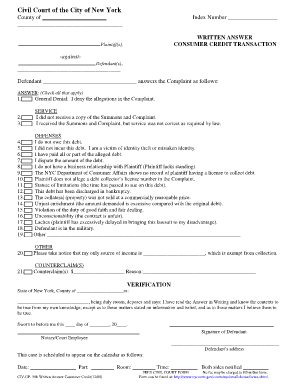

Written Answer Consumer Credit Transaction Form

What is the Written Answer Consumer Credit Transaction Form

The Written Answer Consumer Credit Transaction Form is a critical document used in the context of consumer credit agreements. It serves as a formal response to inquiries or disputes related to consumer credit transactions. This form outlines the details of the transaction, including the terms, conditions, and any relevant disclosures required by law. Understanding this form is essential for both consumers and lenders to ensure compliance with regulations governing consumer credit in the United States.

How to Use the Written Answer Consumer Credit Transaction Form

Using the Written Answer Consumer Credit Transaction Form involves several key steps. First, gather all necessary information related to the consumer credit transaction, including account details and transaction history. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to review the form for accuracy before submission. Finally, submit the form according to the guidelines provided by the lending institution or regulatory body overseeing the transaction.

Steps to Complete the Written Answer Consumer Credit Transaction Form

Completing the Written Answer Consumer Credit Transaction Form requires careful attention to detail. Follow these steps:

- Begin by reading the instructions thoroughly to understand the requirements.

- Collect all relevant documents that support your claims or responses regarding the credit transaction.

- Fill out the form, ensuring that your information is accurate and complete.

- Double-check for any errors or omissions before signing the form.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Written Answer Consumer Credit Transaction Form

The Written Answer Consumer Credit Transaction Form is legally binding when completed correctly. To ensure its validity, it must comply with federal and state regulations governing consumer credit transactions. This includes adherence to the Truth in Lending Act and the Fair Credit Reporting Act, which require specific disclosures and consumer protections. Proper execution of the form can help protect consumer rights and facilitate resolution in disputes.

Key Elements of the Written Answer Consumer Credit Transaction Form

Several key elements must be included in the Written Answer Consumer Credit Transaction Form to ensure its effectiveness and compliance. These elements typically include:

- Identifying information of the consumer and the lender.

- A detailed description of the transaction in question.

- Any relevant dates, including the transaction date and the date of the dispute.

- Clear statements regarding the consumer's position or response to the inquiry.

- Signature of the consumer, affirming the accuracy of the information provided.

Examples of Using the Written Answer Consumer Credit Transaction Form

There are various scenarios in which the Written Answer Consumer Credit Transaction Form may be utilized. For instance, a consumer may use the form to respond to a creditor's inquiry about a late payment or to dispute an incorrect charge on their credit report. Additionally, it can be employed in cases where a consumer seeks clarification regarding the terms of a loan agreement. Each example highlights the importance of clear communication and documentation in consumer credit transactions.

Quick guide on how to complete written answer consumer credit transaction form

Easily prepare Written Answer Consumer Credit Transaction Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to access the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Written Answer Consumer Credit Transaction Form on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Written Answer Consumer Credit Transaction Form effortlessly

- Find Written Answer Consumer Credit Transaction Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, inviting link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require extra document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Written Answer Consumer Credit Transaction Form while ensuring effective communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the written answer consumer credit transaction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a consumer credit transaction?

A consumer credit transaction refers to any transaction in which a consumer borrows money or obtains credit for personal or household use. Examples include loans, credit card purchases, and installment agreements. Understanding consumer credit transactions is essential for managing finances effectively.

-

How can airSlate SignNow facilitate consumer credit transactions?

airSlate SignNow streamlines consumer credit transactions by allowing businesses to send and eSign necessary documents electronically. This enhances efficiency and ensures that all agreements are legally binding and securely stored. Our platform simplifies the process, making it easier for both lenders and consumers.

-

What are the pricing options for using airSlate SignNow?

We offer several pricing plans tailored to meet diverse business needs, starting from basic features to advanced tools. Each plan provides access to essential functions for managing consumer credit transactions effectively. For detailed pricing and features, please visit our pricing page on the airSlate SignNow website.

-

What features does airSlate SignNow offer for consumer credit transactions?

Our platform includes features such as customizable templates, automated workflows, and real-time document tracking, which are vital for managing consumer credit transactions. These tools help businesses increase productivity and ensure compliance with relevant regulations. With airSlate SignNow, managing transactions becomes seamless and efficient.

-

Are there any benefits of using airSlate SignNow for consumer credit transactions?

Yes, using airSlate SignNow for consumer credit transactions offers numerous benefits, including reduced processing times and enhanced security. Our electronic signature solution ensures that documents are signed quickly and safely, which can lead to faster approval for loans and credit. Additionally, it improves customer satisfaction by simplifying the signing process.

-

Can airSlate SignNow integrate with other financial software for consumer credit transactions?

Absolutely! airSlate SignNow integrates seamlessly with popular financial software, allowing businesses to manage consumer credit transactions within their existing systems. These integrations enhance productivity and ensure a smoother workflow, enabling users to focus on business growth and customer service.

-

Is airSlate SignNow compliant with regulations for consumer credit transactions?

Yes, airSlate SignNow adheres to strict compliance standards for consumer credit transactions, including e-signature laws. Our platform is designed to provide legally binding documents while ensuring the privacy and security of sensitive customer information. Businesses can trust our solution to keep them compliant with industry regulations.

Get more for Written Answer Consumer Credit Transaction Form

- Regapp 0130 121117 auth rep form for appeals

- Cryotherapy insurance application rhodes risk form

- 59206optum oncology enrollment form

- Unc health care occupational therapy burn residency application form

- Referral formsvital care rx

- Do not complete this page if you have previously provided this information to columbiadoctors

- Texas denied insurance claims and hail attorneys form

- Inspirit client intake form inspirit salon and spa

Find out other Written Answer Consumer Credit Transaction Form

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement