget while enjoying robust eSigning capabilities.

-

How can airSlate SignNow enhance the efficiency of my IRS Form Tax filing process?

By using airSlate SignNow, you can signNowly expedite the filing process for your IRS Form Tax. Our platform allows you to prepare, send, and receive signed documents in a matter of minutes. This streamlined approach helps you meet deadlines more effectively and reduces the stress associated with tax season.

-

What customer support options does airSlate SignNow provide for IRS Form Tax inquiries?

airSlate SignNow offers various customer support options, including live chat, email assistance, and an extensive FAQ section for any IRS Form Tax inquiries. Our dedicated support team is available to help you with any questions or issues you encounter. We strive to provide timely assistance to keep your operations running smoothly.

Get more for Irs Form Tax

Find out other Irs Form Tax

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License