Refund Surety Format

What is the bid bond?

A bid bond is a type of surety bond that a contractor provides to a project owner to guarantee that they will enter into a contract if they are awarded the project. This bond protects the project owner from financial loss in case the contractor fails to fulfill their obligations. The bid bond serves as a commitment to the project owner that the contractor has the necessary resources and intent to complete the project as specified.

Key elements of the bid bond

Understanding the key elements of a bid bond is crucial for contractors and project owners alike. The main components include:

- Principal: The contractor who is bidding on the project.

- Obligee: The project owner or entity requiring the bond.

- Surety: The bonding company that issues the bond and guarantees the contractor's performance.

- Bond amount: The financial limit of the bond, often a percentage of the total bid amount.

Steps to complete the bid bond

Completing a bid bond involves several important steps to ensure its validity:

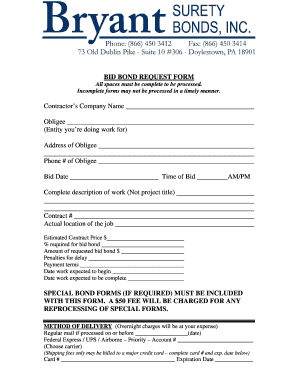

- Gather necessary information: Collect details about the project, including the bid amount and project specifications.

- Choose a surety: Select a reputable bonding company that can issue the bond.

- Fill out the bid bond form: Provide accurate information about the project, contractor, and bond amount.

- Submit the bond: Send the completed bid bond to the project owner as part of the bidding process.

Legal use of the bid bond

To ensure the legal validity of a bid bond, it must comply with specific regulations and requirements. These include adherence to state laws governing surety bonds and ensuring that the bond is executed properly. The bond must also be signed by the contractor and the surety, indicating their agreement to the terms. Failure to comply with these legal standards can result in the bid bond being deemed invalid, which can jeopardize the contractor's ability to secure the project.

How to obtain the bid bond

Obtaining a bid bond typically involves contacting a surety company or a bonding agent. The process generally includes:

- Application: Complete an application form provided by the surety company.

- Financial review: The surety will assess the contractor's financial stability and creditworthiness.

- Bond issuance: Upon approval, the surety will issue the bid bond, which can then be submitted with the project bid.

Examples of using the bid bond

Bid bonds are commonly used in various construction projects, including:

- Public works projects, such as road construction and infrastructure improvements.

- Private sector projects, including commercial building developments.

- Government contracts that require bonding as part of the bidding process.

Quick guide on how to complete refund surety format

Accomplish Refund Surety Format effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed materials, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents swiftly without interruptions. Handle Refund Surety Format on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign Refund Surety Format with ease

- Find Refund Surety Format and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the files or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or disorganized documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Refund Surety Format ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refund surety format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bid bond?

A bid bond is a type of surety bond that guarantees a contractor will enter into a contract if they're awarded the bid. It's an essential financial tool in the construction industry that protects project owners from losses if a contractor defaults. Understanding how bid bonds work can help you ensure successful bidding on projects.

-

How does airSlate SignNow handle bid bond signing?

With airSlate SignNow, you can easily eSign your bid bond documents online. Our platform allows for quick and secure signing, ensuring that all parties can access and execute the bond without delays. This efficiency can signNowly enhance your bidding process by reducing wait times.

-

What are the costs associated with obtaining a bid bond?

The cost of a bid bond usually ranges from 0.5% to 3% of the total bid amount, depending on several factors, including your credit score and the project size. With airSlate SignNow, you can streamline the process of obtaining a bid bond, potentially reducing overall costs associated with paperwork and management.

-

What are the benefits of using airSlate SignNow for bid bonds?

Using airSlate SignNow for managing bid bonds offers signNow advantages, such as faster document turnaround and enhanced security features. Our platform simplifies the entire process from issuing to signing, allowing you to focus on what you do best—winning contracts. Additionally, the affordability of our solution helps keep project costs down.

-

Can bid bonds be customized in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your bid bond documents to meet specific project needs. You can add fields, branding, and other essential elements to ensure compliance with your requirements. This customization capability enhances the professional appearance of your bid bond.

-

Is it possible to track my bid bond status on airSlate SignNow?

Absolutely! airSlate SignNow provides features to track the status of your bid bonds in real time. You'll receive notifications as your documents are viewed, signed, and completed, ensuring you’re always updated on the progress of your bid.

-

What integrations does airSlate SignNow offer for bid bonds?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. These integrations allow you to easily manage your bid bond documents and collaborate with your team efficiently, enhancing your overall workflow.

Get more for Refund Surety Format

Find out other Refund Surety Format

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation