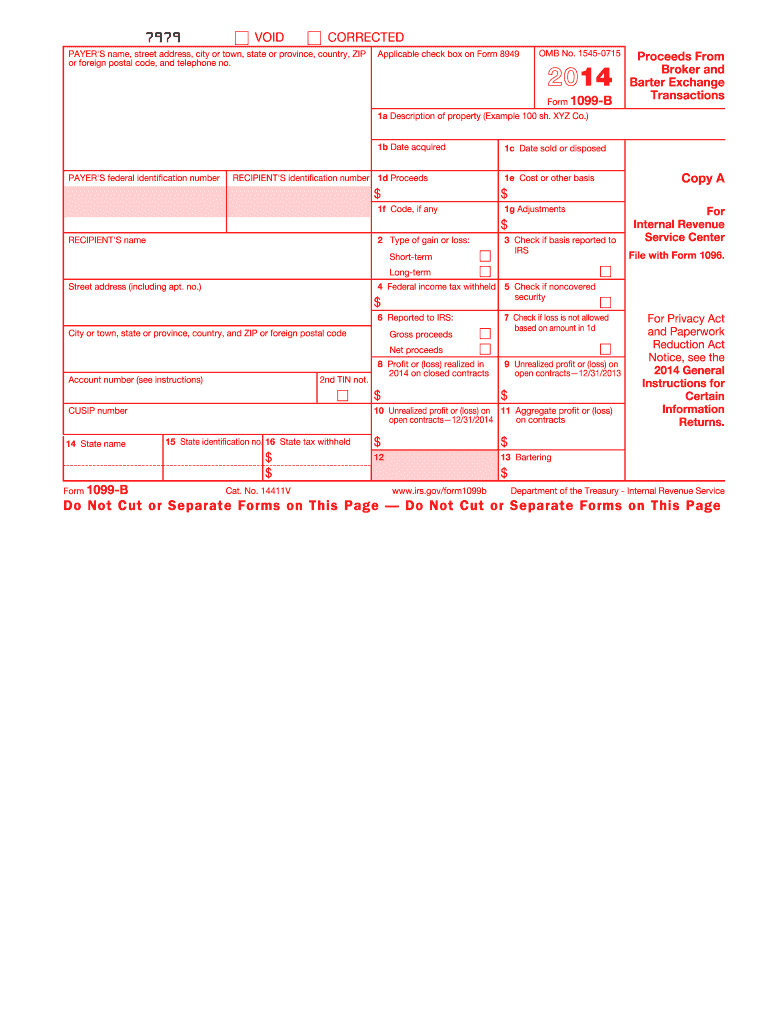

1099 B Form 2014

What is the 1099 B Form

The 1099 B Form is a crucial document used in the United States for reporting proceeds from broker and barter exchange transactions. This form is typically issued by brokers to report the sale of securities, commodities, and other financial instruments. It provides detailed information about the transactions, including the date of sale, amount received, and any applicable gains or losses. Understanding this form is essential for taxpayers who need to accurately report their income on their tax returns.

How to use the 1099 B Form

Using the 1099 B Form involves several steps, primarily focusing on accurately reporting your capital gains and losses. Taxpayers should first gather all relevant information from the form, including transaction dates and amounts. This data should then be transferred to the appropriate sections of the IRS Form 1040 or Schedule D, which is used for reporting capital gains and losses. It is important to ensure that all figures are accurately reflected to avoid discrepancies with the IRS.

Steps to complete the 1099 B Form

Completing the 1099 B Form requires careful attention to detail. Follow these steps:

- Gather all transaction records from your broker for the tax year.

- Identify the total proceeds from each transaction, including sales of stocks and other securities.

- Calculate any capital gains or losses by comparing the sale price to the purchase price.

- Fill out the 1099 B Form with the necessary information, ensuring accuracy in dates and amounts.

- Submit the completed form to the IRS along with your tax return.

Legal use of the 1099 B Form

The legal use of the 1099 B Form is governed by IRS regulations, which require brokers to report transactions accurately. Failure to report this information can lead to penalties for both the issuer and the taxpayer. It is essential for taxpayers to retain copies of their 1099 B Forms for their records, as they serve as official documentation of income for tax purposes. Compliance with IRS guidelines ensures that taxpayers avoid potential legal issues related to underreporting income.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 B Form are critical for compliance. Typically, brokers must send out the form to taxpayers by January thirty-first of the year following the tax year. Additionally, the form must be filed with the IRS by February twenty-eighth if submitted by mail, or by March thirty-first if filed electronically. Being aware of these deadlines helps ensure timely reporting and avoids penalties for late submissions.

Who Issues the Form

The 1099 B Form is issued by brokers or barter exchanges. Brokers are typically financial institutions or firms that facilitate the buying and selling of securities on behalf of clients. These entities are responsible for compiling transaction data and providing accurate reports to both the taxpayer and the IRS. Understanding who issues the form is important for taxpayers to ensure they receive all necessary documentation for their tax filings.

Quick guide on how to complete 2014 1099 b form

Effortlessly Prepare 1099 B Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage 1099 B Form on any platform using airSlate SignNow Android or iOS apps and streamline any document-related process today.

Easily Modify and eSign 1099 B Form

- Obtain 1099 B Form and click Get Form to commence.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Craft your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign 1099 B Form and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1099 b form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1099 b form

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is a 1099 B Form and why is it important?

The 1099 B Form is a tax document used to report proceeds from broker and barter exchange transactions. It is essential for individuals and businesses to accurately report income from these transactions to ensure compliance with IRS regulations. Understanding the 1099 B Form is crucial for tax filing and avoiding potential penalties.

-

How can airSlate SignNow help with signing a 1099 B Form?

airSlate SignNow simplifies the process of signing a 1099 B Form by providing an intuitive platform for electronic signatures. Users can easily upload, send, and eSign their documents securely, ensuring that all parties can complete the process efficiently. This not only saves time but also streamlines compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for 1099 B Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The subscription plans are designed to be cost-effective while providing robust features for managing documents like the 1099 B Form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing 1099 B Forms?

airSlate SignNow provides features such as customizable templates, document tracking, and secure storage, all of which are beneficial when managing a 1099 B Form. The platform also allows for bulk sending, which is ideal for businesses handling multiple forms simultaneously. These features enhance efficiency and organization.

-

Can I integrate airSlate SignNow with other software for handling 1099 B Forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRM systems and accounting software. This integration allows users to manage their 1099 B Form processes more effectively by syncing data and facilitating a smoother workflow.

-

How secure is airSlate SignNow for signing a 1099 B Form?

Security is a top priority for airSlate SignNow. The platform employs industry-standard encryption protocols to protect your sensitive information while signing a 1099 B Form. Additionally, it complies with legal regulations, ensuring that your documents are safe and secure.

-

Can I track the status of my 1099 B Form using airSlate SignNow?

Yes, airSlate SignNow offers a tracking feature that allows you to monitor the status of your 1099 B Form in real-time. You will receive notifications when the document is opened, signed, and completed, enabling you to stay updated throughout the signing process.

Get more for 1099 B Form

- Before mailing your individual income tax returngeorgia form

- Information return of non arms length transactions with non residents t106 summary form

- Annual report form 1 2020 annual report form 1 2020

- Form t5001 ampquotapplication for tax shelter identification

- Ifta quarterly tax form fill online printable fillable

- Balance sheet information 1998 and later tax years

- 2021 personal tax credits return canadaca form

- T1135 fill out and auto calculatecomplete form online

Find out other 1099 B Form

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online