Form 40 Idaho

What is the Form 40 Idaho

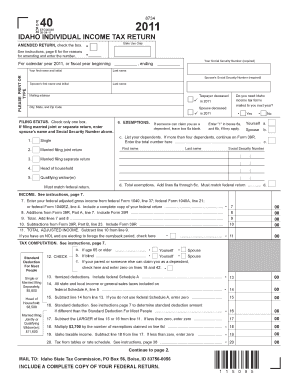

The Form 40 Idaho is the official state income tax return form used by residents of Idaho to report their annual income. This form is essential for individuals and households to calculate their tax liability based on their income earned throughout the year. The form allows taxpayers to claim various deductions and credits, which can significantly reduce the amount of taxes owed. Understanding the purpose and structure of Form 40 is crucial for accurate tax filing and compliance with state regulations.

How to use the Form 40 Idaho

Using the Form 40 Idaho involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, providing details about your income, deductions, and credits. It is important to follow the instructions provided with the form to avoid errors. After completing the form, review it for accuracy before submitting it to the Idaho State Tax Commission.

Steps to complete the Form 40 Idaho

Completing the Form 40 Idaho requires a systematic approach:

- Gather necessary documents, including income statements and deduction records.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim applicable deductions, such as those for dependents or specific expenses.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form to certify its accuracy.

Legal use of the Form 40 Idaho

The Form 40 Idaho is legally binding when completed and submitted according to state regulations. To ensure its legal standing, taxpayers must provide accurate information and comply with all filing requirements. The form must be signed by the taxpayer or an authorized representative. Furthermore, adherence to deadlines is vital, as late submissions may incur penalties. Utilizing a reliable eSignature platform can enhance the security and legitimacy of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 40 Idaho are crucial for taxpayers to note. Typically, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, allowing for additional time to file without incurring penalties. Keeping track of these dates ensures compliance and avoids unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 40 Idaho. The form can be filed online through the Idaho State Tax Commission's website, which is a convenient option for many. Alternatively, taxpayers can mail the completed form to the designated address provided in the instructions. In-person submissions may also be possible at local tax commission offices. Each method has its own processing times and requirements, so it is advisable to choose the most suitable option based on individual circumstances.

Quick guide on how to complete form 40 idaho

Complete Form 40 Idaho effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent sustainable alternative to conventional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 40 Idaho on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Form 40 Idaho without hassle

- Find Form 40 Idaho and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and eSign Form 40 Idaho and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 40 idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 40 Idaho and why do I need it?

Form 40 Idaho is the state income tax return form required for reporting your income in Idaho. It’s essential for ensuring compliance with state tax laws and for calculating any taxes owed or refunds due to you. Using airSlate SignNow can help streamline the process of completing and eSigning this form.

-

How can airSlate SignNow help me with Form 40 Idaho?

airSlate SignNow allows you to create, send, and securely eSign Form 40 Idaho with ease. The platform's user-friendly design makes it simple to fill out your tax information accurately and efficiently, reducing the chances of errors that could delay your filing process.

-

Is there a cost associated with using airSlate SignNow for Form 40 Idaho?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. These plans provide a cost-effective solution for businesses and individuals looking to manage documents like Form 40 Idaho online while ensuring convenience and efficiency.

-

What features does airSlate SignNow offer for handling Form 40 Idaho?

airSlate SignNow provides features such as document templates, eSignature capability, and real-time tracking, which are particularly useful when dealing with Form 40 Idaho. These functionalities are designed to save you time and keep your filing organized.

-

Can I integrate airSlate SignNow with other applications for Form 40 Idaho?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when managing Form 40 Idaho. This allows you to import data from other platforms, making the completion of your tax duties even more efficient.

-

How secure is my information when using airSlate SignNow for Form 40 Idaho?

Very secure! airSlate SignNow uses advanced encryption and security protocols to ensure your information related to Form 40 Idaho remains confidential and protected. You can confidently eSign and send documents without worrying about data bsignNowes.

-

Is training available for using airSlate SignNow with Form 40 Idaho?

Yes, airSlate SignNow offers comprehensive resources and customer support to help you understand how to effectively use the platform, including managing Form 40 Idaho. You can access tutorials, webinars, and live support to address any questions you may have.

Get more for Form 40 Idaho

- Designated agent bond for illinois vehicle dealers form

- Lmsw application status check the status of your license form

- Tax exempt organization search internal revenue service form

- Posting notice revised tennessee form

- Vat 65a form

- Pdf uniform sales use tax resale certificate multijurisdiction

- Form raibn1 notification form

- Paragraph 49 exemption application form

Find out other Form 40 Idaho

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed