State Tax Registration Application the Payroll Center Form

What is the State Tax Registration Application The Payroll Center

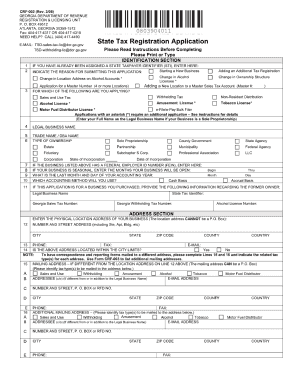

The State Tax Registration Application The Payroll Center is a crucial document for businesses operating in the United States. It allows employers to register for state tax identification numbers, which are necessary for withholding and remitting state taxes on employee wages. This application ensures compliance with state tax laws and provides a framework for the proper reporting of payroll taxes. By completing this form, businesses can establish their tax obligations and maintain good standing with state tax authorities.

Steps to complete the State Tax Registration Application The Payroll Center

Completing the State Tax Registration Application The Payroll Center involves several key steps. First, gather all necessary information, including your business name, address, and federal Employer Identification Number (EIN). Next, determine the type of business entity you operate, such as a corporation, partnership, or sole proprietorship. Fill out the application accurately, ensuring that all required fields are completed. After reviewing the application for any errors, submit it to the appropriate state agency, either online or by mail, depending on your state’s requirements. Keep a copy of the submitted application for your records.

Legal use of the State Tax Registration Application The Payroll Center

The legal use of the State Tax Registration Application The Payroll Center is essential for businesses to fulfill their tax obligations. This form must be completed accurately and submitted to the appropriate state tax authority. The application serves as a formal request for a state tax identification number, which is legally required for businesses that employ workers. Failure to complete this application correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for maintaining compliance with state tax laws.

Required Documents for the State Tax Registration Application The Payroll Center

When preparing to complete the State Tax Registration Application The Payroll Center, certain documents are necessary. These typically include your federal Employer Identification Number (EIN), business formation documents (such as articles of incorporation or partnership agreements), and identification information for the business owner(s). Depending on your state, additional documentation may be required, such as proof of business address or licenses. Ensuring that you have all required documents ready will facilitate a smoother application process.

Filing Deadlines / Important Dates

Filing deadlines for the State Tax Registration Application The Payroll Center can vary by state. It is crucial for businesses to be aware of these deadlines to avoid penalties. Generally, new businesses should submit their registration application before their first payroll period. Some states may have specific deadlines for various types of businesses or for different tax obligations. Staying informed about these important dates helps ensure compliance and avoids unnecessary fines.

Application Process & Approval Time

The application process for the State Tax Registration Application The Payroll Center typically involves submitting the completed form to the relevant state tax authority. The approval time can vary widely by state, ranging from a few days to several weeks. Factors influencing approval time include the volume of applications received by the state agency and the accuracy of the submitted information. Businesses should plan accordingly, allowing ample time for processing before their payroll obligations begin.

Quick guide on how to complete state tax registration application the payroll center

Complete State Tax Registration Application The Payroll Center effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage State Tax Registration Application The Payroll Center on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to alter and eSign State Tax Registration Application The Payroll Center with ease

- Obtain State Tax Registration Application The Payroll Center and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Choose how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign State Tax Registration Application The Payroll Center and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state tax registration application the payroll center

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Tax Registration Application The Payroll Center?

The State Tax Registration Application The Payroll Center is a digital tool designed to streamline the process of registering for state taxes. With this application, businesses can simplify compliance and ensure timely submissions, helping to minimize the risk of penalties.

-

How does the State Tax Registration Application The Payroll Center benefit my business?

By using the State Tax Registration Application The Payroll Center, businesses can save time and reduce administrative burdens. This user-friendly solution enables you to complete registrations efficiently, allowing you to focus more on your core business operations.

-

What features are included in the State Tax Registration Application The Payroll Center?

The State Tax Registration Application The Payroll Center includes features such as automated form filling, real-time compliance alerts, and easy tracking of submissions. These features work together to enhance your experience and ensure accuracy in your state tax registrations.

-

Is the State Tax Registration Application The Payroll Center affordable for small businesses?

Yes, the State Tax Registration Application The Payroll Center offers cost-effective pricing plans tailored for small businesses. We believe that efficient tax management should be accessible to all, making it an ideal choice for companies of any size.

-

Can I integrate the State Tax Registration Application The Payroll Center with other software?

Absolutely! The State Tax Registration Application The Payroll Center can be seamlessly integrated with various accounting and payroll software, ensuring smooth data flow and enhanced efficiency. This means you can easily link your existing systems for better tax management.

-

What types of businesses should use the State Tax Registration Application The Payroll Center?

The State Tax Registration Application The Payroll Center is ideal for any business that needs to comply with state tax obligations, including startups, small businesses, and established companies. It caters to diverse industries, making it a versatile solution for managing tax registrations.

-

How can I get started with the State Tax Registration Application The Payroll Center?

Getting started with the State Tax Registration Application The Payroll Center is easy! Simply sign up on our website, choose a pricing plan that suits your needs, and follow the guided setup process to begin streamlining your state tax registrations.

Get more for State Tax Registration Application The Payroll Center

- Publication 3218 rev 04 99 report on the application and administration of section 482 form

- 9465sp electronic form

- Form it 203 gr att b schedule b yonkers group return for nonresident partners tax year

- 8 dealer application form templates pdf

- Form patient history form story physical therapy

- V62 pdf form

- Kinship diagram maker form

- At t settlement claim form

Find out other State Tax Registration Application The Payroll Center

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement