Form W 8ben E How to Filled

What is the Form W-8BEN-E?

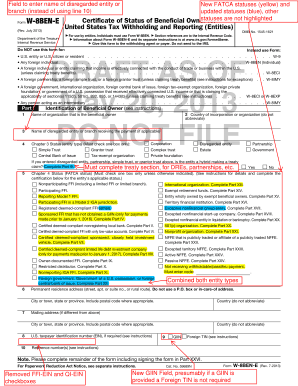

The Form W-8BEN-E is a tax document used by foreign entities to certify their status for U.S. tax withholding purposes. This form is essential for non-U.S. businesses and organizations that receive income from U.S. sources, such as dividends, interest, or royalties. By submitting the W-8BEN-E, these entities can claim a reduced rate of withholding tax or exemption from withholding under an applicable tax treaty between their country and the United States. It is important for foreign entities to understand the implications of this form to ensure compliance with U.S. tax laws.

Key Elements of the Form W-8BEN-E

The Form W-8BEN-E contains several critical sections that must be completed accurately. Key elements include:

- Identification of the Beneficial Owner: This section requires the name, country of incorporation, and address of the foreign entity.

- Claim of Tax Treaty Benefits: Entities must indicate if they are claiming benefits under a tax treaty and provide the relevant country.

- Certification and Signature: The form must be signed by an authorized representative of the entity, affirming that the information provided is accurate.

Completing these sections correctly is vital for ensuring that the form is accepted by U.S. financial institutions and the IRS.

Steps to Complete the Form W-8BEN-E

Completing the Form W-8BEN-E involves several steps:

- Gather Required Information: Collect necessary details about the entity, including its legal name, address, and tax identification number.

- Fill Out the Form: Complete each section of the form, ensuring all information is accurate and up to date.

- Claim Tax Treaty Benefits: If applicable, provide information about the tax treaty and the benefits being claimed.

- Sign the Form: An authorized representative must sign and date the form to validate it.

- Submit the Form: Send the completed form to the U.S. withholding agent or financial institution requesting it.

Following these steps carefully can help avoid delays and issues with tax withholding.

Legal Use of the Form W-8BEN-E

The legal use of the Form W-8BEN-E is crucial for compliance with U.S. tax regulations. By submitting this form, foreign entities can legally establish their non-U.S. status and potentially reduce their tax withholding rates. It is important to ensure that the form is filled out correctly and submitted to the appropriate parties. Failure to provide a valid W-8BEN-E can result in higher withholding rates and potential penalties. Entities should keep records of submitted forms and any correspondence related to their tax status.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-8BEN-E can vary depending on the nature of the income and the relationship with the U.S. withholding agent. Generally, the form should be submitted before income payments are made to ensure the correct withholding tax rate is applied. It is advisable to check with the withholding agent for specific deadlines and any updates on tax regulations that may affect filing requirements.

Who Issues the Form W-8BEN-E?

The Form W-8BEN-E is issued by the Internal Revenue Service (IRS) in the United States. It is specifically designed for use by foreign entities that need to provide documentation to U.S. payers regarding their status for tax purposes. The form is available on the IRS website and can be filled out electronically or on paper, depending on the preferences of the entity and the requirements of the withholding agent.

Quick guide on how to complete form w 8ben e how to filled

Effortlessly Prepare Form W 8ben E How To Filled on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form W 8ben E How To Filled on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Easily Modify and eSign Form W 8ben E How To Filled

- Locate Form W 8ben E How To Filled and click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Finish button to save your changes.

- Select how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form W 8ben E How To Filled to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben e how to filled

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-8 form and why do I need it?

A W-8 form, specifically designed for non-U.S. persons, certifies your foreign status for tax withholding purposes. It's essential for businesses or individuals receiving payments from U.S. sources to avoid excessive backup withholding. Understanding what is a W-8 is crucial as it helps ensure compliance with IRS regulations.

-

How do I fill out a W-8 form using airSlate SignNow?

AirSlate SignNow simplifies the process of filling out a W-8 form by providing a user-friendly interface and electronic signing features. You can easily input your information, upload necessary documentation, and send the form directly to the appropriate parties. This streamlines your workflow and ensures that you understand what is a W-8 before submission.

-

What features does airSlate SignNow offer for managing W-8 forms?

AirSlate SignNow offers various features such as customizable templates, secure cloud storage, and real-time tracking for W-8 forms. These tools help you manage documentation efficiently and ensure that you have all necessary forms signed and filed correctly. Knowing what is a W-8 helps you leverage these features effectively.

-

Is airSlate SignNow a cost-effective solution for handling W-8 forms?

Yes, airSlate SignNow is a cost-effective solution for managing W-8 forms as it eliminates paper costs and reduces processing time. With competitive pricing plans, you can streamline your documentation process without breaking the bank. Understanding what is a W-8 and how to manage it efficiently can help your business save resources.

-

Can I integrate airSlate SignNow with other applications for W-8 management?

Absolutely! AirSlate SignNow offers integration capabilities with various applications like Google Drive and Salesforce, allowing you to manage W-8 forms seamlessly. This integration can enhance your overall workflow and ensure that you have a comprehensive understanding of what is a W-8 within your systems.

-

What are the benefits of using airSlate SignNow for W-8 forms?

Using airSlate SignNow for W-8 forms streamlines the signing process, ensures compliance, and improves overall document security. Additionally, it provides easy access to completed forms for audit purposes. By knowing what is a W-8 and utilizing this platform, you can enhance both efficiency and accuracy in your business operations.

-

How does airSlate SignNow ensure the security of W-8 forms?

AirSlate SignNow prioritizes security through encryption, secure cloud storage, and compliance with industry standards. This ensures that your W-8 forms and sensitive information remain protected throughout the signing process. Understanding what is a W-8 also includes knowing that your data is handled with care and confidentiality.

Get more for Form W 8ben E How To Filled

Find out other Form W 8ben E How To Filled

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online