It 3601 I Form

What is the It 3601 I Form

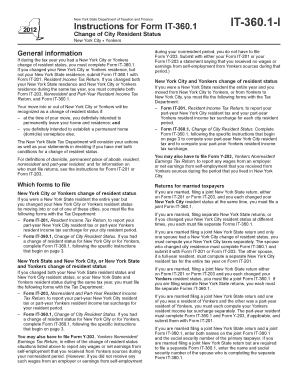

The It 3601 I Form is a specific document used for various tax-related purposes in the United States. It is primarily utilized by individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the It 3601 I Form

Using the It 3601 I Form involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to the information required on the form. Next, fill out the form with the relevant data, ensuring that all entries are accurate and complete. Once completed, review the form for any errors before submitting it to the appropriate tax authority. This careful approach helps facilitate a smooth filing process.

Steps to complete the It 3601 I Form

Completing the It 3601 I Form requires attention to detail. Follow these steps:

- Obtain the latest version of the It 3601 I Form from a reliable source.

- Read the instructions carefully to understand what information is needed.

- Fill in your personal or business details as required.

- Provide accurate financial data, ensuring all figures are correct.

- Review the completed form for any mistakes or omissions.

- Sign and date the form where indicated.

Legal use of the It 3601 I Form

The legal use of the It 3601 I Form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated time frame. Additionally, it is important to retain a copy of the form for your records, as it may be required for future reference or in the event of an audit. Compliance with these regulations ensures that the form serves its intended purpose without legal complications.

Required Documents

When completing the It 3601 I Form, certain documents may be required to provide supporting information. These documents typically include:

- Previous tax returns or relevant financial statements.

- Documentation of income sources, such as W-2s or 1099s.

- Records of deductions or credits that may be claimed.

Gathering these documents beforehand can streamline the process and help ensure that all necessary information is accurately reported.

Form Submission Methods

The It 3601 I Form can be submitted through various methods, depending on the preferences of the filer. Common submission methods include:

- Online submission through the IRS e-filing system, which is often the quickest method.

- Mailing a paper version of the form to the designated IRS address.

- In-person submission at local IRS offices, where assistance may be available.

Choosing the appropriate submission method can depend on factors such as urgency and personal preference.

Quick guide on how to complete it 3601 i form

Complete It 3601 I Form seamlessly on any device

Online document organization has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage It 3601 I Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign It 3601 I Form effortlessly

- Locate It 3601 I Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign It 3601 I Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 3601 i form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 3601 I Form?

The IT 3601 I Form is a specific document used for various tax-related purposes. It is essential for businesses to understand its requirements to ensure proper compliance with tax regulations. airSlate SignNow allows you to easily manage and eSign the IT 3601 I Form efficiently.

-

How does airSlate SignNow simplify the IT 3601 I Form signing process?

airSlate SignNow streamlines the IT 3601 I Form signing process by providing an intuitive platform for document management. Users can send, sign, and store the IT 3601 I Form electronically, reducing the time spent on paperwork and enhancing overall workflow efficiency.

-

What are the pricing options for using airSlate SignNow with the IT 3601 I Form?

airSlate SignNow offers several pricing plans that cater to different business needs. You can choose a plan that suits your budget while allowing unlimited access to features necessary for managing the IT 3601 I Form. Explore our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications for the IT 3601 I Form?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow while managing the IT 3601 I Form. Popular integrations include CRM systems, cloud storage services, and productivity tools, providing a comprehensive solution for document handling.

-

What are the key features of airSlate SignNow relevant to the IT 3601 I Form?

Key features of airSlate SignNow that enhance the usability of the IT 3601 I Form include electronic signatures, templates for quick document preparation, and secure storage for important files. These features ensure that your document management is efficient and secure.

-

How does airSlate SignNow ensure the security of the IT 3601 I Form?

airSlate SignNow prioritizes the security of your documents, including the IT 3601 I Form, through encryption and secure access protocols. This means that your sensitive information remains protected and compliant with legal standards.

-

What benefits can businesses gain from using airSlate SignNow for the IT 3601 I Form?

By utilizing airSlate SignNow for the IT 3601 I Form, businesses can experience increased efficiency and reduced turnaround times. The solution enables quicker document processing and improves collaboration among team members handling tax-related paperwork.

Get more for It 3601 I Form

Find out other It 3601 I Form

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy