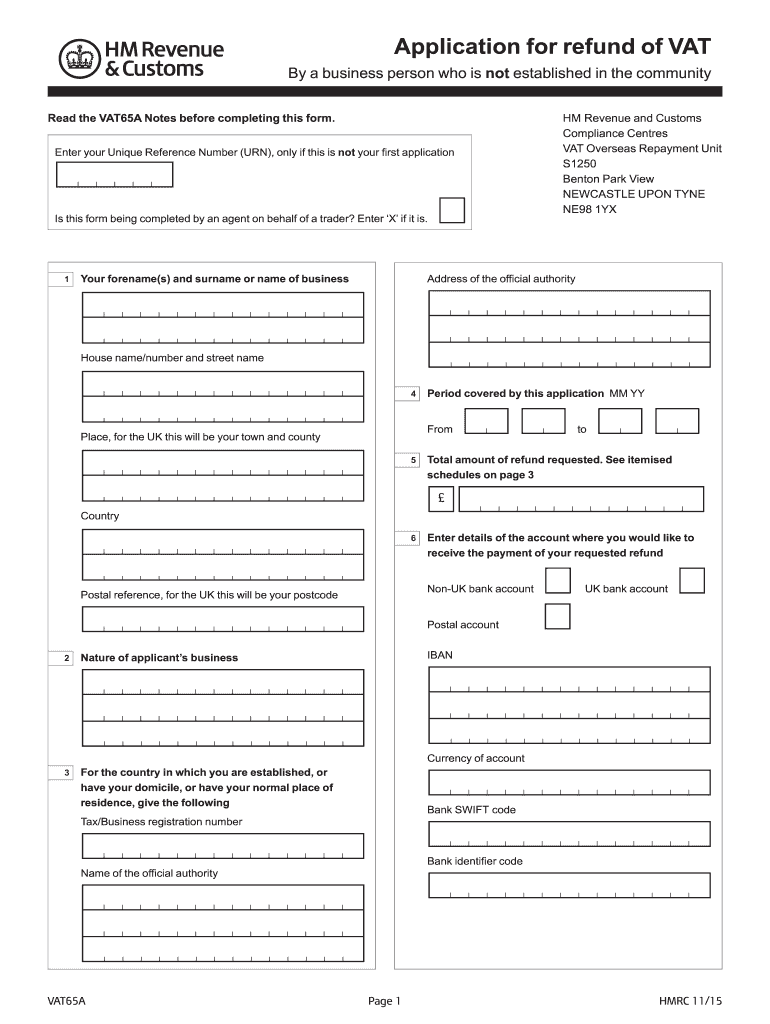

Vat 65a 2019

What is the HMRC CIS Refund Form?

The HMRC CIS refund form is a specific document used by contractors and subcontractors within the Construction Industry Scheme (CIS) in the United Kingdom. This form allows individuals to claim back any tax that has been deducted from their payments, which may be more than their actual tax liability. The form is essential for ensuring that workers in the construction sector can receive refunds for overpaid taxes, thereby maintaining their financial well-being.

Steps to Complete the HMRC CIS Refund Form

Completing the HMRC CIS refund form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your Unique Taxpayer Reference (UTR) and details of your earnings and deductions. Next, fill out the form with your personal information, including your name, address, and National Insurance number. Be sure to accurately report the amounts that were deducted from your payments. Once completed, review the form for any errors before submitting it to HMRC.

Required Documents for the HMRC CIS Refund Form

To successfully submit the HMRC CIS refund form, specific documents are required. These typically include:

- Your Unique Taxpayer Reference (UTR)

- National Insurance number

- Details of payments received and tax deducted

- Any relevant invoices or payment statements

Having these documents ready will streamline the process and help ensure that your claim is processed without delays.

Form Submission Methods

The HMRC CIS refund form can be submitted through various methods. You can choose to file it online via the HMRC website, which offers a straightforward process for digital submissions. Alternatively, you may print the form and send it by mail to the appropriate HMRC address. If you prefer in-person submissions, visiting a local HMRC office is also an option, though this may require an appointment.

Eligibility Criteria for the HMRC CIS Refund Form

To be eligible for a refund using the HMRC CIS refund form, you must meet certain criteria. Primarily, you need to be a registered contractor or subcontractor under the CIS. Additionally, you must have had tax deducted from your payments that exceeds your actual tax liability. It is important to ensure that you have all relevant documentation to support your claim, as this will be reviewed by HMRC during the processing of your refund.

Legal Use of the HMRC CIS Refund Form

The HMRC CIS refund form is legally binding when completed correctly and submitted in accordance with HMRC guidelines. It is essential to provide accurate information to avoid any potential legal issues, including penalties for false claims. Understanding the legal implications of this form can help ensure that your submission is valid and that you receive your entitled refund without complications.

Quick guide on how to complete vat 65a

Complete Vat 65a effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, since you can access the proper form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage Vat 65a on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Vat 65a effortlessly

- Locate Vat 65a and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Vat 65a and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat 65a

Create this form in 5 minutes!

How to create an eSignature for the vat 65a

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the HMRC CIS refund form?

The HMRC CIS refund form is a document used by contractors and subcontractors in the construction industry to claim a refund for any tax deducted at source under the Construction Industry Scheme (CIS). By properly filling out this form, you can recover the amount overpaid in taxes.

-

How can the airSlate SignNow platform assist with the HMRC CIS refund form?

airSlate SignNow provides an easy-to-use platform that allows you to electronically sign and send the HMRC CIS refund form securely. Our solution simplifies the process, ensuring that you can manage all your documents effectively and receive notifications upon completion.

-

Is there a cost associated with using the airSlate SignNow service for the HMRC CIS refund form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are cost-effective and designed to provide value, especially when handling important documents like the HMRC CIS refund form, ensuring you get the best return on your investment.

-

What features can I find in airSlate SignNow for managing the HMRC CIS refund form?

airSlate SignNow includes features such as document templates, signature requests, and tracking options to efficiently manage the HMRC CIS refund form. This streamlining not only saves time but also ensures that all information is correctly documented and easy to retrieve.

-

Can I integrate airSlate SignNow with other applications while working on the HMRC CIS refund form?

Absolutely! airSlate SignNow provides integrations with a variety of applications, allowing for smoother workflows when dealing with the HMRC CIS refund form. This integration capability makes it easier to manage your construction documents alongside your preferred software tools.

-

What are the benefits of using airSlate SignNow for the HMRC CIS refund form?

Using airSlate SignNow for your HMRC CIS refund form offers numerous benefits, including enhanced security, time savings, and easy document management. You can ensure compliance with regulations and faster processing of your refund claims, leading to greater efficiency in your operations.

-

How do I access the HMRC CIS refund form on airSlate SignNow?

To access the HMRC CIS refund form on airSlate SignNow, simply log into your account and use our search feature or your saved templates. The intuitive interface makes it simple to find, edit, and send the form as needed, ensuring that your refund request is submitted without delay.

Get more for Vat 65a

- Exemption certificates for sales taxexemption certificates for sales taxexemption certificates for sales taxexemption form

- International fuel tax agreement ifta texas comptroller of public form

- Maryland employer form withholding mw506fr final return

- Ty 2021 515 tax year 2021 515 individual taxpayer form

- Combined form registration cra applicationcombined form registration cra applicationh 1b electronic registration

- Mw507 form

- Floridarevenuecomformslibrarycurrentapplication for common paymaster rule 73b 10037 fac

Find out other Vat 65a

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online