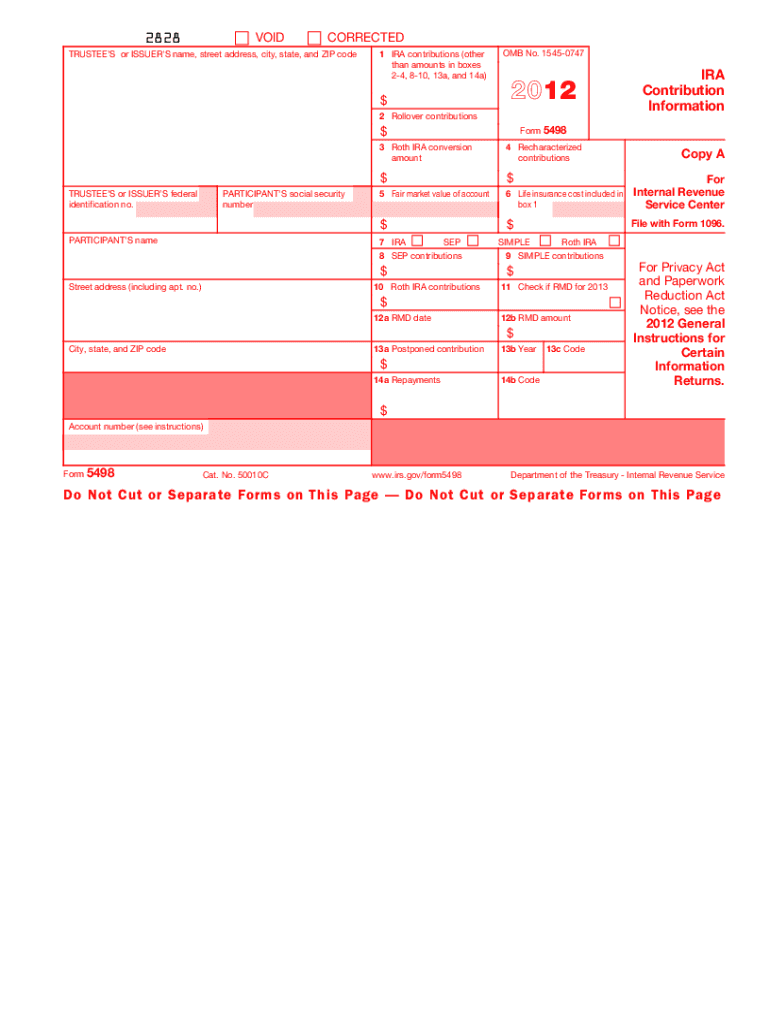

Form 5498 for 2012

What is the Form 5498 For

The Form 5498 is an informational tax form used in the United States to report contributions to individual retirement accounts (IRAs) and other tax-advantaged accounts. This form is essential for both taxpayers and the Internal Revenue Service (IRS) as it provides details about contributions made to various retirement plans, including traditional IRAs, Roth IRAs, and SEP IRAs. The information reported helps the IRS ensure compliance with contribution limits and other regulations related to retirement savings.

How to use the Form 5498 For

Using the Form 5498 involves understanding its purpose and how it fits into your overall tax reporting. Taxpayers do not file this form with their tax returns; instead, it is used by the IRS to track contributions. You should keep the Form 5498 for your records, as it contains important information that may be needed for future tax filings or when taking distributions from your retirement accounts. Additionally, it is advisable to review the form for accuracy, ensuring that all reported contributions reflect your actual deposits.

Steps to complete the Form 5498 For

Completing the Form 5498 requires several steps to ensure accuracy and compliance. First, gather all relevant documentation regarding your IRA contributions for the tax year. This includes records of any contributions made, rollovers, and conversions. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, report the total contributions made to your IRAs in the appropriate sections of the form. Finally, review the completed form for any errors before filing it with your tax records.

Legal use of the Form 5498 For

The Form 5498 serves a legal purpose in documenting retirement contributions, which is crucial for tax compliance. It helps verify that taxpayers adhere to contribution limits set by the IRS. Failure to report contributions accurately can lead to penalties or disqualification from certain tax benefits. Therefore, it is important to ensure that the information on the form is correct and submitted in accordance with IRS guidelines. Keeping a copy of the form for your records can also be beneficial in case of audits or inquiries from the IRS.

Key elements of the Form 5498 For

Several key elements are essential to the Form 5498. These include:

- Taxpayer Information: This section includes your name, address, and Social Security number.

- Account Information: Details about the type of IRA and the account number.

- Contribution Amounts: Total contributions made during the tax year, including rollovers and conversions.

- Fair Market Value: The fair market value of the account as of December 31 of the reporting year.

Filing Deadlines / Important Dates

The Form 5498 must be filed by the financial institution that manages your IRA, and it is typically due by May 31 of the year following the tax year in which contributions were made. This means that for contributions made in the previous calendar year, the form must be submitted by the end of May. It is important to keep track of these deadlines to ensure compliance and avoid potential penalties associated with late reporting.

Quick guide on how to complete form 5498 for 2012

Effortlessly Prepare Form 5498 For on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your files without delays. Handle Form 5498 For on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 5498 For Effortlessly

- Locate Form 5498 For and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 5498 For to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 for 2012

Create this form in 5 minutes!

How to create an eSignature for the form 5498 for 2012

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 5498 For and why is it important?

Form 5498 For is an IRS form used to report contributions to individual retirement accounts (IRAs). It is important for individuals to understand this form as it helps ensure they are compliant with tax regulations. Accurate reporting on Form 5498 For can also assist in tracking retirement savings and contributions.

-

How can airSlate SignNow help with Form 5498 For?

airSlate SignNow streamlines the process of completing and sending Form 5498 For by providing an easy-to-use platform for electronic signatures. With our solution, users can easily fill out the form, sign it, and send it securely, saving time and reducing paperwork. This efficiency is especially beneficial during tax season.

-

What features does airSlate SignNow offer for managing Form 5498 For?

airSlate SignNow offers features such as customizable templates, electronic signatures, and real-time tracking specifically designed for managing Form 5498 For. These features ensure that users can easily create, send, and manage their forms while maintaining compliance and security.

-

Is there a cost associated with using airSlate SignNow for Form 5498 For?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Each plan provides access to essential features for managing Form 5498 For, ensuring that you only pay for the functionalities you need. A free trial is also available to help users explore the platform.

-

Can I integrate airSlate SignNow with other software for Form 5498 For?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing users to import and export data related to Form 5498 For effortlessly. This integration capability enhances workflow efficiency and ensures that all necessary information is readily available.

-

What are the benefits of using airSlate SignNow for Form 5498 For?

Using airSlate SignNow for Form 5498 For offers numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. By digitizing the form-filling and signing process, users can reduce human error and ensure timely submissions to the IRS.

-

How secure is airSlate SignNow when handling Form 5498 For?

Security is a top priority at airSlate SignNow. When handling Form 5498 For, our platform employs advanced encryption and security measures to protect sensitive information. Users can trust that their data is safe and secure throughout the document management process.

Get more for Form 5498 For

- You have to file your t4 information return

- Completing form t3010 registered

- Income tax guide for individuals city of grand rapids form

- 5081 instructions state of michigan form

- 4580 2019 michigan business tax unitary business group combined filing schedule for standard members 4580 2019 michigan form

- Ar1000anr amended income tax return for non residents dfa arkansas form

- 4892 corporate income tax amended return state of form

- Michigan wine tax report lcc 3890 state of michigan form

Find out other Form 5498 For

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF