Credit Score Disclosure Form PDF

What is the Credit Score Disclosure Form Pdf

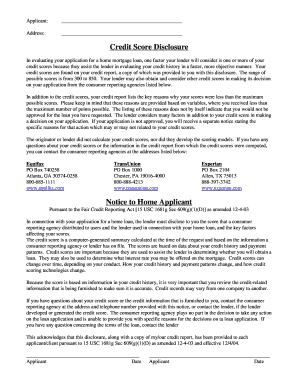

The credit score disclosure form pdf is a document that provides individuals with important information regarding their credit scores. This form is typically used by lenders, financial institutions, and credit reporting agencies to disclose credit-related information to consumers. It outlines the details of how credit scores are calculated, the factors that influence them, and the rights of consumers regarding their credit information. Understanding this form is crucial for individuals looking to manage their credit health effectively.

How to use the Credit Score Disclosure Form Pdf

Using the credit score disclosure form pdf involves a few straightforward steps. First, download the form from a reliable source. Once you have the document, review the sections carefully. Ensure that you fill in any required personal information accurately. After completing the form, you may need to submit it to a lender or credit bureau, depending on the purpose of the disclosure. It is essential to keep a copy for your records, as it can be useful for monitoring your credit status.

Steps to complete the Credit Score Disclosure Form Pdf

Completing the credit score disclosure form pdf requires attention to detail. Follow these steps for successful completion:

- Download the form and open it using a PDF reader.

- Fill in your personal details, including your name, address, and Social Security number.

- Review the sections that explain credit score factors and your rights.

- Sign and date the form where required.

- Save a copy of the completed form for your records.

- Submit the form as instructed, either online or via mail.

Legal use of the Credit Score Disclosure Form Pdf

The legal use of the credit score disclosure form pdf is governed by federal regulations, including the Fair Credit Reporting Act (FCRA). This law mandates that consumers must be informed about their credit scores and the factors affecting them. When used properly, the form serves as a legal document that protects consumers' rights and ensures transparency in credit reporting practices. It is important to understand that the information provided in this form must be accurate and up-to-date to comply with legal standards.

Key elements of the Credit Score Disclosure Form Pdf

Several key elements are crucial in the credit score disclosure form pdf. These include:

- Personal Information: Details such as name, address, and Social Security number.

- Credit Score Information: Explanation of how credit scores are calculated and the factors that influence them.

- Consumer Rights: Information regarding the rights of consumers to dispute inaccuracies and obtain free credit reports.

- Contact Information: Details for the credit reporting agency or lender for further inquiries.

Examples of using the Credit Score Disclosure Form Pdf

There are various scenarios in which the credit score disclosure form pdf may be utilized. For instance:

- A consumer applying for a mortgage may need to submit this form to a lender to understand their creditworthiness.

- Individuals seeking to improve their credit scores can use the form to identify areas that need attention.

- When disputing a credit report error, consumers may reference the information provided in the form to support their claims.

Quick guide on how to complete credit score disclosure form pdf

Complete Credit Score Disclosure Form Pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Credit Score Disclosure Form Pdf on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest method to modify and electronically sign Credit Score Disclosure Form Pdf without hassle

- Find Credit Score Disclosure Form Pdf and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Credit Score Disclosure Form Pdf to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit score disclosure form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit score disclosure form PDF?

A credit score disclosure form PDF is a document that provides essential information regarding an individual's credit score. It is typically used in lending situations to ensure that consumers understand their creditworthiness. Using airSlate SignNow allows you to easily create, send, and eSign these forms.

-

How can I create a credit score disclosure form PDF using airSlate SignNow?

Creating a credit score disclosure form PDF with airSlate SignNow is simple. You can either use our template library or upload your document, customize it to your needs, and then convert it into a PDF. Once ready, you can send it out for electronic signatures.

-

Is there a cost associated with sending a credit score disclosure form PDF?

Yes, there is a cost associated with using airSlate SignNow, but it's designed to be cost-effective for businesses of all sizes. Different pricing plans are available, allowing you to choose based on your needs, including the frequency of sending credit score disclosure form PDFs.

-

What features does airSlate SignNow offer for handling credit score disclosure form PDFs?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and secure document storage. These features make it easy to manage your credit score disclosure form PDFs efficiently while ensuring compliance and enhancing user experience.

-

Can I integrate airSlate SignNow with other software to manage credit score disclosure form PDFs?

Absolutely! airSlate SignNow offers integrations with various applications such as CRM software, document management systems, and more. This allows for seamless management and tracking of your credit score disclosure form PDFs within your existing workflow.

-

What are the benefits of using airSlate SignNow for credit score disclosure form PDFs?

Using airSlate SignNow for credit score disclosure form PDFs streamlines the signing process, saving you time and effort. The platform also enhances security with encrypted documents, ensuring that sensitive information remains confidential throughout the signing process.

-

How long does it take to get a credit score disclosure form PDF signed?

The time it takes to get a credit score disclosure form PDF signed varies depending on the recipient's availability. However, with airSlate SignNow's easy-to-use interface, recipients can quickly review and sign documents, often completing the process in minutes.

Get more for Credit Score Disclosure Form Pdf

- Miami dade county eviction package form

- 981a1 petition to terminate parental rights pending stepparent adoption when should this form be used

- Interim release payment form

- Order to show cause guamselfhelporg guamselfhelp form

- Illinois petitioner alcoholdrug evaluation form

- Notice financial form

- Limited entry appearance form

- Petition fraud form

Find out other Credit Score Disclosure Form Pdf

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer