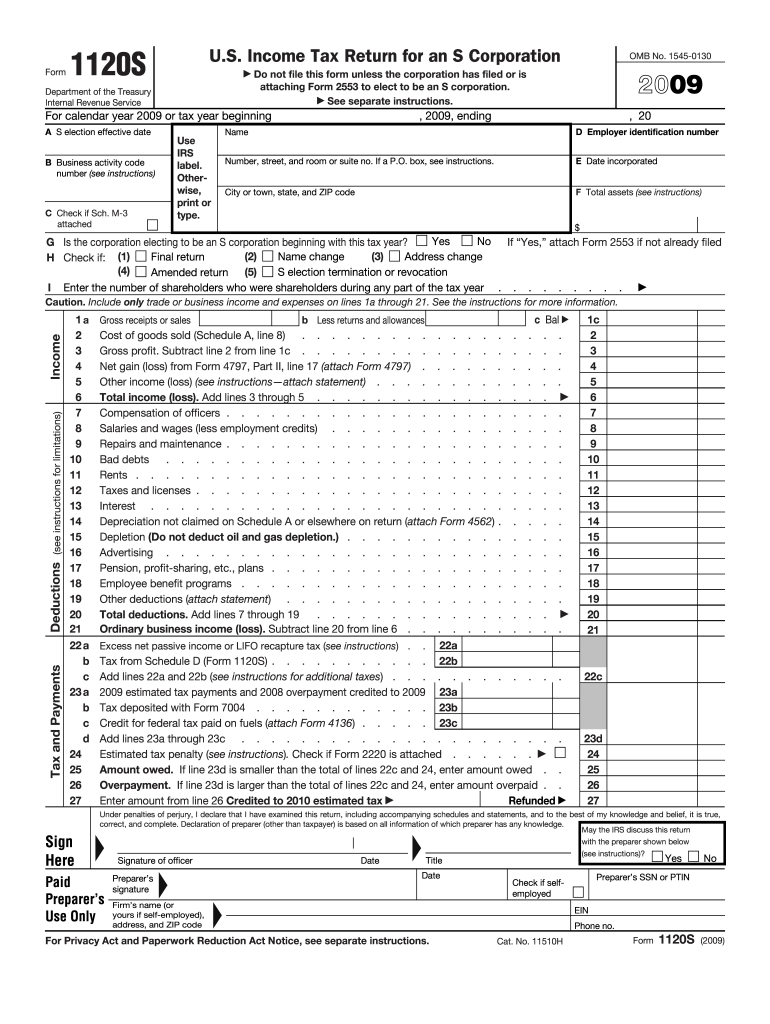

Form 1120s 2009

What is the Form 1120S

The Form 1120S is a tax return specifically designed for S corporations in the United States. This form is used to report income, deductions, gains, losses, and other tax-related information for the corporation. Unlike traditional corporations, S corporations pass their income directly to shareholders, allowing them to avoid double taxation. The Form 1120S is essential for ensuring compliance with federal tax regulations and for accurately reflecting the financial activities of the S corporation.

How to use the Form 1120S

Using the Form 1120S involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete the form by accurately reporting the corporation's income, deductions, and credits. It is crucial to ensure that all information is correct to avoid penalties or audits. After filling out the form, it must be signed by an authorized officer of the corporation before submission to the IRS.

Steps to complete the Form 1120S

Completing the Form 1120S requires careful attention to detail. Follow these steps for accurate completion:

- Begin with the corporation's basic information, including name, address, and Employer Identification Number (EIN).

- Report the total income earned by the corporation during the tax year.

- List all allowable deductions, such as salaries, rent, and utilities.

- Calculate the corporation's taxable income by subtracting total deductions from total income.

- Complete the Schedule K, which details each shareholder's share of income, deductions, and credits.

- Review the form for accuracy and ensure all required signatures are included.

Filing Deadlines / Important Dates

The filing deadline for Form 1120S is typically the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to file on time to avoid penalties and interest on unpaid taxes.

Legal use of the Form 1120S

The legal use of the Form 1120S is governed by IRS regulations. This form must be filed annually by S corporations to report their income and deductions. Accurate completion and timely submission are essential for compliance with federal tax laws. Failure to file or inaccuracies in the form can result in penalties, including fines and potential audits. Utilizing digital solutions for completing and submitting the form can enhance security and ensure compliance with legal standards.

Required Documents

To complete the Form 1120S, several documents are necessary. These include:

- Financial statements, such as income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for all deductions claimed, including receipts and invoices.

- Shareholder information, including their respective ownership percentages.

Having these documents organized and readily available will streamline the process of completing the form.

Who Issues the Form

The Form 1120S is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides the form along with instructions on how to complete it, ensuring that S corporations have the necessary resources to comply with federal tax requirements.

Quick guide on how to complete form 1120s 2009

Complete Form 1120s effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form 1120s on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Form 1120s with ease

- Locate Form 1120s and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1120s while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120s 2009

Create this form in 5 minutes!

How to create an eSignature for the form 1120s 2009

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 1120s and who needs to file it?

Form 1120s is the U.S. Income Tax Return for an S Corporation. It is used by S Corporations to report income, deductions, and credits to the IRS. If your business is structured as an S Corp, filing Form 1120s is essential for compliance and tax reporting.

-

How can airSlate SignNow help with signing Form 1120s?

airSlate SignNow provides a streamlined solution for eSigning Form 1120s, allowing you to easily send and receive signed documents. With our user-friendly interface, you can ensure that your tax forms are signed quickly and securely, simplifying your tax filing process.

-

Is there a cost associated with using airSlate SignNow for Form 1120s?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to handle Form 1120s and other documents without breaking the bank, ensuring you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for handling Form 1120s?

airSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage that enhance your experience when managing Form 1120s. These tools make it easier to prepare, send, and track your tax documents, ensuring a smooth eSigning process.

-

Can I integrate airSlate SignNow with other software for Form 1120s?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, including accounting and tax preparation tools. This integration helps you manage your Form 1120s more efficiently, allowing for streamlined workflows and improved productivity.

-

What are the benefits of using airSlate SignNow for Form 1120s?

Using airSlate SignNow for Form 1120s offers numerous benefits, including enhanced security, time savings, and greater convenience. With eSigning, you eliminate the need for printing and mailing, which helps you file your taxes faster and more securely.

-

How secure is airSlate SignNow when signing Form 1120s?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When signing Form 1120s through our platform, you can trust that your sensitive information is protected throughout the eSigning process.

Get more for Form 1120s

- 4582 2019 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2019 michigan business tax form

- 4892 michigan corporate income tax amended return form

- Income tax forms grandrapidsmigov

- Fin 578 iba tax refund of a corporation this form must be completed by a registered corporation claiming a tax refund under the

- Pdf taxpayers ombudsman complaint form

- Retail sales tax act tobacco tax act fuel tax act form

- Mi w4 emploees michigan withholding exemption certificate mi w4 emploees michigan withholding exemption certificate form

- Business amp occupation tax form city of princeton wv

Find out other Form 1120s

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe