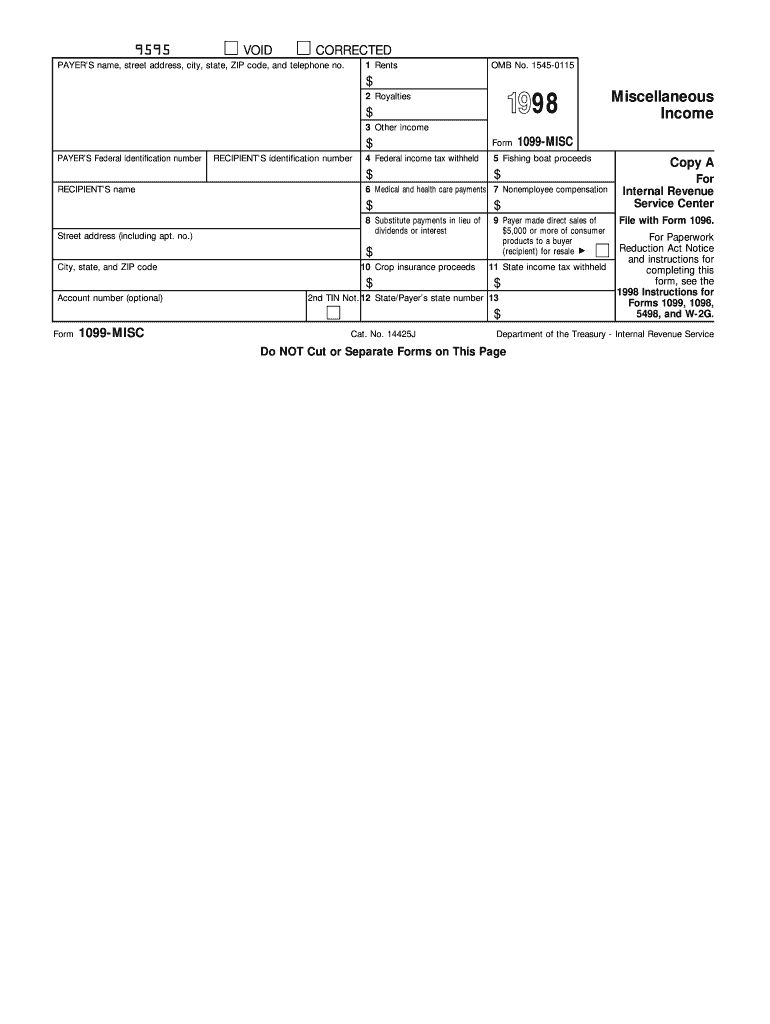

Irs Form 1998

What is the IRS Form

The IRS Form is a document required by the Internal Revenue Service for various tax-related purposes. Each form serves a specific function, such as reporting income, claiming deductions, or providing information about tax obligations. Understanding the purpose of each form is crucial for compliance with federal tax laws. Common forms include the 1040 for individual income tax returns, the W-2 for wage and tax statements, and the 1099 for reporting various types of income. Each form has unique requirements and deadlines, making it essential for taxpayers to familiarize themselves with the appropriate documents for their specific situations.

How to use the IRS Form

Using the IRS Form involves several steps to ensure accurate completion and submission. First, identify the correct form based on your tax situation. Next, gather all necessary documents, such as income statements and receipts for deductions. Carefully fill out the form, ensuring that all information is accurate and complete. It's advisable to double-check for any errors or omissions before submission. Once completed, you can file the form electronically or by mail, depending on your preference and the form's requirements. Utilizing eSignature solutions can simplify the signing process and enhance the security of your submission.

Steps to complete the IRS Form

Completing the IRS Form requires a systematic approach to avoid mistakes. Begin by selecting the appropriate form for your needs. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Fill out the form accurately, ensuring all fields are completed as required.

- Use a reliable eSignature solution for signing the form if submitting electronically.

- Review the completed form for any errors or missing information.

- Submit the form by the deadline, either electronically or via mail.

Legal use of the IRS Form

The legal use of the IRS Form is governed by federal tax laws. Each form must be completed accurately to ensure compliance with IRS regulations. Failure to use the form correctly can lead to penalties, including fines or audits. It is essential to maintain records of submitted forms and any supporting documentation for at least three years, as the IRS may request this information during an audit. Utilizing an eSignature solution can provide an added layer of security and legitimacy to your submissions, ensuring that your forms are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns (Form 1040) are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Other forms, such as the W-2, must be issued to employees by January 31. It is crucial to be aware of these deadlines to avoid late fees and penalties. Marking important dates on your calendar can help ensure timely submissions.

Form Submission Methods

IRS Forms can be submitted through various methods, including electronic filing, mail, and in-person submission at designated IRS offices. Electronic filing is often the fastest and most efficient method, allowing for quicker processing and confirmation of receipt. For those who prefer traditional methods, forms can be printed, signed, and mailed to the appropriate IRS address. In-person submissions may be available for specific forms or situations. Understanding the available submission methods can help taxpayers choose the option that best suits their needs.

Quick guide on how to complete 1998 irs form

Complete Irs Form effortlessly on any device

Managing documents online has gained signNow traction among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly, without any holdups. Handle Irs Form on any device using the airSlate SignNow applications for Android or iOS, and streamline your document-centric processes today.

How to modify and eSign Irs Form with ease

- Find Irs Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 irs form

Create this form in 5 minutes!

How to create an eSignature for the 1998 irs form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an IRS Form?

An IRS Form is a document used to report various financial activities and transactions to the Internal Revenue Service. These forms are essential for taxpayers to accurately report income, claim deductions, and comply with tax regulations. Utilizing airSlate SignNow can streamline the process of filling out and submitting your IRS Form electronically.

-

How can airSlate SignNow help with IRS Form submissions?

AirSlate SignNow simplifies the process of completing and eSigning your IRS Form by providing an intuitive interface and secure features. With our platform, you can easily fill out the form, gather necessary signatures, and submit it directly to the IRS—all in one place. This reduces the risk of delays and ensures compliance with tax submission deadlines.

-

What features does airSlate SignNow offer for managing IRS Forms?

AirSlate SignNow offers features such as document templates, eSignature capabilities, and secure storage, making it a versatile solution for managing IRS Forms. You can create reusable templates for various forms, reducing the time spent on repetitive tasks. Additionally, our platform provides audit trails to trace every step of your document's journey.

-

Is airSlate SignNow cost-effective for businesses needing IRS Forms?

Yes, airSlate SignNow offers competitive pricing plans to ensure that businesses can access cost-effective solutions for managing IRS Forms. We provide multiple subscription tiers tailored to different business sizes and needs, making it easier to find a plan that fits your budget. With our service, you gain efficiency without breaking the bank.

-

Can I integrate airSlate SignNow with other software for IRS Forms?

Absolutely! AirSlate SignNow integrates seamlessly with several third-party applications, allowing you to streamline your workflow when dealing with IRS Forms. Whether you use popular accounting software or customer relationship management tools, these integrations can help you automate processes and reduce manual input.

-

What are the benefits of using airSlate SignNow for IRS Forms?

Using airSlate SignNow for your IRS Forms offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security measures. The electronic signature feature allows for quick approvals, while automated workflows minimize the chances of errors. This efficiency allows businesses to focus more on their core activities rather than administrative tasks.

-

Is there customer support available for IRS Form-related queries?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any IRS Form-related questions. Our knowledgeable support team is available via phone, email, or chat to ensure you receive the help you need. We strive to resolve your issues quickly so you can complete your forms efficiently and accurately.

Get more for Irs Form

- History park facility use application web based rfp form

- Nhra bh form

- Application r certificate form

- Professional reference questionnaire abih form

- Rei wbc intake form

- Sample volunteer application for nonprofit organizations volunteer recruitment form

- Global adverse event and special situation reporting roche pro form

- Printclearnot for electronic filing contact 60981 form

Find out other Irs Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself